Guam Self-Employed Personal Trainer or Training Services Contract

Description

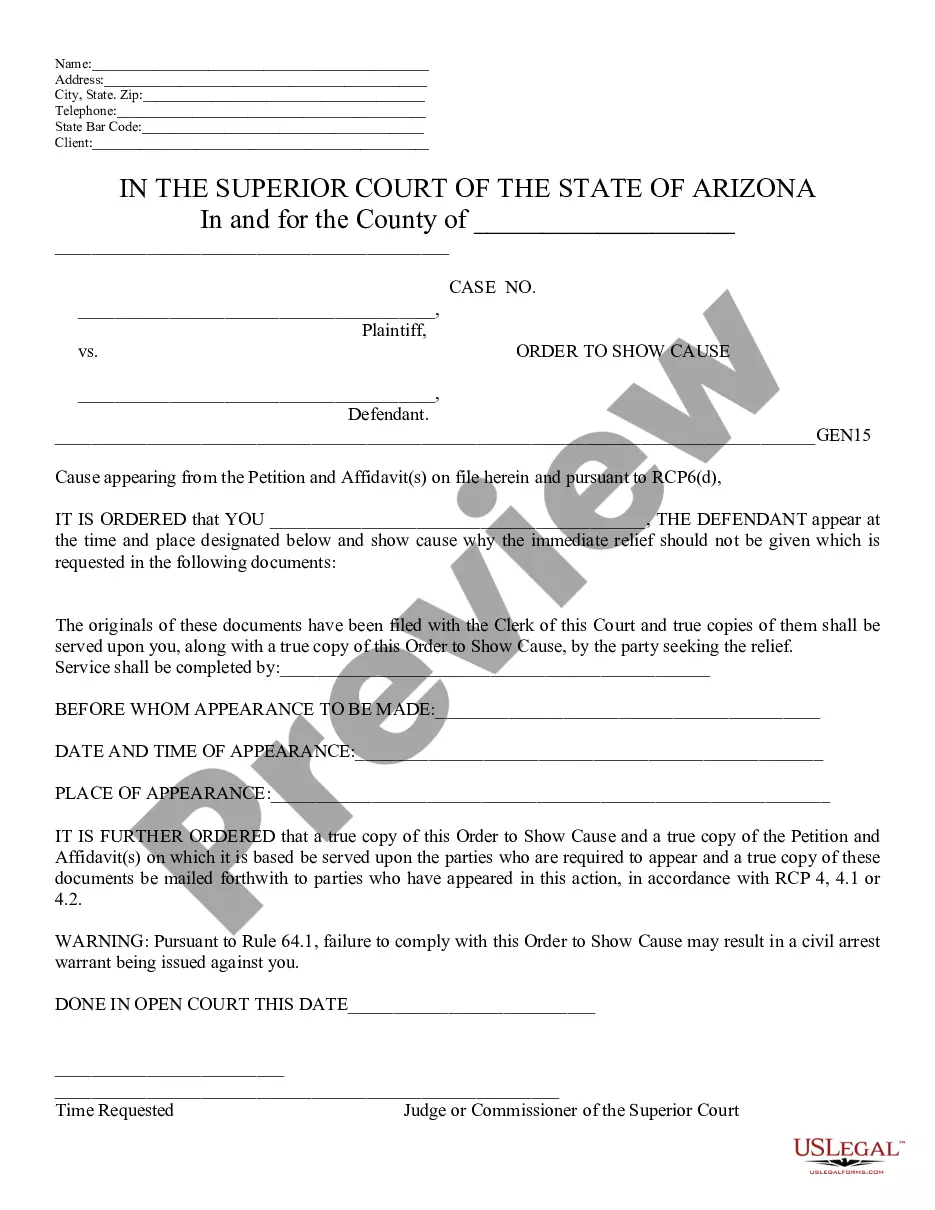

How to fill out Self-Employed Personal Trainer Or Training Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal paper templates that you can download or print. By using the website, you can find thousands of forms for professional and personal use, organized by categories, states, or keywords. You can quickly locate the latest versions of forms such as the Guam Self-Employed Personal Trainer or Training Services Contract.

If you currently have a monthly subscription, Log In and download the Guam Self-Employed Personal Trainer or Training Services Contract from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

To use US Legal Forms for the first time, here are some simple steps to get started: Ensure you have selected the correct form for your locale. Click the Preview button to review the form's content. Check the form details to confirm you have chosen the right one. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the payment plan you prefer and provide your information to create an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Guam Self-Employed Personal Trainer or Training Services Contract. Every template you added to your account has no expiration date and is yours indefinitely. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Guam Self-Employed Personal Trainer or Training Services Contract with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize a vast array of professional and state-specific templates that fulfill your business or personal requirements and needs.

Form popularity

FAQ

Making a contract as a personal trainer involves outlining your services, payment structure, and client responsibilities. Be clear about your cancellation policies and any liability waivers. To ensure that your contract meets legal standards, consider using a template tailored for a Guam Self-Employed Personal Trainer or Training Services Contract, available through platforms like USLegalForms.

To register as a self-employed personal trainer, you typically need to obtain a business license and register your business name with local authorities. It's also important to check if you require any specific certifications or permits in Guam. Additionally, utilizing resources like USLegalForms can help you navigate the registration process smoothly, including creating your Guam Self-Employed Personal Trainer or Training Services Contract.

To create a personal training contract, start by outlining the services you offer and the expectations of both parties. Include details on payment terms, session length, cancellation policies, and liability waivers. Utilizing a template specifically designed for a Guam Self-Employed Personal Trainer or Training Services Contract can simplify this process, ensuring you cover essential legal aspects.

Setting up an LLC as a personal trainer can provide legal protection and personal liability protection. This structure can help separate your personal assets from your business assets. It's particularly beneficial for those operating as a Guam Self-Employed Personal Trainer, as this designation can enhance your credibility. Consulting with a legal expert can guide you through the process effectively.

Yes, a personal trainer can be self-employed. This offers flexibility in managing your schedule and choosing your clients. As a self-employed personal trainer, you can also tailor your services to meet your clients' needs. For those in Guam, understanding the Guam Self-Employed Personal Trainer or Training Services Contract is essential for establishing your business.

Yes, you can absolutely be a self-employed personal trainer. Many trainers choose this path to have more control over their schedules and business practices. By utilizing a Guam Self-Employed Personal Trainer or Training Services Contract, you can clearly define your services and expectations with clients. This contract not only protects you legally but also establishes professionalism and trust with your clients.

A Guam Self-Employed Personal Trainer can earn a variable income based on factors such as client base, service offerings, and location. On average, personal trainers can make between $30 to $100 per hour, depending on their experience and the type of training services they provide. Additionally, trainers who build a strong reputation and client loyalty can significantly increase their earnings over time. It’s essential to have a solid business plan and consider a Training Services Contract to outline your services and payment structure.

Personal trainers file taxes by reporting their earnings on Form 1040 and detailing their business expenses on Schedule C. As a Guam Self-Employed Personal Trainer, you also need to calculate self-employment tax with Schedule SE. Keeping accurate records of your training sessions and expenses will simplify the filing process. Consider seeking the help of professionals or using platforms like USLegalForms to ensure compliance.

If you're self-employed, you can show proof of income through various documents, such as your tax returns, bank statements, and invoices. A well-organized profit and loss statement can also be beneficial. Using services like USLegalForms can assist you in generating the necessary documents to support your income claims effectively.

To show proof of income as a Guam Self-Employed Personal Trainer, you can provide your bank statements, invoices, or payment receipts from clients. Additionally, a profit and loss statement can demonstrate your earnings over a specific period. Using tools like USLegalForms can help you create professional documents that outline your training services and income.