Hawaii Quitclaim Deed from an Individual to a Trust

Definition and meaning

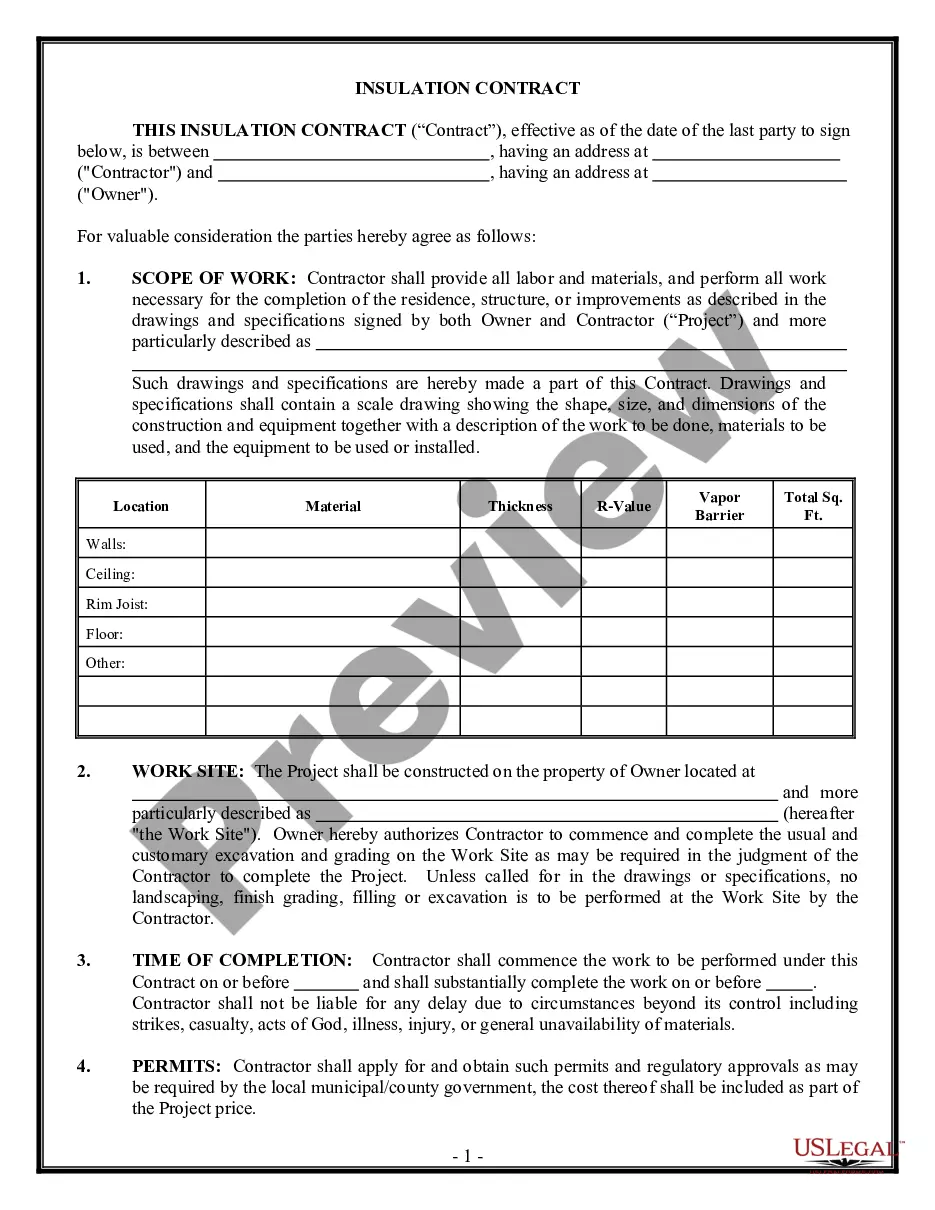

A Hawaii Quitclaim Deed from an Individual to a Trust is a legal document that allows an individual (the grantor) to transfer their ownership interest in a property to a trust (the grantee). This type of deed does not provide any warranties regarding the property title, meaning the grantor is not guaranteeing that they have clear title or that the property is free from other claims. It is commonly used in estate planning to place assets into a trust for the benefit of the designated beneficiaries.

How to complete a form

To fill out the Hawaii Quitclaim Deed, follow these steps:

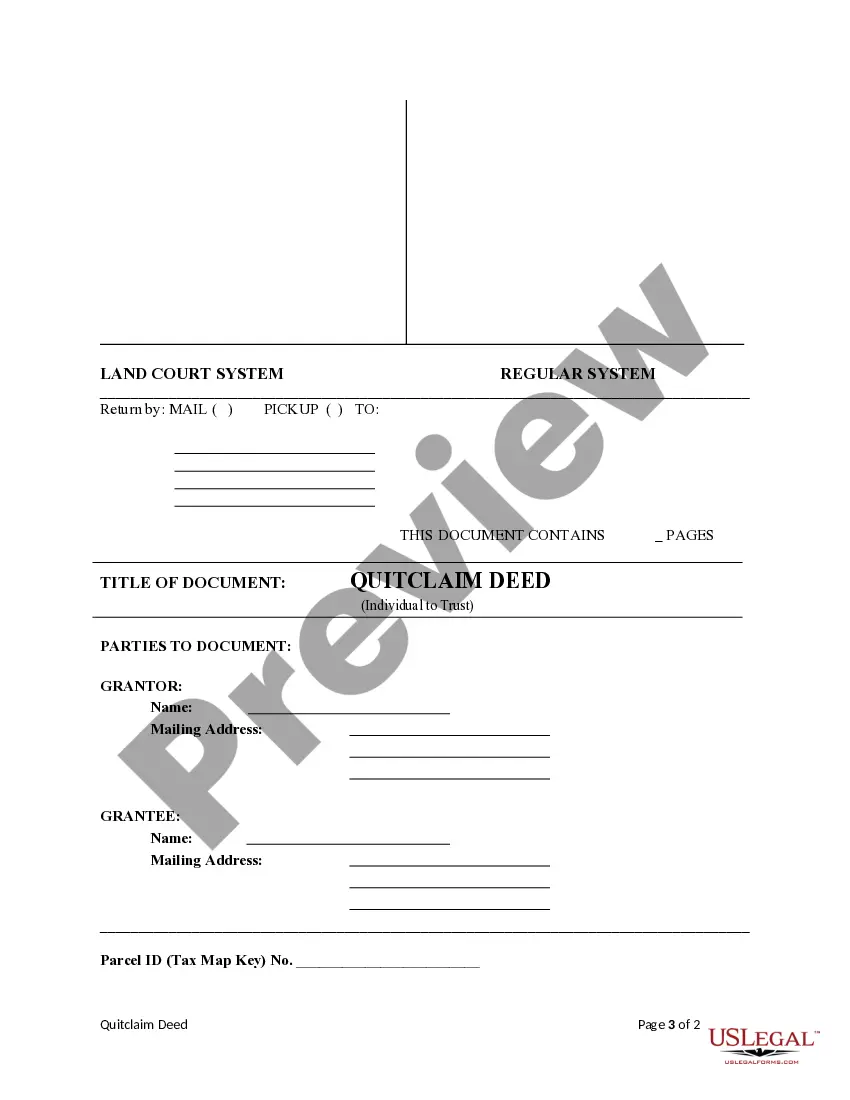

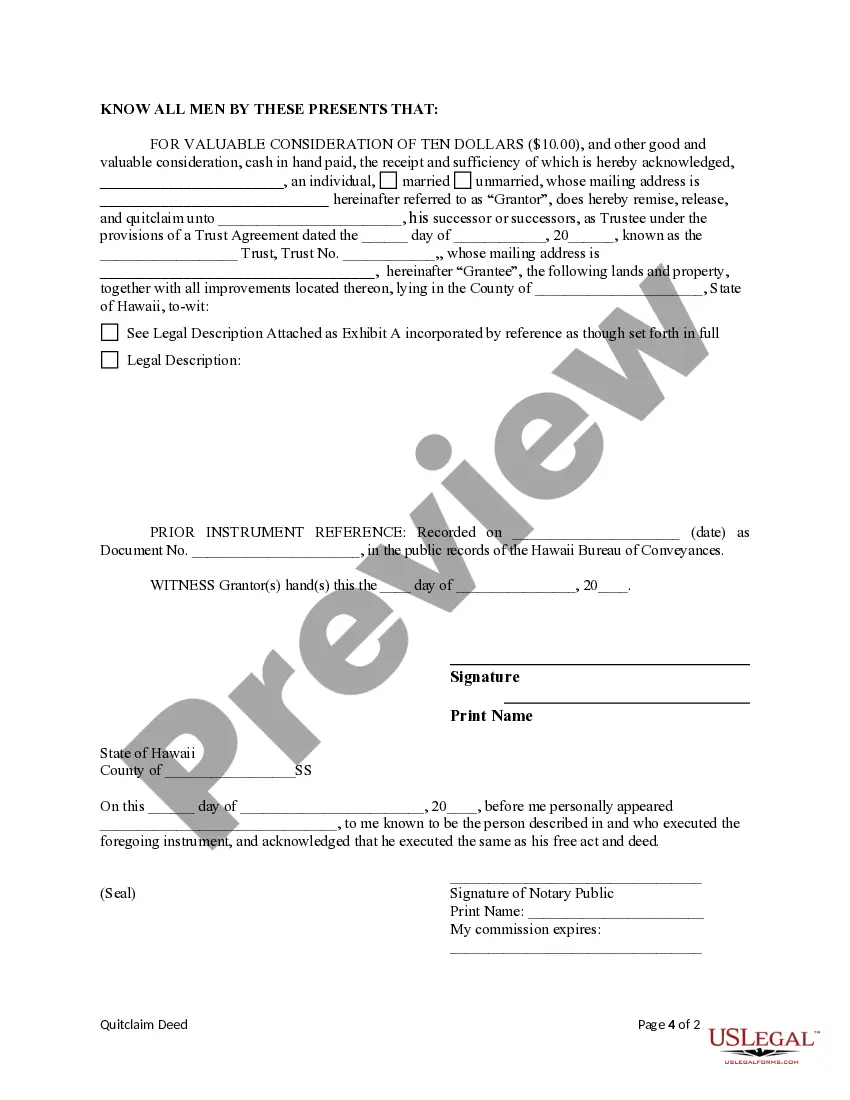

- Enter the names and addresses of the grantor and grantee.

- Provide a legal description of the property being transferred, which can often be found on the property’s title or tax documents.

- Complete the date of the trust agreement.

- Specify any prior instrument references regarding previous ownership.

- Sign the document in front of a notary public to validate the transfer.

Who should use this form

This form is suitable for individuals looking to transfer property ownership to a trust as part of their estate planning process. It is ideal for those who wish to manage their assets more effectively or ensure that their beneficiaries will receive property after their passing. Users may include:

- Property owners setting up a trust.

- Individuals transitioning property ownership as part of estate planning.

- People looking to simplify property transfers without the need for extensive legal procedures.

State-specific requirements

In Hawaii, specific requirements must be met when completing a Quitclaim Deed. The following points are essential:

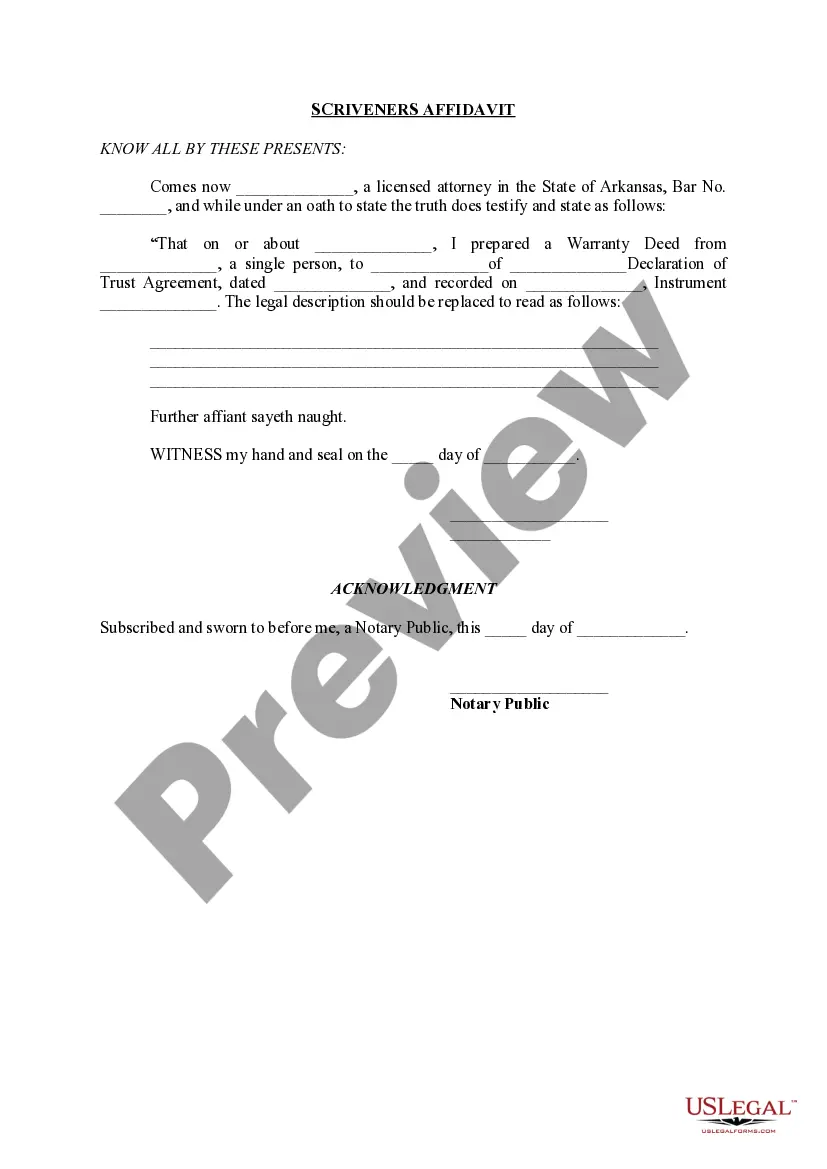

- The deed must be executed in writing and signed by the grantor.

- It must be notarized to ensure that the signature is valid and enforceable.

- It should be recorded with the Hawaii Bureau of Conveyances to protect the interests of the grantee and to provide public notice of the transfer.

What to expect during notarization or witnessing

During the notarization process, you will need to present valid identification to the notary public. The notary will verify your identity and witness you signing the Quitclaim Deed. It is their responsibility to certify that you are signing the document voluntarily and that you are competent to do so. After notarization, the notary public will affix their signature and seal to the document.

Common mistakes to avoid when using this form

When completing the Hawaii Quitclaim Deed, it is essential to avoid several common errors:

- Failing to include a complete legal description of the property.

- Not signing the document in front of a notary public.

- Leaving out important details, such as the date of the trust agreement.

- Not recording the deed with the Bureau of Conveyances after completion.

Form popularity

FAQ

One of the main issues with a Hawaii Quitclaim Deed from an Individual to a Trust is that it transfers ownership without guarantees. This lack of warranties can lead to potential disputes over property rights later. Additionally, it might not be the best option for complex estate planning needs. Consulting with a legal expert or using a reliable service like US Legal Forms can help navigate these concerns.

To fill out a Hawaii Quitclaim Deed from an Individual to a Trust form, provide clear and concise information about the property, the grantor, and the trustee of the trust. Make sure to include the legal description of the property, which can typically be found on your current deed. After completing the form, sign and date it before a notary to make it legally valid.

Yes, you can prepare a Hawaii Quitclaim Deed from an Individual to a Trust yourself with relative ease. It's important to ensure that you are using the correct form and that you provide accurate details about the property and parties involved. However, for peace of mind and compliance with state laws, you might consider using a platform like US Legal Forms to access professionally crafted documents.

To execute a Hawaii Quitclaim Deed from an Individual to a Trust, start by obtaining a quitclaim deed form specific to Hawaii. Next, fill in the required information, including the names of the individual and the trust, and then sign the document in front of a notary. Finally, you must file the completed deed with your local county recorder's office.

The primary reason for using a Hawaii Quitclaim Deed from an Individual to a Trust is to transfer property rights without warranty. This simple process typically enables individuals to transfer ownership of their property into a trust for various benefits, including avoiding probate and facilitating estate planning.

To transfer property ownership in Hawaii, you should consider utilizing a Hawaii Quitclaim Deed from an Individual to a Trust. This deed allows for a straightforward transfer of property rights without extensive legal procedures. Write the deed accurately, have it signed and notarized, and then file it with the state. If you need assistance, the US Legal Forms platform offers templates and support to help you navigate this process smoothly.

The easiest way to transfer ownership of a house may involve using a Hawaii Quitclaim Deed from an Individual to a Trust. This method simplifies the transfer process, as it does not require warranties on the title. It is crucial to ensure that you include accurate property details and have the deed notarized for legal validity. Utilizing our US Legal Forms platform can provide an easy solution to obtain the necessary forms and guidance.

To transfer a title in Hawaii, you can use a Hawaii Quitclaim Deed from an Individual to a Trust. This legal document allows the current owner to transfer property rights to a trust effectively. Ensure that you correctly complete the form, sign it in front of a notary, and then record it with the Bureau of Conveyances. This process ensures that the trust holds the title after the transfer is complete.

To remove someone from a deed of trust, consider executing a Hawaii Quitclaim Deed from an Individual to a Trust as a potential solution. This deed facilitates the transfer of property interests and legally removes individuals from the deed. Seeking legal advice is advisable to navigate the process and ensure it aligns with state laws.

Yes, a quitclaim deed can transfer property from a trust to another party. When using a Hawaii Quitclaim Deed from an Individual to a Trust, the trustee can convey the property held in trust to a specified individual or another entity. Make sure to follow all necessary legal steps to ensure the transaction is valid and recognized.