This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Guam Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

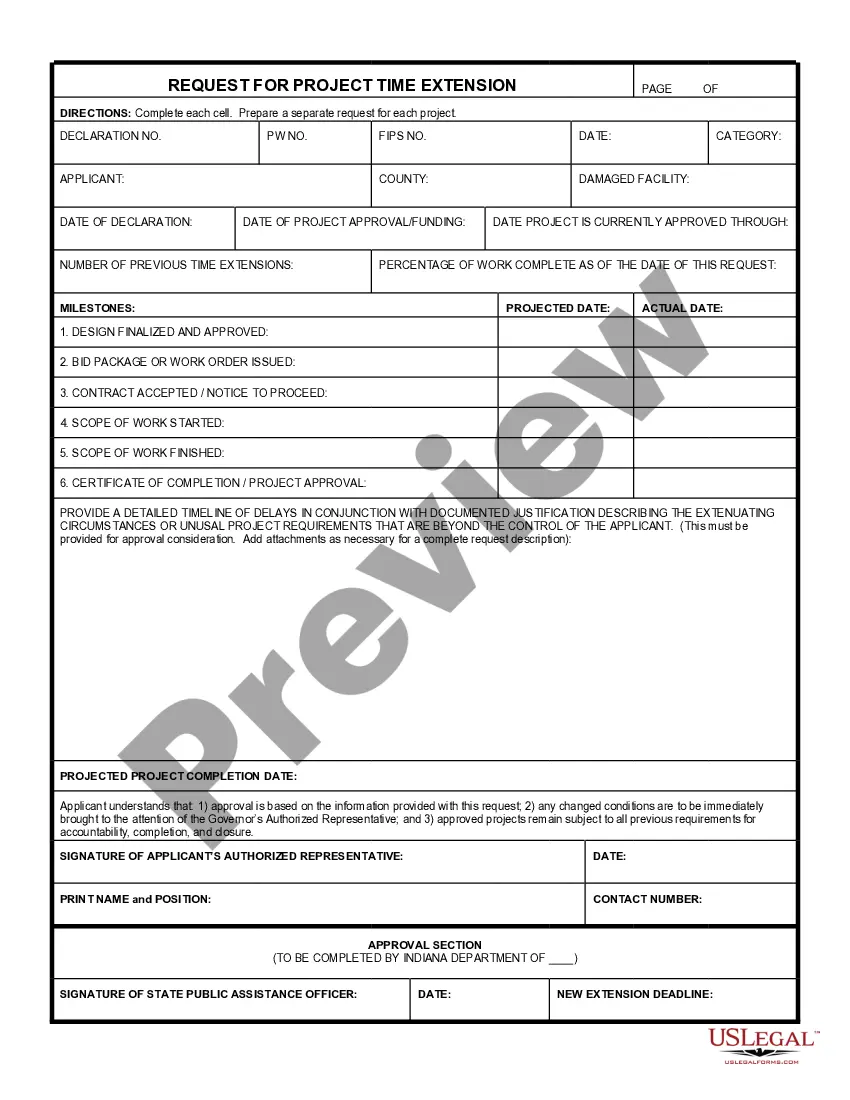

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

If you have to total, down load, or printing lawful papers templates, use US Legal Forms, the most important variety of lawful varieties, that can be found on the Internet. Use the site`s easy and hassle-free look for to obtain the documents you require. A variety of templates for company and person purposes are sorted by groups and suggests, or search phrases. Use US Legal Forms to obtain the Guam Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries within a few mouse clicks.

When you are currently a US Legal Forms buyer, log in to your account and click on the Obtain switch to have the Guam Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. You can also accessibility varieties you earlier acquired within the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for that proper metropolis/country.

- Step 2. Make use of the Preview solution to look over the form`s information. Don`t forget about to read the outline.

- Step 3. When you are unhappy using the develop, take advantage of the Research industry at the top of the display to locate other types of your lawful develop template.

- Step 4. Upon having discovered the form you require, select the Purchase now switch. Pick the prices prepare you choose and add your credentials to sign up for an account.

- Step 5. Process the deal. You should use your charge card or PayPal account to perform the deal.

- Step 6. Choose the file format of your lawful develop and down load it in your device.

- Step 7. Complete, edit and printing or indicator the Guam Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Every single lawful papers template you acquire is your own property eternally. You possess acces to every single develop you acquired in your acccount. Select the My Forms segment and pick a develop to printing or down load once again.

Contend and down load, and printing the Guam Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with US Legal Forms. There are thousands of professional and express-distinct varieties you can use for your personal company or person needs.

Form popularity

FAQ

The distribution trustee handles making decisions about whether and when to accumulate or distribute trust funds. This division of responsibilities is particularly helpful if there are any conflicts between beneficiaries or between one of the trustees and a beneficiary.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

Divvying up your estate in an equal way between your children often makes sense, especially when their histories and circumstances are similar. Equal distribution can also avoid family conflict over fairness or favoritism.

What Happens After a Beneficiary Refuses Inheritance. Once you refuse an inheritance you lose all control over who receives it in your place. A grantor's Will generally includes contingent beneficiaries ? people who should receive assets if any of the primary beneficiaries cannot receive the money.

Even when a beneficiary disagrees with a trustee's actions, they typically cannot override the trustee just because they don't like their choices. Unless the trustee clearly violates the terms of the trust or breaches their fiduciary duty, there is typically little a beneficiary can do.

Disclaiming is the legal term for declining an inheritance. It's the process of refusing the physical or monetary assets you were set to receive as the named beneficiary of a will or trust inheritance. You also can decline funds held within a 401(k) retirement account, as well as the payout of a life insurance policy.

The trust may further provide for the trustee to distribute a percentage of each beneficiary's trust to the beneficiary every year on the anniversary of the settlor's death until the trust has no more assets remaining in it, or it may provide for the trustee to make partial distributions of the trust's principal to ...

Trustees have a fiduciary duty to distribute assets as per the trust's terms. Regrettably, some trustees may refuse. In such cases, beneficiaries should seek legal counsel. Under California Probate Code Section 17200, beneficiaries can petition the California Probate Court to compel distribution.

Can a beneficiary refuse a trust distribution. Yes, beneficiaries possess the legal right to decline or refuse any distributions or benefits designated to them from a trust or a will.