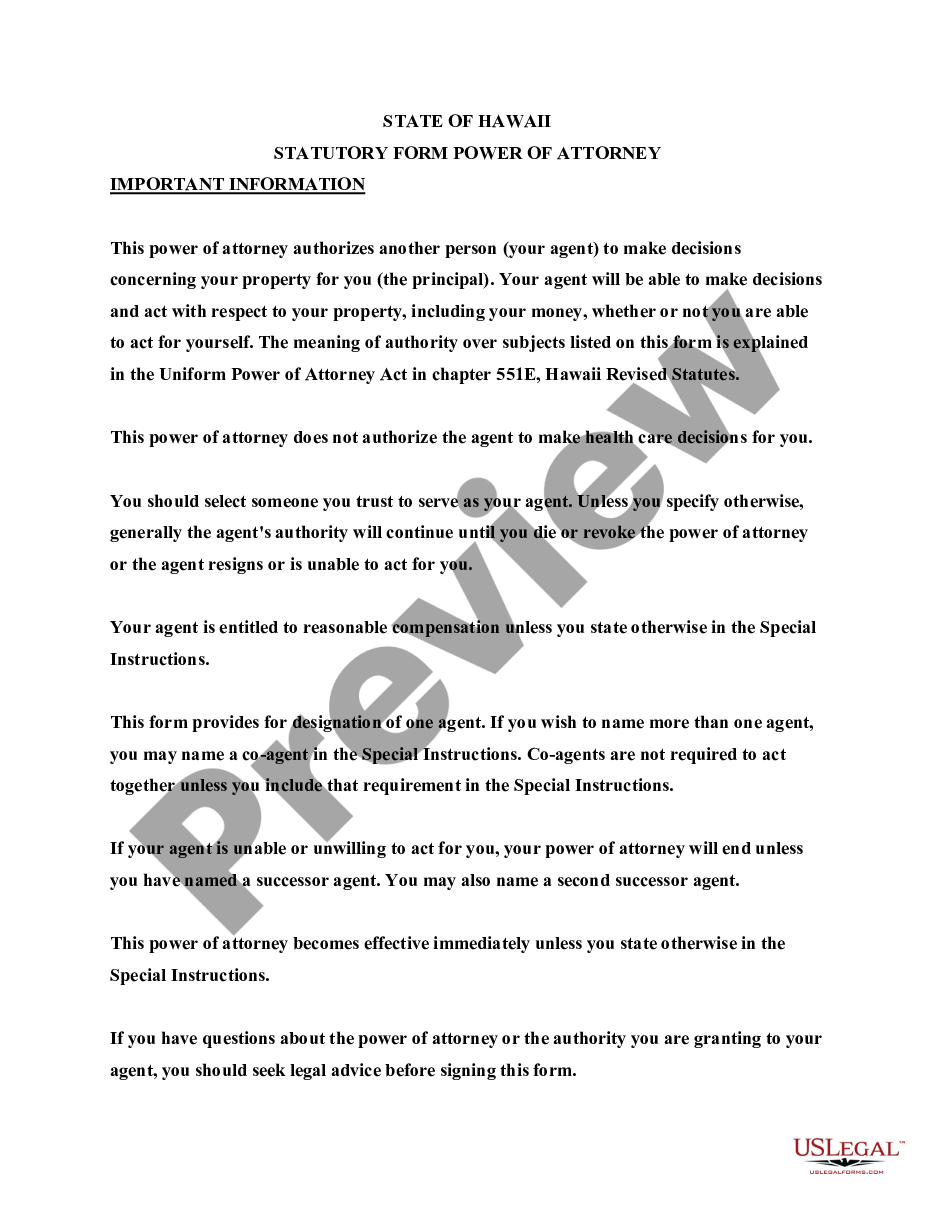

Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial

Description

How to fill out Hawaii Statutory Form Of Power Of Attorney For Property And Finances Or Financial?

Obtain one of the most extensive collections of approved documents. US Legal Forms is a platform where you can discover any state-specific forms in just a few clicks, such as the Hawaii Statutory Form of Power of Attorney for Property and Finances or various Financial templates.

There's no need to waste hours of your time looking for a court-admissible document. Our experienced professionals make sure you receive the most current documents at all times.

To utilize the document library, select a subscription and create an account. If you are already registered, simply Log In and click the Download button. The Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial template will be saved quickly in the My documents tab (where all forms you save on US Legal Forms are stored).

That's it! You should complete the Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly navigate through over 85,000 useful forms.

- If you plan to use state-specific documents, ensure you specify the correct state.

- If possible, review the description to understand all details of the document.

- Utilize the Preview option if available to examine the information about the document.

- If everything appears correct, click Buy Now.

- After selecting a pricing plan, create your account.

- Make payment via credit card or PayPal.

- Download the example to your computer by clicking Download.

Form popularity

FAQ

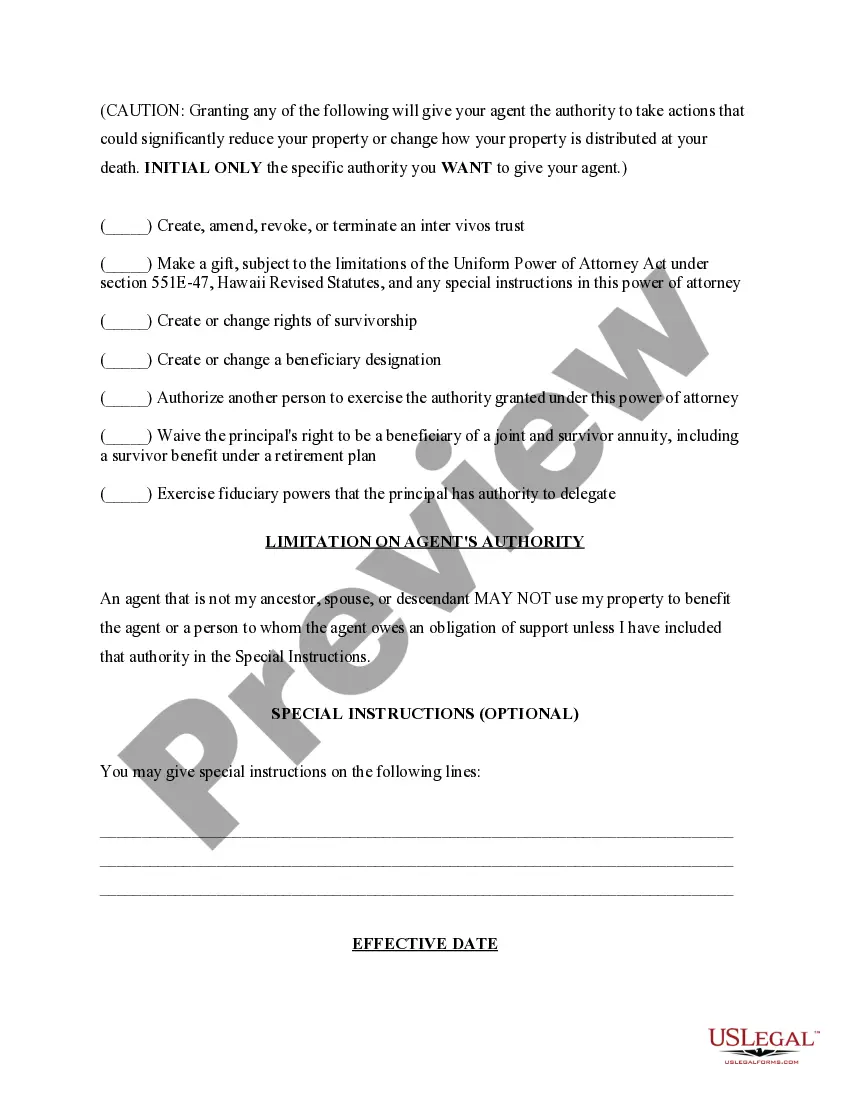

No, a statutory power of attorney and a durable power of attorney are not the same. The Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial allows you to designate someone to manage your financial affairs, but a durable power of attorney remains effective even if you become incapacitated. This means that while both serve important roles in financial management, the durability aspect is crucial for long-term planning. Using the appropriate documents from US Legal Forms can ensure you have the right protections in place.

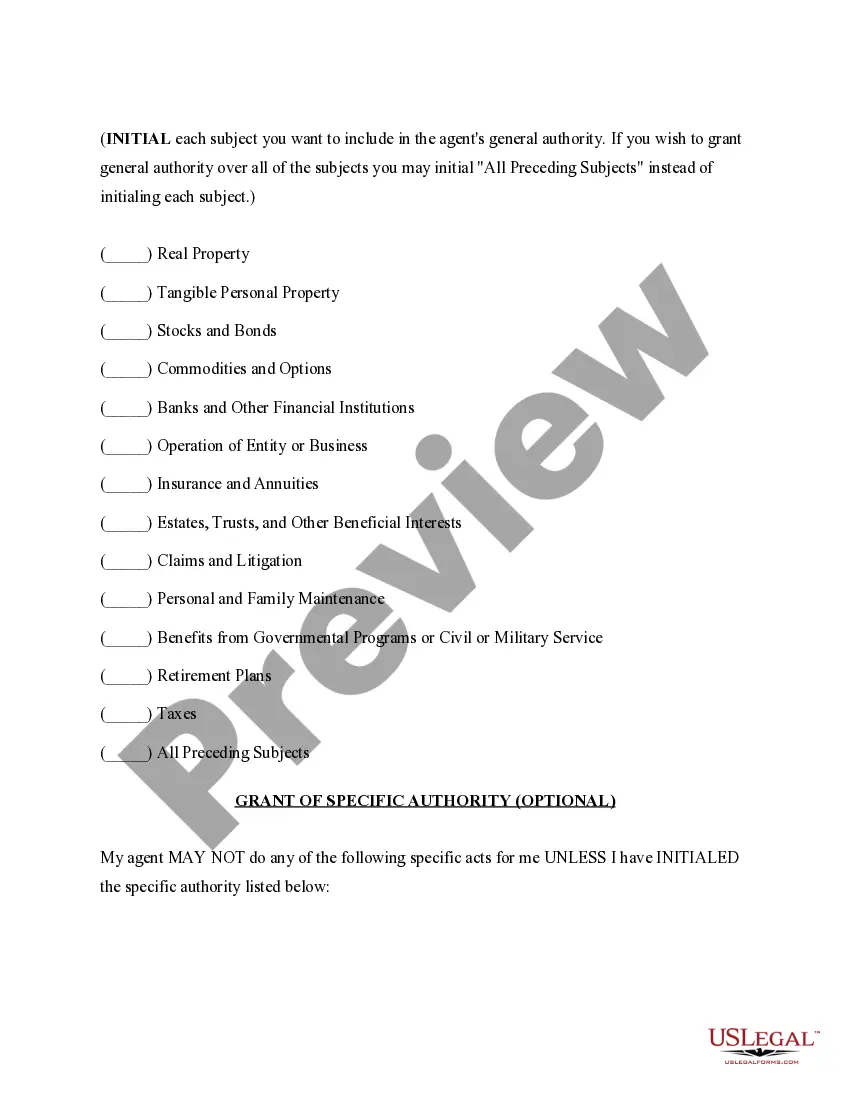

A financial power of attorney in Hawaii allows you to appoint someone to manage your financial affairs when you are unable to do so. This document defines the powers granted to your agent, which may include handling investments, paying bills, and managing property transactions. The Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial is designed to provide a clear framework for these responsibilities. Using a trusted platform like uslegalforms can simplify the process of creating this important document.

The main difference between a durable Power of Attorney and a standard POA lies in the duration of the authority granted. A durable POA remains effective even if you become incapacitated, allowing your agent to continue managing your financial affairs as specified. In contrast, a standard POA typically becomes invalid if you are unable to make decisions for yourself. Utilizing the Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial ensures you have the appropriate level of authority in place.

A Power of Attorney (POA) grants authority to another person to act on your behalf, particularly in financial matters. However, it's important to note that the individual you appoint does not take on financial responsibility for your debts or obligations. Instead, they must act in your best interest and manage your assets according to your wishes. Understanding the roles outlined in the Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial can clarify any concerns about responsibilities.

While the best type may vary based on individual needs, many experts recommend the financial power of attorney for its comprehensive coverage. The Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial is particularly favored because it includes clear guidelines on managing your financial matters. This format offers flexibility and clarity, ensuring that your agent understands their responsibilities fully. Consulting with legal professionals can help you determine the most suitable option for your situation.

Yes, in Hawaii, a power of attorney typically needs to be notarized to be valid. This requirement ensures that the document is executed properly and helps prevent fraud. When using the Hawaii Statutory Form of Power of Attorney for Property and Finances or Financial, having it notarized adds another layer of protection, ensuring that your wishes are respected. It's essential to follow these guidelines to ensure the form's acceptance and enforceability.

A standard power of attorney becomes invalid if you become incapacitated, whereas a statutory durable power of attorney remains effective regardless of your health status. The Hawaii Statutory Form of Power of Attorney for Property and Finances can be durable, ensuring your agent can manage your financial affairs even if you can no longer make decisions. This feature is particularly important for long-term planning.

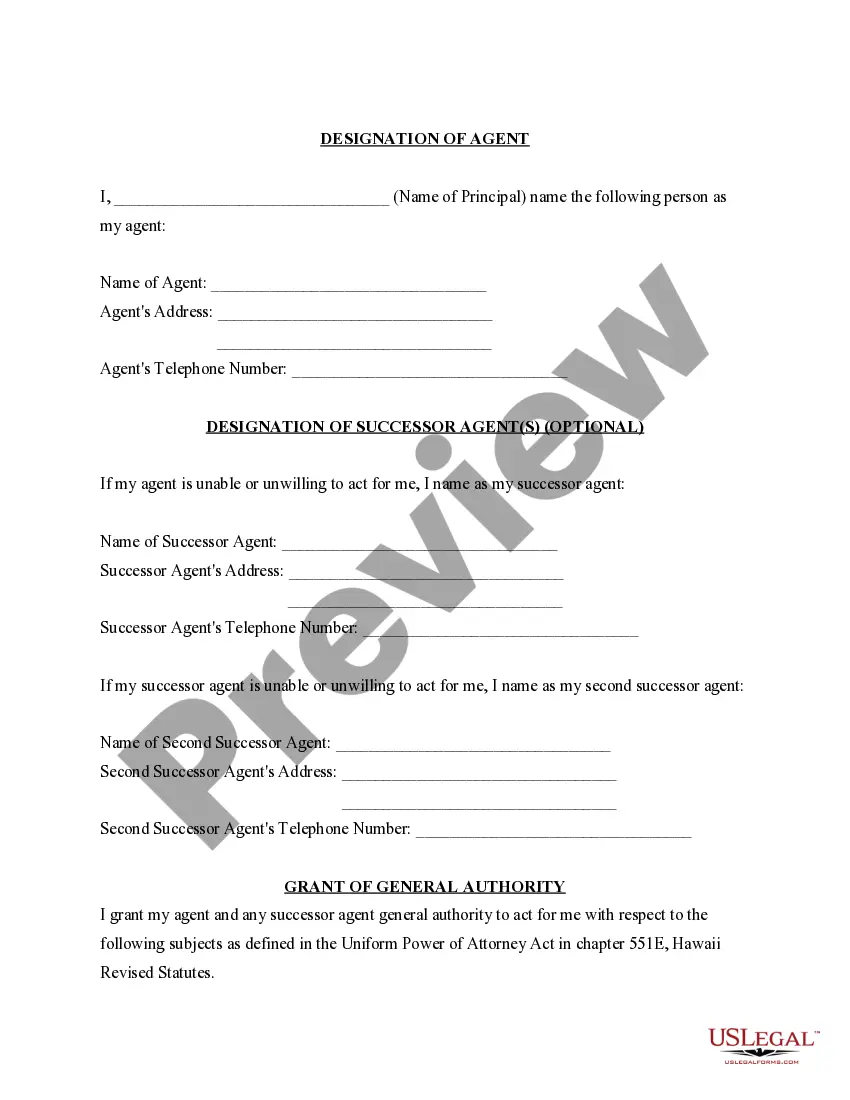

Setting up a power of attorney in Hawaii is a straightforward process. Start by selecting a trusted individual to act as your agent, and then obtain the Hawaii Statutory Form of Power of Attorney for Property and Finances. Complete the form by providing the necessary details about your agent and your financial situation. Don't forget to sign the document in front of a notary to ensure its enforceability.

Filling out a financial power of attorney involves several important steps. First, ensure you have a filled-out Hawaii Statutory Form of Power of Attorney for Property and Finances on hand. Identify your agent, list your financial accounts, and specify the powers you want to grant. After reviewing the document for completeness, have it notarized to ensure its legal validity.

To fill out a financial power of attorney in Hawaii, gather all necessary information regarding your assets and finances. Begin by selecting a trusted individual as your agent. Then, use the Hawaii Statutory Form of Power of Attorney for Property and Finances, ensuring you complete all sections accurately and clearly. Finally, sign the document in front of a notary public to validate it.