Hawaii Closing Statement

Overview of this form

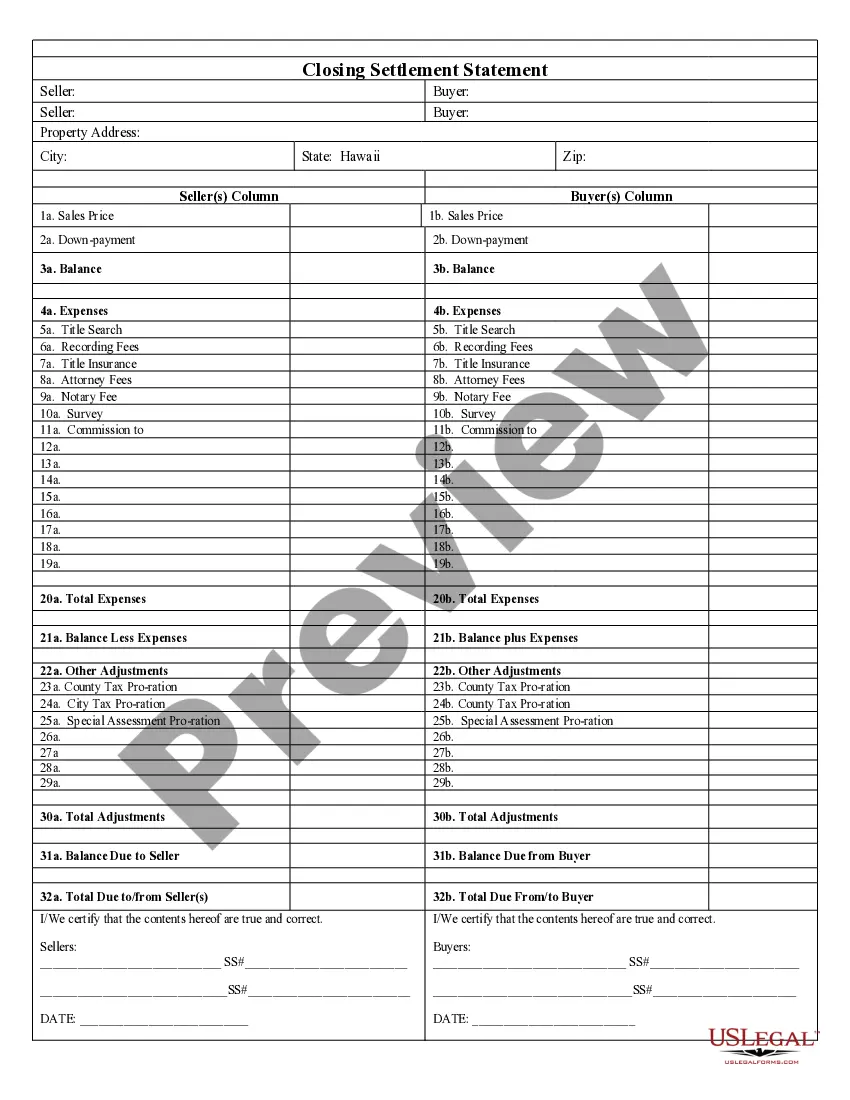

The Closing Statement is a vital document used in real estate transactions, specifically for cash sales or owner financing deals. It outlines the financial details of the transaction, including the amounts owed, the expenses incurred, and the remaining balance due to either party. This form differs from other real estate documents, such as purchase agreements or deeds, as its primary focus is on summarizing the financial aspects of the sale.

Key parts of this document

- Balance calculations: Includes fields for total expenses and balances due to/from parties.

- Expense breakdown: Lists detailed expenses, such as title search fees, recording fees, and attorney costs.

- Adjustments section: Addresses various financial adjustments, including tax prorations and special assessments.

- Certification by parties: Spaces for signatures of both buyer and seller to confirm accuracy.

When to use this form

This form should be used during the final stages of a real estate transaction when the buyer is ready to make the payment, and all associated expenses need to be documented. It serves as a comprehensive summary of all financial obligations and payouts related to the sale, ensuring that both parties have a clear understanding of the amounts being exchanged.

Intended users of this form

The following individuals should use the Closing Statement:

- Real estate buyers and sellers involved in a cash sale or owner financing transaction.

- Real estate agents who need to provide an accurate financial summary to their clients.

- Attorneys handling real estate transactions on behalf of their clients.

Steps to complete this form

- Identify the parties involved in the transaction (buyer and seller).

- Specify the property details, including address and transaction type.

- List all applicable expenses in their respective fields, ensuring accuracy.

- Calculate total expenses and balances to ensure correctness.

- Have both parties sign and date the form to certify its accuracy.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Forgetting to include all relevant expenses in the breakdown.

- Providing incorrect property details or transaction amounts.

- Not updating balances after calculating adjustments, leading to discrepancies.

- Failing to obtain signatures from both buyer and seller.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows users to modify the form as necessary for their specific transaction.

- Access to professionally drafted templates, ensuring legal compliance and accuracy.

Looking for another form?

Form popularity

FAQ

At closing, the seller signs the deed to transfer ownership of the property. This act is crucial for officially transferring the title to the buyer. Once signed, the deed is recorded to protect both parties' interests. Both the Hawaii Closing Statement and the deed play significant roles in ensuring the completion of the property transfer.

The closing statement is typically prepared by the closing agent or an attorney. They compile all financial information related to the transaction, including fees and credits, into the Hawaii Closing Statement. This ensures accuracy and completeness of the documentation. Utilizing platforms like USLegalForms can streamline this preparation process, making it easier for you.

Typically, both the buyer and the seller sign the Hawaii Closing Statement. Their signatures confirm agreement to the financial details outlined in the document. The closing agent or attorney may also sign to validate the closing process. This ensures all parties are on the same page regarding the transaction.

Yes, a closing statement must be signed to finalize the property transaction. In Hawaii, this statement details all costs and credits associated with the sale. By signing the Hawaii Closing Statement, both parties acknowledge their agreement to these terms. Therefore, it serves as a critical step in the closing process.

At closing, several essential documents are signed, including the Hawaii Closing Statement. This statement outlines all financial transactions related to the sale, ensuring transparency. Additionally, buyers and sellers may sign the deed, promissory notes, and mortgage documents. Each piece of paperwork plays a crucial role in finalizing the property transfer.

A brief Hawaii Closing Statement condenses the key financial information pertaining to a property sale into a shorter format. It typically highlights the most critical figures without excessive detail, making it easy to read and understand. This version is ideal for quick reviews, especially for individuals seeking an overview without unnecessary complexities.

A general Hawaii Closing Statement outlines the essential financial details of a real estate transaction. It summarizes all costs, credits, and relevant transactions that occurred between the buyer and seller at closing. Understanding this statement helps all parties involved stay informed and ensures proper handling of financial aspects.

To obtain your Hawaii Closing Statement, you can request it from your title company or attorney involved in the transaction. Many service providers, like uslegalforms, offer a simple platform to access and generate your closing statement. Ensure you keep a copy for your records, as it provides essential details about the concluded sale.

A typical Hawaii Closing Statement lists all transactions associated with the sale of real estate. It includes detailed sections on income, expenses, and distribution of funds. The statement serves as an official record that can be referenced by both parties and their legal representatives if questions or disputes arise in the future.

A good example of a Hawaii Closing Statement includes a detailed summary of the financial transactions that occurred in a property sale. It typically itemizes the closing costs, escrow fees, and any adjustments made during the transaction. This document helps ensure that both parties understand the final amounts owed and received, minimizing misunderstandings.