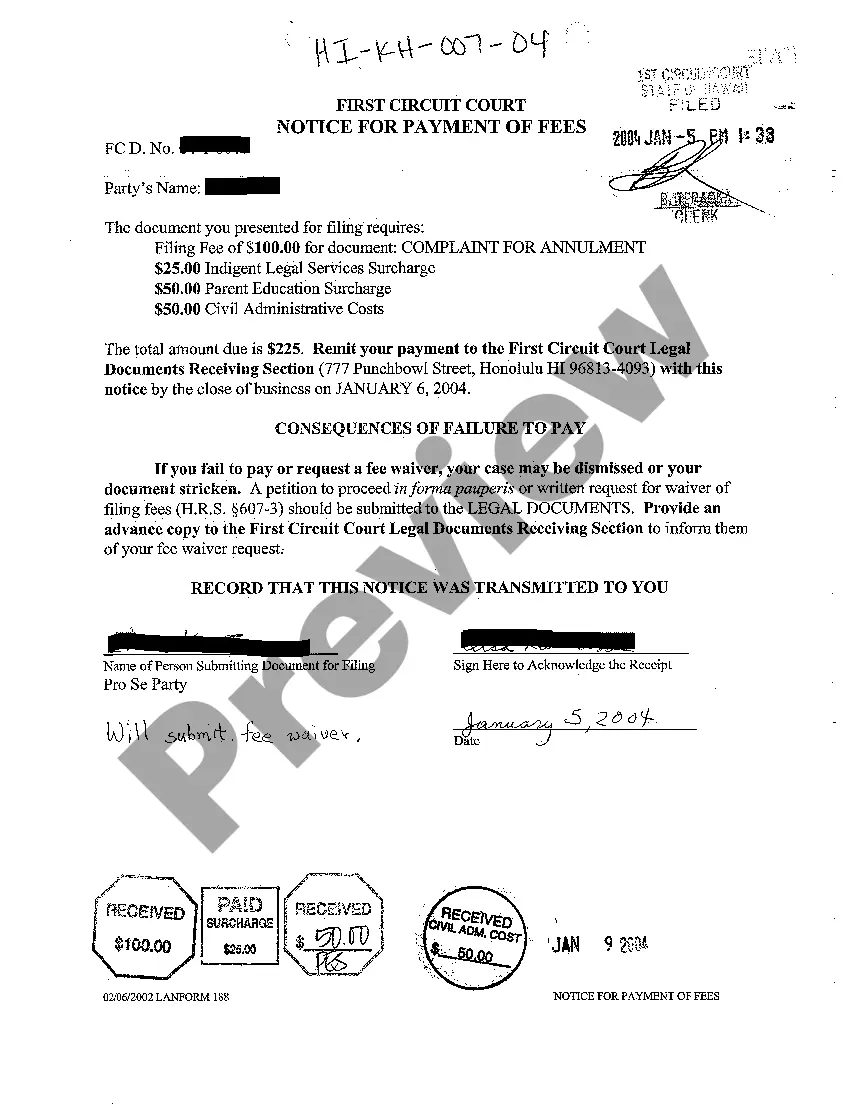

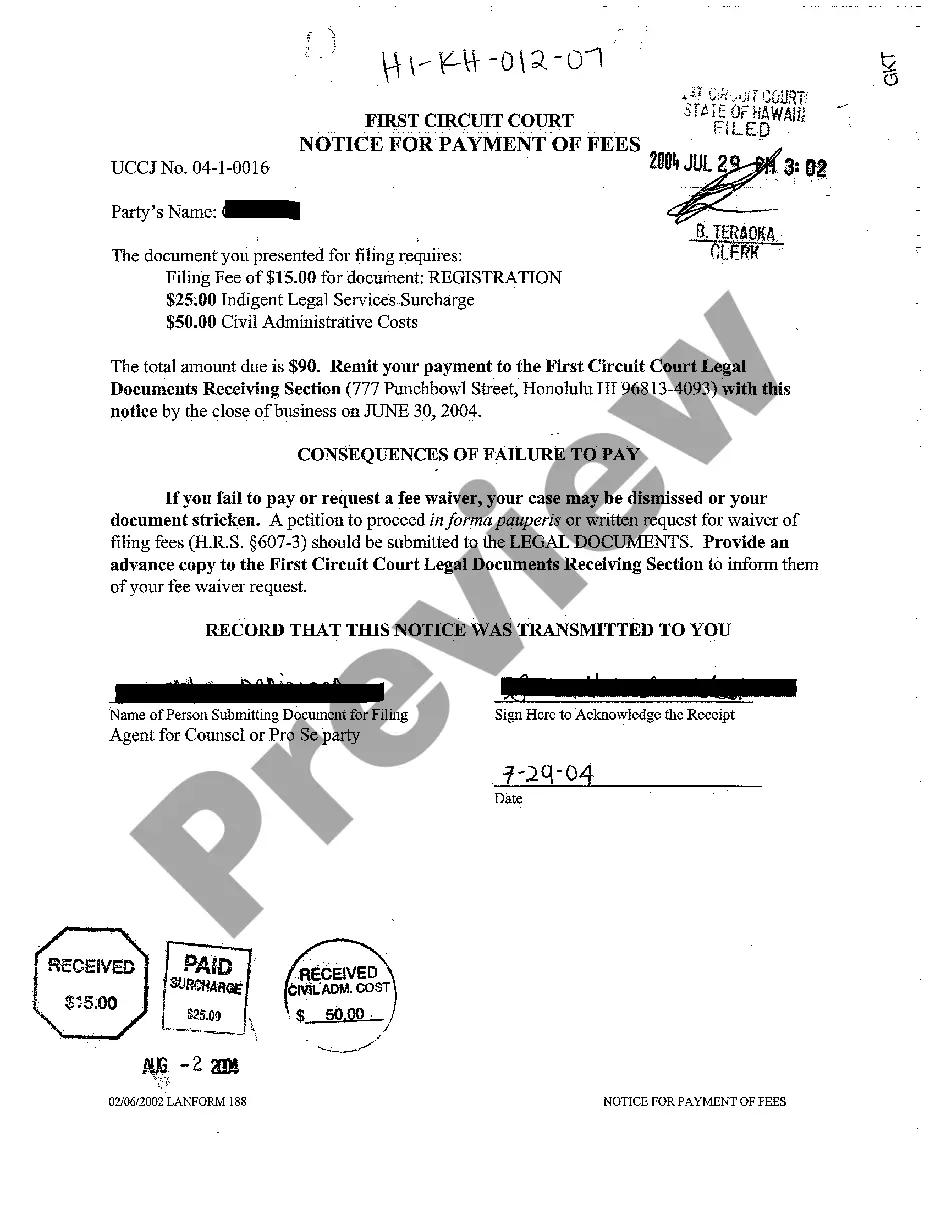

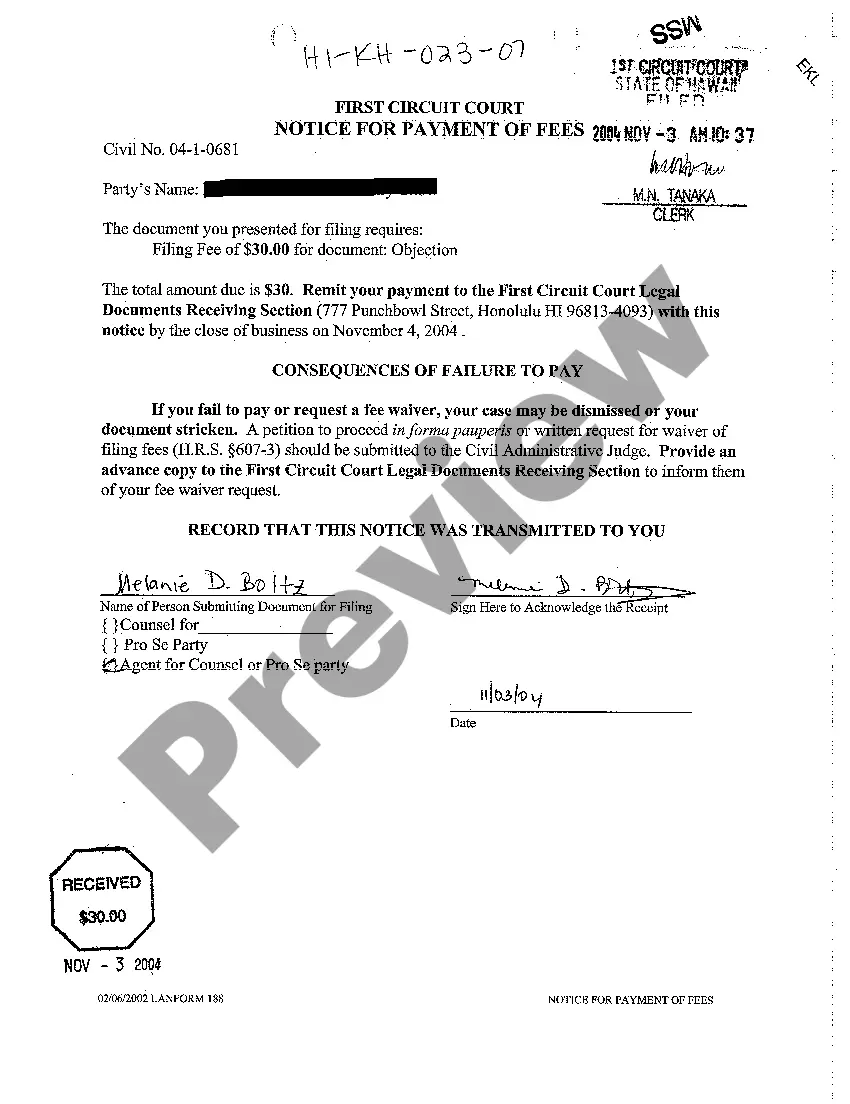

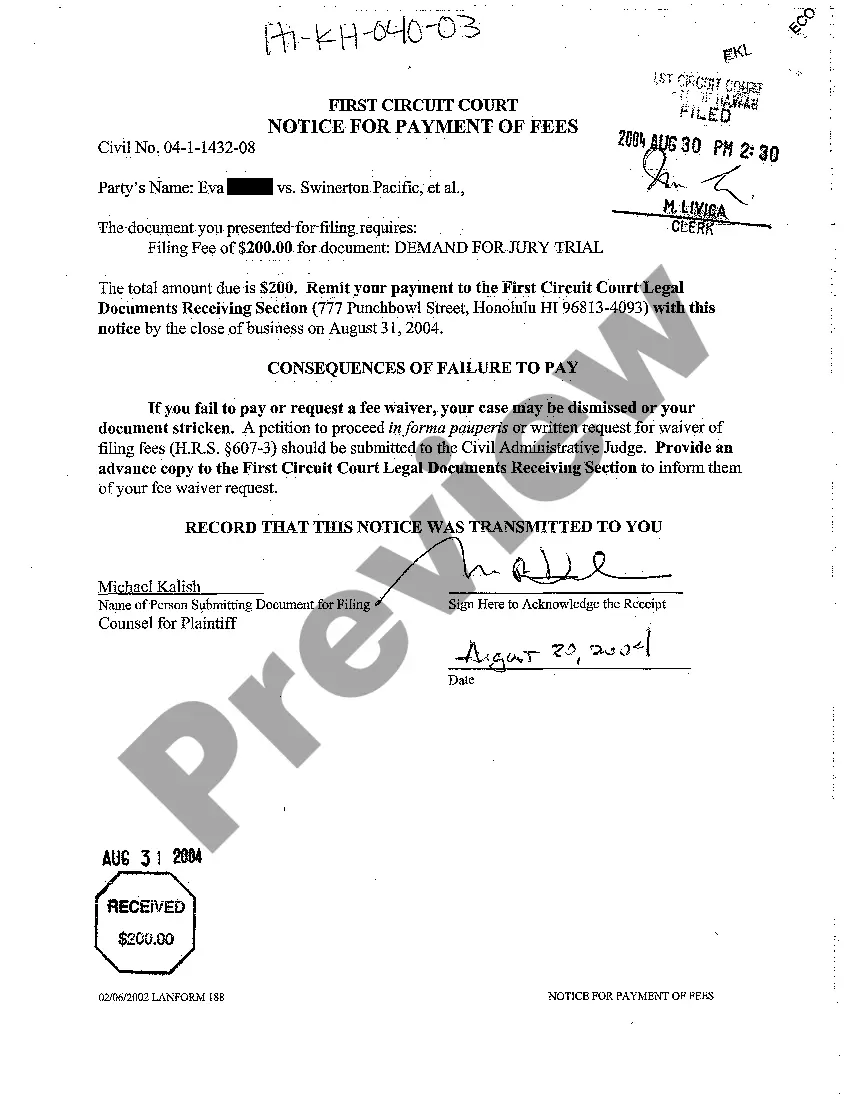

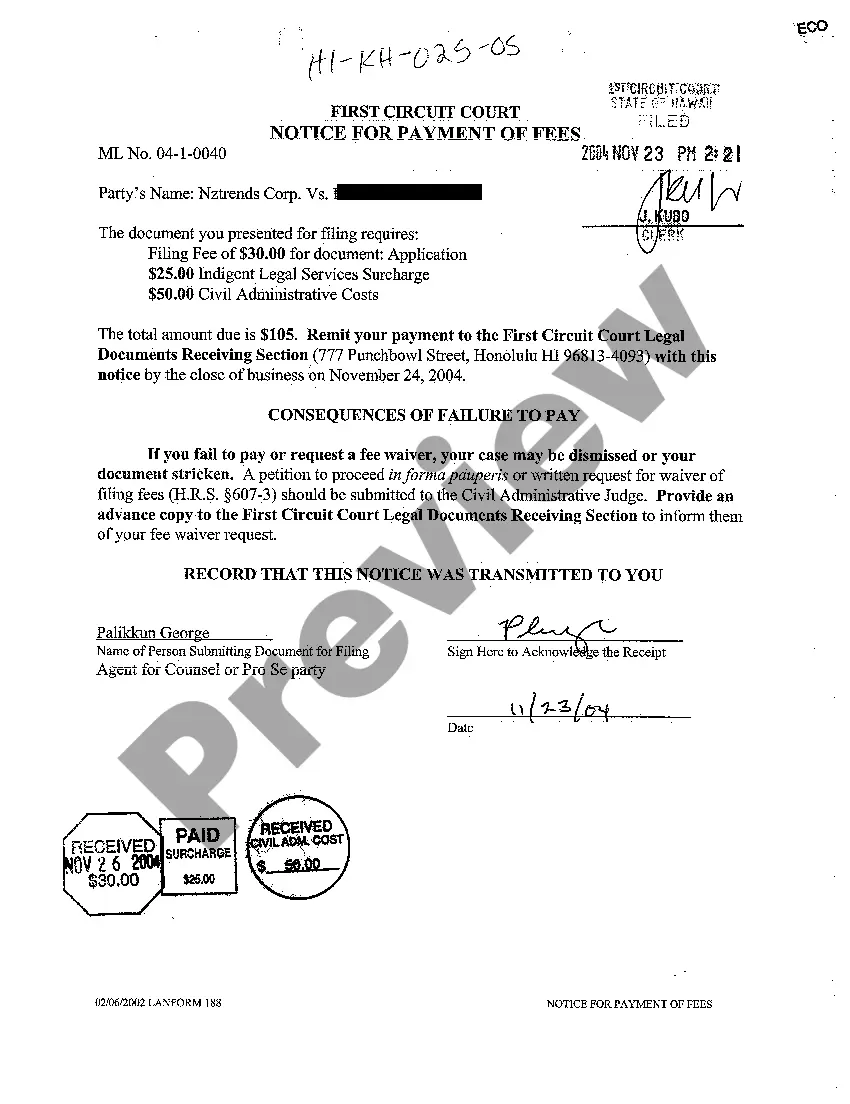

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Among numerous complimentary and paid samples available online, you cannot guarantee their precision.

For instance, who developed them or whether they possess the expertise to fulfill your requirements.

Stay calm and utilize US Legal Forms!

Review the template by examining the description while using the Preview feature. Click Buy Now to commence the ordering process or search for another example using the Search bar at the top. Choose a pricing plan, register for an account, and complete the payment for the subscription via your credit/debit card or PayPal. Download the document in your preferred format. After signing up and purchasing your subscription, you can use your Hawaii Notice for Payment of Fees as frequently as necessary or as long as it remains valid in your state. Modify it in your chosen online or offline editor, complete it, sign it, and print a hard copy. Accomplish more for less with US Legal Forms!

- Locate Hawaii Notice for Payment of Fees templates crafted by experienced attorneys.

- Avoid the costly and time-consuming task of searching for a lawyer and the subsequent expense of hiring them to draft a document that you can easily locate yourself.

- If you hold a subscription, Log In to your account and observe the Download button next to the file you seek.

- You will also have access to all of your previously obtained templates in the My documents menu.

- If you are visiting our website for the first time, follow the instructions below to effortlessly obtain your Hawaii Notice for Payment of Fees.

- Ensure that the document you are viewing is legitimate in your location.

Form popularity

FAQ

Hawaii form G-49 should be mailed to the Department of Taxation, specifically directed towards their designated address for G-49 submissions. It's essential to verify that you include any necessary documents as specified in the Hawaii Notice for Payment of Fees to ensure proper processing. If you are unsure or would like additional assistance, consider using USLegalForms for step-by-step guidance throughout your filing process.

To submit your N-20 form in Hawaii, you must mail it to the Department of Taxation, ensuring that it goes to the correct address for processing. Be sure to check for any specific mailing instructions in the Hawaii Notice for Payment of Fees, as this can save you time and trouble. If you need further assistance, platforms like USLegalForms offer comprehensive resources to guide you through the mailing process.

The G45 and G49 forms serve different purposes in Hawaii's tax system. The G45 is a general excise tax return, while the G49 is related to annual reconciliation of general excise and use taxes. Both forms are important for fulfilling your tax obligations, but knowing the distinctions can simplify your reporting process. The Hawaii Notice for Payment of Fees can help clarify any questions regarding these forms and their requirements.

In Hawaii, failure to comply with Electronic Funds Transfer (EFT) requirements can lead to significant penalties. Individuals or businesses may face late fees and additional charges if payments are not made on time. Understanding the Hawaii Notice for Payment of Fees is crucial, as it outlines the necessary steps to avoid these penalties. Utilizing resources like USLegalForms can provide guidance on compliance and help you navigate these obligations.

To close an LLC in Hawaii, you need to file a Certificate of Dissolution with the Department of Commerce and Consumer Affairs. It's important to settle all debts and obligations before filing. Additionally, if applicable, make sure to handle any required Hawaii Notice for Payment of Fees related to the dissolution process. This will ensure that your LLC is closed legally and properly.

The maximum claim in Hawaii's small claims court is $3,500. This limit is designed to help individuals resolve disputes without incurring high costs associated with traditional litigation. To ensure a smooth filing process, remember to include the Hawaii Notice for Payment of Fees, as it outlines the required fees for your claim.

The maximum amount you can sue for in Hawaii varies based on the type of court handling your case. For small claims court, this limit is $3,500, whereas regular claims court allows for claims above $5,000, with no upper cap. Always ensure you include the Hawaii Notice for Payment of Fees when you file your case, as this serves as an essential step in the legal process.

In Hawaii, the maximum amount you can claim in small claims court is $3,500. This limit is set to make the court accessible for individuals without the need for extensive legal representation. If your claim falls within this amount, you must follow the proper procedure and file the necessary Hawaii Notice for Payment of Fees to proceed effectively.

In Hawaii, the regular claims court can handle cases with claims exceeding $5,000. It's essential to understand that if your claim is within this limit, your case may be better suited for small claims court instead. If you are filing a claim, ensure you are aware of the required Hawaii Notice for Payment of Fees, as this documentation is crucial for the legal process.

To establish a payment plan in Hawaii, contact your local taxing authority to inquire about options. Often, they allow you to negotiate a feasible payment schedule based on your financial situation. During this process, reference any Hawaii Notice for Payment of Fees to help clarify your obligations and indicate your commitment to resolving your tax payments.