Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Amid numerous complimentary and paid options available online, you cannot guarantee their precision. For instance, the identity of their creators or whether they possess the necessary skills to meet your needs is uncertain.

Always remain composed and utilize US Legal Forms! Discover Hawaii Fiduciary Deed templates for Executors, Trustees, Trustors, Administrators, and other Fiduciaries crafted by knowledgeable legal professionals, thereby avoiding the costly and time-consuming process of seeking an attorney to draft documents for you.

If you have a membership, Log In to your account and locate the Download button adjacent to the document you need. You will also have access to all of your previously obtained samples in the My documents section.

Once you have registered and secured your subscription, you can utilize your Hawaii Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries as frequently as necessary or as long as it remains valid in your area. Modify it in your preferred online or offline editor, complete it, sign it, and produce a physical copy. Accomplish more for less with US Legal Forms!

- Verify that the document you locate is acceptable in your area.

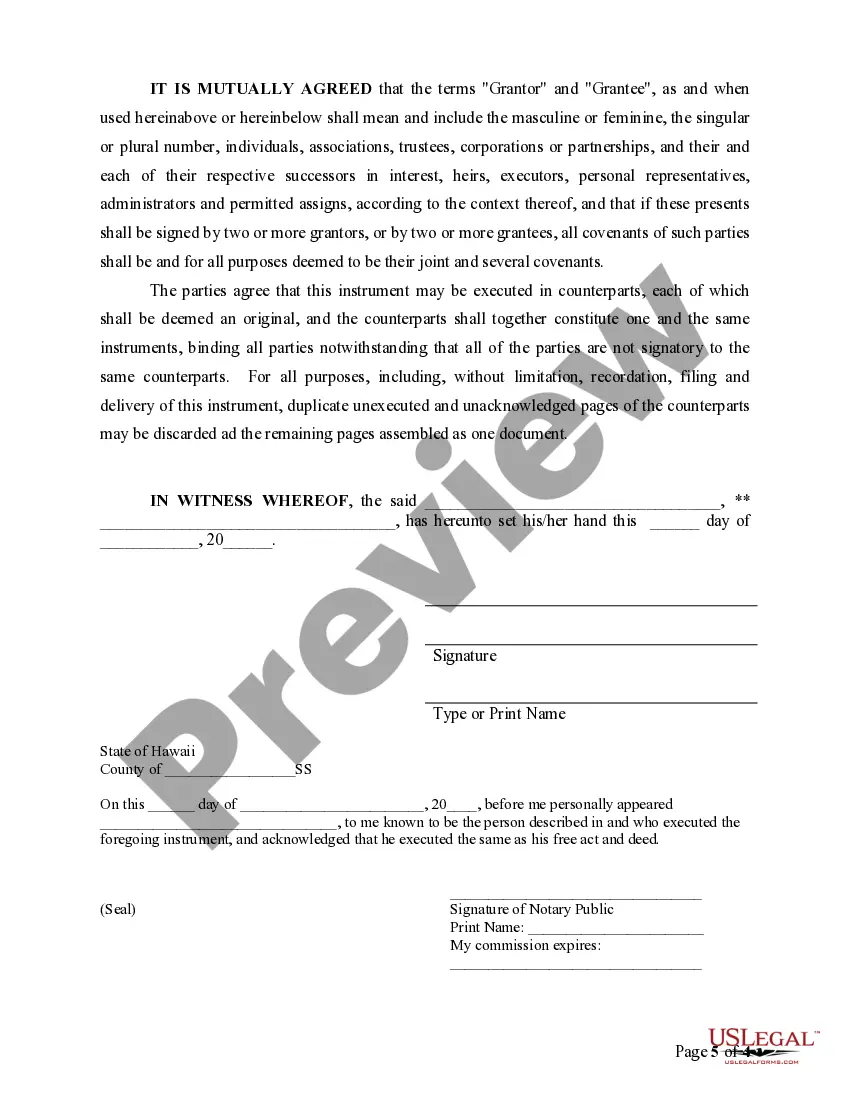

- Examine the file by reviewing the description using the Preview feature.

- Click Buy Now to initiate the purchase process or search for another template using the Search bar at the top.

- Select a pricing plan and establish an account.

- Complete the subscription payment through your credit/debit card or PayPal.

- Download the form in the format you require.

Form popularity

FAQ

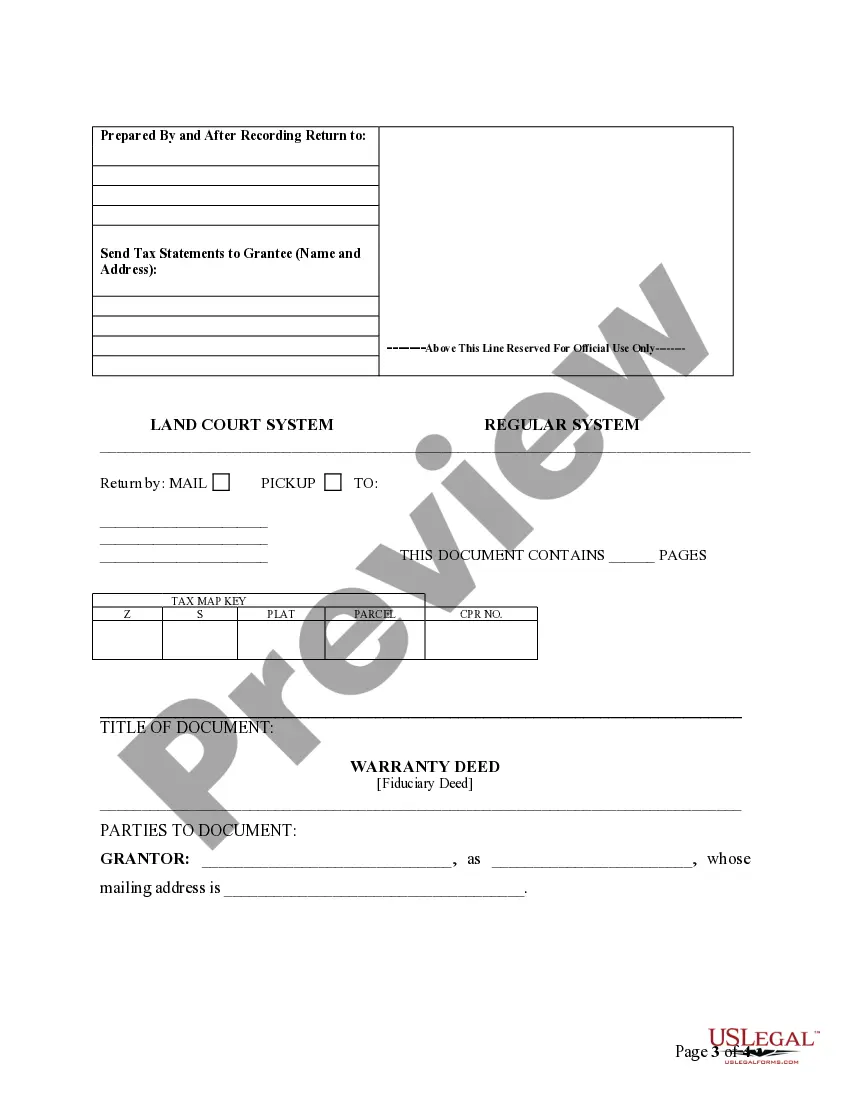

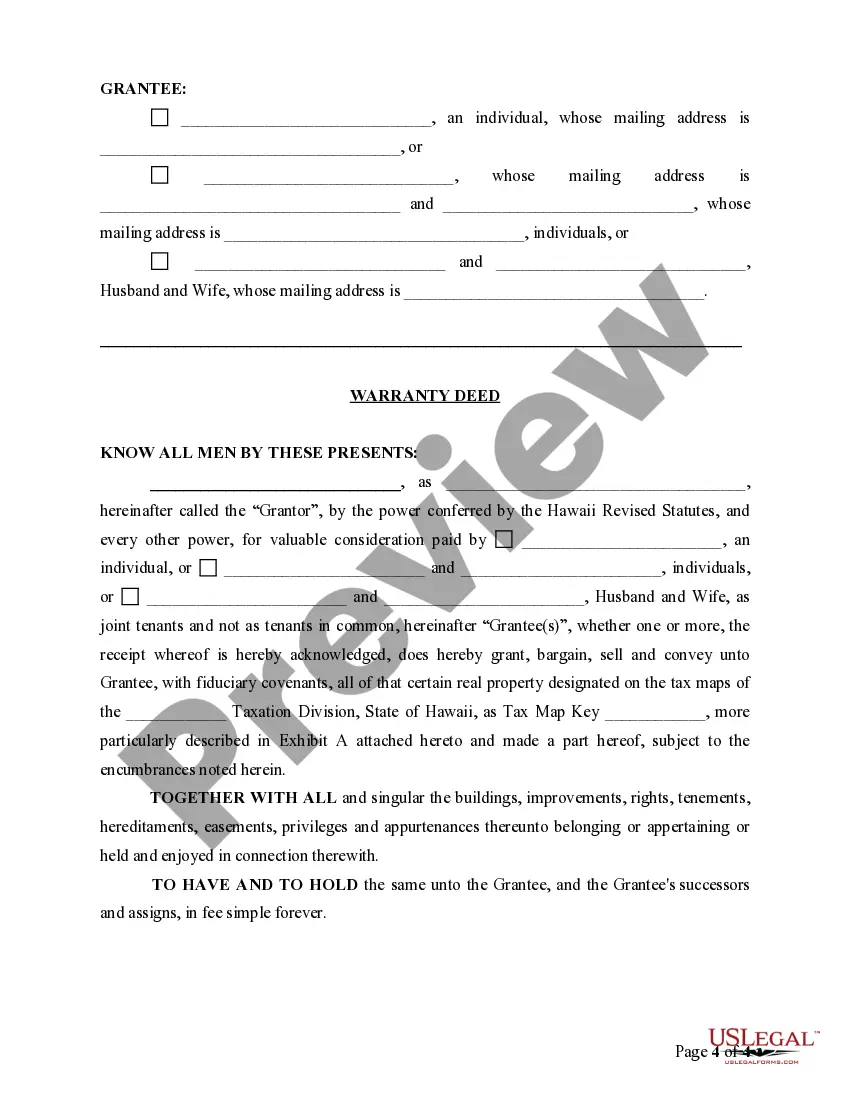

A warranty deed guarantees that the property owner has the right to transfer ownership and that there are no unknown liens or encumbrances. In contrast, a fiduciary deed allows an executor, trustee, or administrator to transfer property on behalf of another person but may not include such guarantees. Understanding these differences is essential for Executors, Trustees, Trustors, Administrators, and other Fiduciaries when navigating property transactions. Choosing a Hawaii Fiduciary Deed can provide clarity and assurance in fulfilling your responsibilities.

The purpose of a fiduciary deed is to facilitate the transfer of property when an individual is acting in a legal capacity on behalf of another person. Executors, Trustees, Trustors, Administrators, and other Fiduciaries often utilize this deed to comply with legal obligations and honor the wishes of the property owner. This ensures a smooth and lawful transfer of assets, particularly in cases where the original owner is deceased or incapacitated.

The safest type of deed generally depends on the specifics of the transaction, but a fiduciary deed is seen as secure in many situations. This deed allows Executors, Trustees, Trustors, Administrators, and other Fiduciaries to transfer property under the guidance of the law. By opting for a Hawaii Fiduciary Deed, you can ensure a legally sound and safe transfer of ownership.

To execute a beneficiary deed in Hawaii, you need to visit a local office or courthouse that handles property transactions. It involves filling out the appropriate forms and possibly consulting with legal professionals. Using the Hawaii Fiduciary Deed can streamline this process for Executors, Trustees, and other Fiduciaries looking to ensure accurate and effective property transfers.

Fiduciary ownership refers to the responsibility of a person, known as a fiduciary, to manage assets on behalf of another party. This relationship is based on trust and often involves Executors, Trustees, Trustors, Administrators, and other Fiduciaries. By using a Hawaii Fiduciary Deed, these individuals can properly manage and transfer property in alignment with the wishes of the original owner.

No, a fiduciary deed is not the same as a regular deed. While both serve to transfer property, a fiduciary deed is executed by a fiduciary in accordance with their duties, ensuring compliance with legal and trust requirements. In cases where you must manage property for another, leveraging a Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries helps maintain legal integrity in the transfer process.

A fiduciary deed in Pennsylvania is a specialized legal document used to convey property under the authority of a fiduciary, such as an executor or trustee. This deed ensures that the fiduciary can transfer property held in trust, in compliance with the terms set forth in the trust document or will. When dealing with property as a fiduciary, utilizing a Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries can streamline the process and provide legal clarity.

In Pennsylvania, the common types of deeds include warranty deeds, executor's deeds, and quitclaim deeds. Each type serves different purposes, depending on the situation and the level of protection desired. If acting as a fiduciary, it is vital to choose the correct deed type, such as a Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, to serve your obligations effectively.

An executor's deed serves a specific purpose; it transfers property from a deceased person’s estate to beneficiaries, but it offers limited guarantees regarding title. In contrast, a warranty deed provides robust assurances about the title’s validity. When considering a Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it is essential to understand these differences to protect both the estate and the heirs.

The strongest deed is usually considered a warranty deed because it provides the greatest protection for the buyer. It guarantees that the seller holds clear title to the property and has the right to transfer it. Furthermore, the warranty deed includes assurances against any future claims on the property. When handling property as a fiduciary, such as using a Hawaii Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, clarity in title is crucial.