Guam Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

If you wish to obtain, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need. Various templates for commercial and personal use are categorized by type and state, or keywords.

Utilize US Legal Forms to get the Guam Self-Employed Utility Services Contract in just a few clicks.

Every legal document format you purchase is yours indefinitely. You will have access to every form you obtained in your account. Go to the My documents section and select a form to print or download again.

Compete and obtain, and print the Guam Self-Employed Utility Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Guam Self-Employed Utility Services Contract.

- You can also access forms you've previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

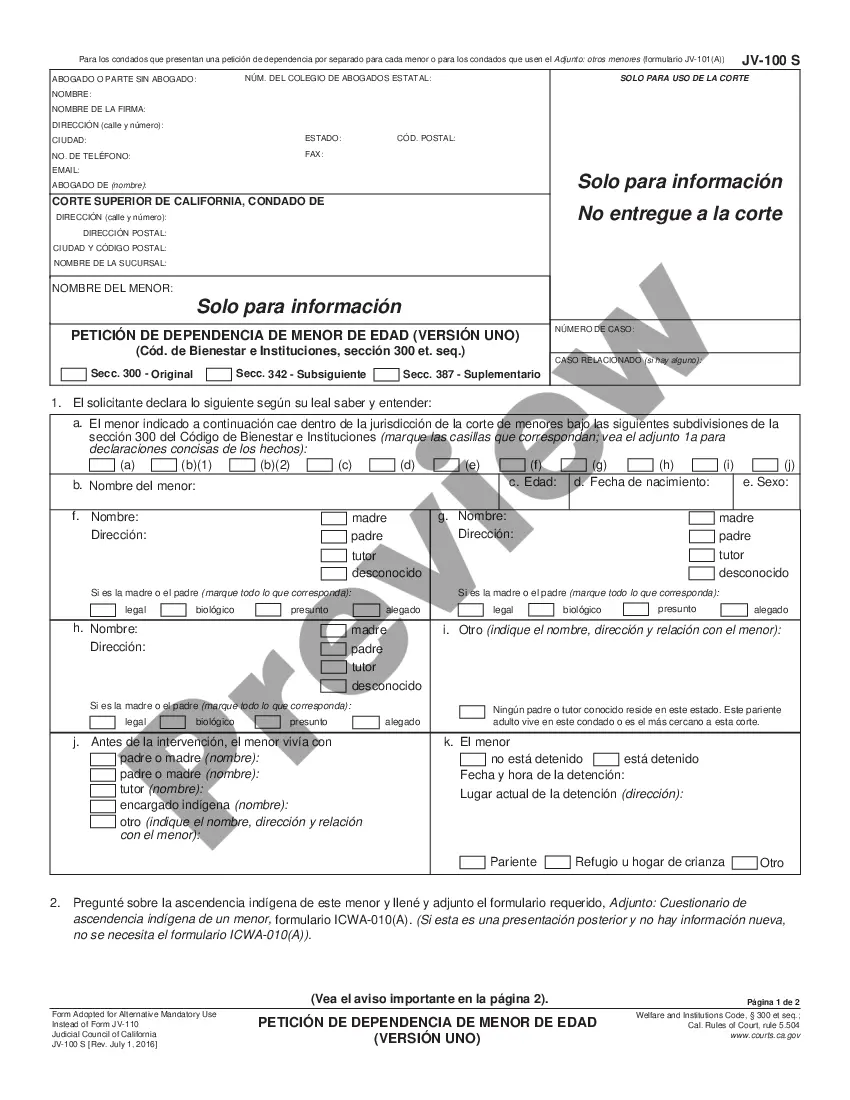

- Step 1. Ensure you have chosen the form for your correct region/country.

- Step 2. Use the Preview option to review the form's details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have located the form you need, select the Acquire now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Guam Self-Employed Utility Services Contract.

Form popularity

FAQ

Service contract labor standards apply to contracts that involve service employees working on government projects, including the Guam Self-Employed Utility Services Contract. These standards ensure fair wages and working conditions for employees engaged in such services. It's essential to understand these regulations to maintain compliance and protect your business. Platforms like US Legal Forms can provide resources to help you navigate these standards effectively.

employed contract, like the Guam SelfEmployed Utility Services Contract, establishes a formal agreement between a selfemployed individual and a client. This contract outlines the terms of service, payment details, and the scope of work. By clearly defining expectations, both parties understand their obligations, minimizing potential disputes. Utilizing platforms like US Legal Forms can simplify this process by providing customizable contract templates tailored to your needs.

Writing a contract for a 1099 employee requires you to specify the services provided, payment structure, and duration of the work. Make sure to include clauses that clarify the independent nature of the work relationship. For added clarity, consider using a Guam Self-Employed Utility Services Contract template from uslegalforms to ensure all necessary elements are included.

To write a self-employment contract, start with the parties involved, followed by a description of the services to be provided. Include payment terms, timelines, and any legal requirements specific to your industry. A Guam Self-Employed Utility Services Contract can serve as a solid template for your agreement.

Self-employed contracts outline the relationship between the contractor and the client, specifying the work performed and payment details. These contracts protect both parties by clarifying expectations and responsibilities. When creating a Guam Self-Employed Utility Services Contract, ensure you include all relevant details to avoid misunderstandings.

Writing a self-employed contract involves defining the scope of work, payment terms, and deadlines. Be sure to include confidentiality clauses if necessary. A well-drafted Guam Self-Employed Utility Services Contract can help you cover all essential aspects and protect your interests.

To write a simple employment contract, start by outlining the role, responsibilities, and compensation. Clearly state the terms of employment, including duration and any benefits. For self-employed individuals, a Guam Self-Employed Utility Services Contract can serve as a model to structure your agreement effectively.

Yes, you can write your own legally binding contract, including a Guam Self-Employed Utility Services Contract. To ensure its validity, include essential elements such as the names of the parties, terms of the agreement, and signatures. However, using a template from a trusted platform like uslegalforms can provide guidance and ensure compliance with local laws.

The new federal rule for independent contractors focuses on clarifying the classification of workers and their rights. This rule impacts how self-employed individuals operate, including those under a Guam Self-Employed Utility Services Contract. Understanding these regulations ensures that you comply with federal guidelines and protect your business interests.

To report income for self-employment in Guam, you need to gather all your income records and expenses. You will typically report this information on your income tax returns, using forms designated for self-employed individuals. Utilizing a Guam Self-Employed Utility Services Contract can streamline this process, as it provides a structured approach to managing your financial records.