A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Hawaii Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

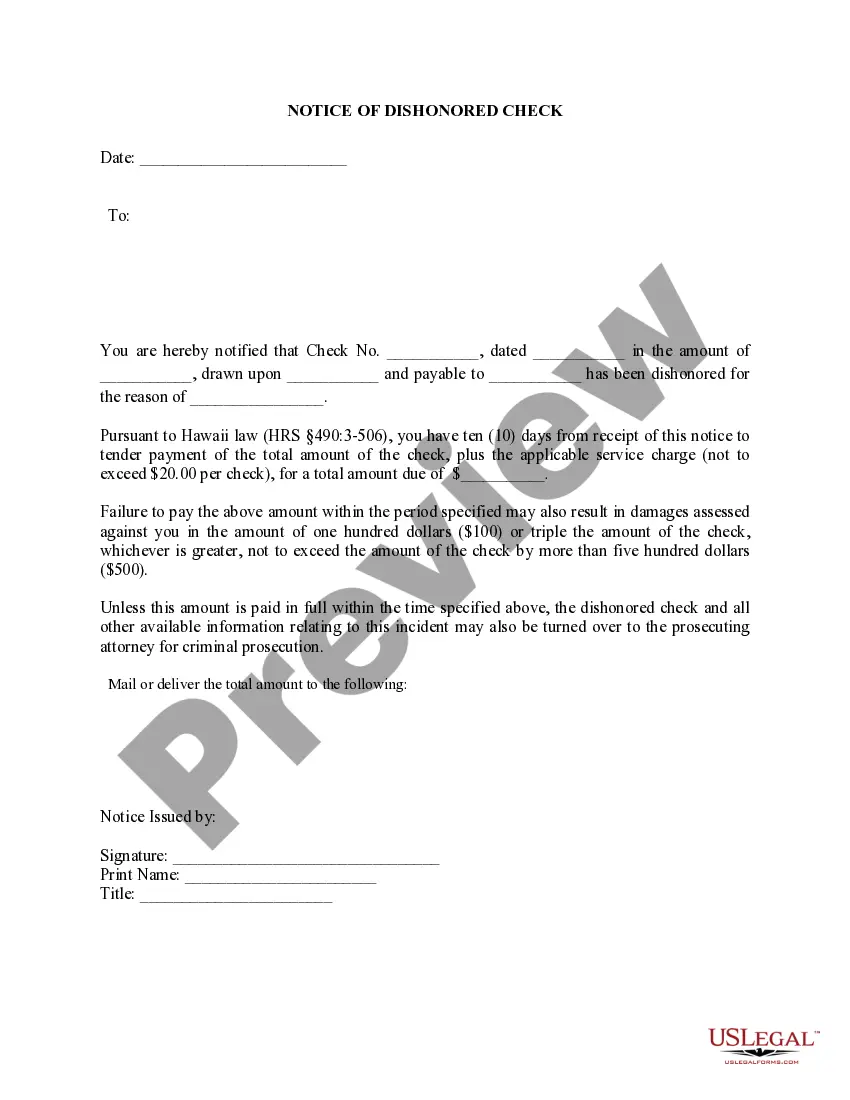

How to fill out Hawaii Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Utilize the most comprehensive collection of sanctioned documents. US Legal Forms serves as a platform where you can discover any state-specific paperwork in just a few clicks, like Hawaii Notice of Dishonored Check - Civil - Keywords: invalid check, returned check samples.

No need to squander hours searching for a legally admissible document. Our certified experts ensure you receive current samples every time.

To access the forms library, select a subscription and register an account. If you have already registered, simply Log In and hit the Download button. The Hawaii Notice of Dishonored Check - Civil - Keywords: invalid check, returned check file will be automatically stored in the My documents tab (a section for each form you download on US Legal Forms).

That’s it! You should submit the Hawaii Notice of Dishonored Check - Civil - Keywords: invalid check, returned check template and verify it. To ensure that everything is correct, consult your local legal advisor for assistance. Register and easily browse through over 85,000 valuable samples.

- If you intend to use a state-specific template, make sure to specify the correct state.

- If possible, review the description to grasp all the details of the document.

- Utilize the Preview feature if available, to examine the contents of the document.

- If everything appears to be in order, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Make payment via card or PayPal.

- Download the document to your device by clicking Download.

Form popularity

FAQ

Writing a bounced check occurs when you issue a check without sufficient funds in your account to cover the amount. When you do this, the bank will return the check as a dishonored check, causing inconvenience for both you and the recipient. To avoid this, make sure to verify your account balance before issuing a check. If you find yourself needing to address a bounced check, consider using our Hawaii Notice of Dishonored Check - Civil template to outline the necessary steps and legal implications.

When a check is dishonored, it typically gets returned to the payee, marking it as unpaid. The payee may attempt to collect the funds, which can include additional fees for the inconvenience. If unpaid for a long period, you might face legal action, depending on the circumstances. You can find helpful templates and legal guidance on how to respond to dishonored checks at USLegalForms.

A bank may dishonor a check for various reasons including insufficient funds, account closure, a stale-dated check, signature discrepancies, or exceeding the available line of credit. Other common issues include drawing from an account that has been frozen or is reported lost or stolen. Understanding these reasons can empower you to write checks more responsibly. USLegalForms can provide further insights on preventing dishonored checks.

If you write a check that bounces, you may be subject to fees charged by your bank and possibly by the payee. It’s crucial to communicate promptly with the recipient and resolve the issue to avoid legal action. Taking preventive measures, such as monitoring your account balances regularly, can prevent this headache. USLegalForms offers solutions to help you understand and manage your obligations concerning bounced checks.

An example of a dishonored check is when a business issues a check to a supplier, but the bank returns it marked 'NSF' (non-sufficient funds) because the business account lacks enough funds. This situation can lead to strained relationships and additional fees. Knowing how to deal with dishonored checks is crucial for financial management. Resources at USLegalForms can guide you in resolving these challenges.

A check may be returned or dishonored for several reasons, such as insufficient funds in the account or an incorrect signature. Bounced checks can also occur if the issuer has closed the account or if the check is stale-dated. Acknowledging these factors can help you avoid writing bad checks in the future. Tools available on USLegalForms can assist you in managing these situations effectively.

A dishonored check is one that a bank refuses to process due to insufficient funds or other issues. This means the intended recipient does not receive the funds from the issuer’s account. In Hawaii, both issuers and recipients of dishonored checks should understand their rights and responsibilities. You can find useful information on this through resources like USLegalForms.

If you write a bad check that exceeds $500, you may face severe legal consequences. In Hawaii, this can lead to civil penalties, and you may also be held liable for the check’s amount plus additional fees. It's important to address this situation promptly to avoid further complications, such as court action. Using platforms like USLegalForms can help you navigate the legal requirements surrounding bounced checks.

If a cheque bounces due to insufficient balance, your first action should be to contact the check issuer. It’s crucial to inform them of the bounced check and to discuss repayment options. Sending a formal notice, like the Hawaii Notice of Dishonored Check - Civil, can help document the situation and guide you on how to proceed. U.S. Legal Forms offers resources to aid you in managing these unfortunate circumstances effectively.

A bounced check is one that cannot be processed due to insufficient funds in the issuer's account. To avoid issuing a bad check, keep a close watch on your account balance and ensure you have enough funds before writing checks. Additionally, consider using online tools for better financial management. If you do encounter issues, consult U.S. Legal Forms for assistance with the Hawaii Notice of Dishonored Check - Civil to resolve matters promptly.