Guam Binding Nature of Assignment

Description

How to fill out Binding Nature Of Assignment?

You can spend several hours on the Internet searching for the legitimate document web template that meets the federal and state demands you want. US Legal Forms supplies a huge number of legitimate varieties that are analyzed by experts. It is simple to download or print out the Guam Binding Nature of Assignment from your service.

If you already have a US Legal Forms accounts, you are able to log in and click on the Download button. Next, you are able to complete, modify, print out, or indication the Guam Binding Nature of Assignment. Each legitimate document web template you get is the one you have eternally. To obtain one more backup of the acquired kind, visit the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site initially, adhere to the straightforward directions listed below:

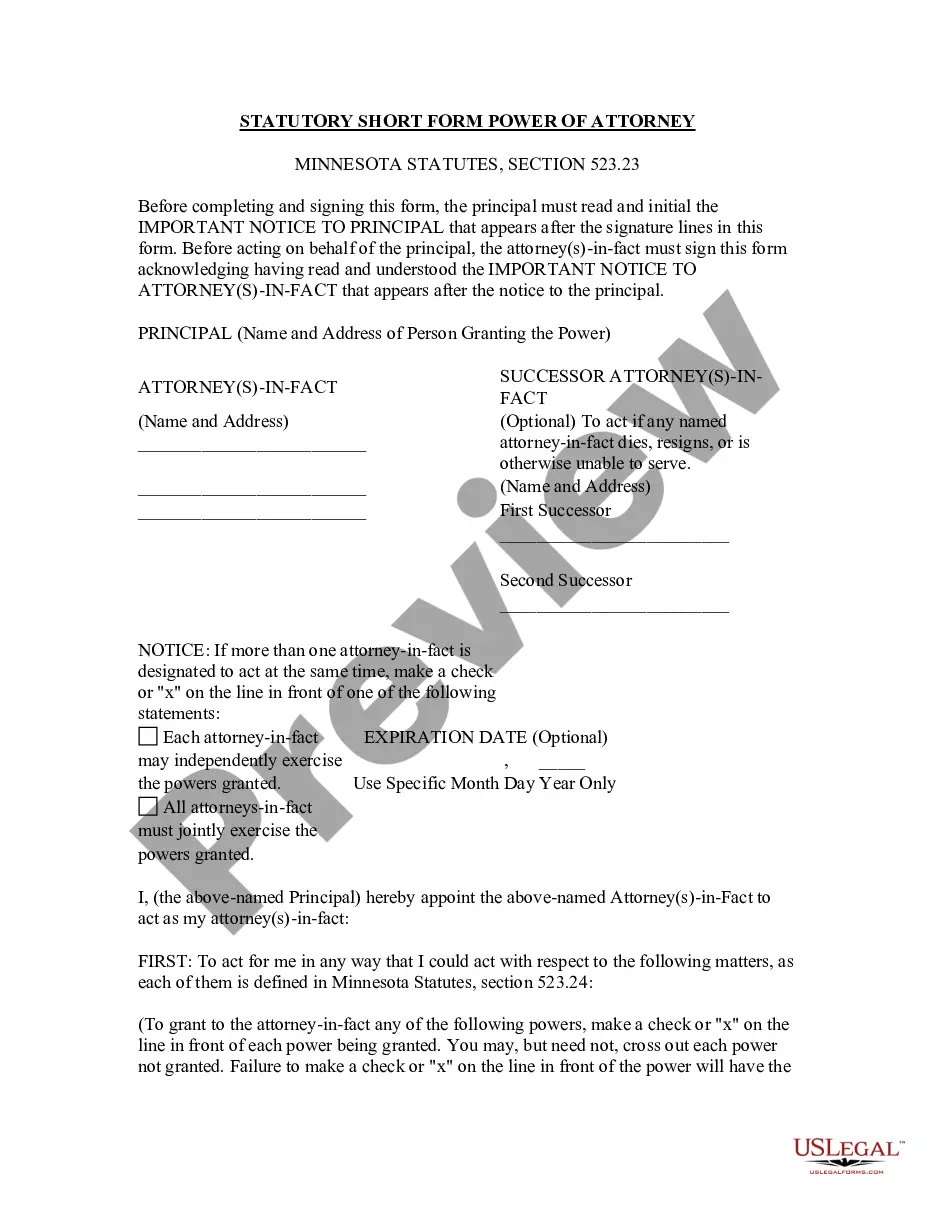

- Very first, ensure that you have chosen the proper document web template for your area/city of your choice. Read the kind explanation to make sure you have picked the right kind. If accessible, make use of the Review button to search with the document web template too.

- In order to get one more version from the kind, make use of the Search industry to discover the web template that fits your needs and demands.

- When you have located the web template you want, click Purchase now to continue.

- Pick the rates program you want, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal accounts to pay for the legitimate kind.

- Pick the format from the document and download it for your device.

- Make changes for your document if possible. You can complete, modify and indication and print out Guam Binding Nature of Assignment.

Download and print out a huge number of document layouts making use of the US Legal Forms Internet site, which provides the biggest selection of legitimate varieties. Use skilled and condition-certain layouts to take on your business or personal requirements.

Form popularity

FAQ

Section 26201, Article 2, Chapter 26 of Title 11, of the Guam Code Annotated (GCA), states there is hereby levied and shall be assessed and collected monthly privilege taxes against the persons on account of their businesses and other activities in Guam measured by the application of rates against values, gross ...

4 percent Title 11, Chapter 26, of the Guam Code Annotated provides the authority for imposing gross receipts taxes, and Section 26202(a) of Chapter 26 states that businesses (referred to in this report as taxpayers) selling goods and services will be taxed at a rate of 4 percent on the gross proceeds of sales. AUDIT REPORT - GovInfo govinfo.gov ? content ? pkg ? pdf ? GPO-D... govinfo.gov ? content ? pkg ? pdf ? GPO-D...

The Guam Code states that the BPT tax rate to be levied, assessed, and collected on contractors is 4 percent of the contractor's gross income for goods and services performed. The BPT applies to all persons or contractors doing work on Guam, whether or not their business is located on the island. GUAM'S BUSINESS PRIVILEGETAX - DOI OIG doioig.gov ? default ? files ? 2021-migration doioig.gov ? default ? files ? 2021-migration

Family and Medical Act ? FMLA Employees are entitled to take up to a total of 12 workweeks in any 12 months for Family Care and Medical leave. Employers with less than 20 employees are entitled to refuse to grant family care and medical leave to the employees.

Guam also has a Business Privilege Tax, which is 5% of gross sales. Below, we offer a guide to understanding Guam LLC taxes. Guam LLC Taxes - Northwest Registered Agent northwestregisteredagent.com ? llc ? taxes northwestregisteredagent.com ? llc ? taxes

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam. Guam Tax Structure guamtax.com ? info ? structure guamtax.com ? info ? structure