District of Columbia Agreement Designating Agent to Lease Mineral Interests

Description

How to fill out Agreement Designating Agent To Lease Mineral Interests?

US Legal Forms - one of many greatest libraries of authorized types in the USA - gives a wide range of authorized document templates you can obtain or printing. Using the web site, you can find 1000s of types for company and specific functions, categorized by classes, says, or keywords and phrases.You will discover the most recent models of types much like the District of Columbia Agreement Designating Agent to Lease Mineral Interests within minutes.

If you have a subscription, log in and obtain District of Columbia Agreement Designating Agent to Lease Mineral Interests from your US Legal Forms local library. The Down load option can look on each and every kind you look at. You gain access to all in the past acquired types inside the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, allow me to share basic directions to get you started out:

- Ensure you have chosen the best kind for your personal metropolis/area. Go through the Preview option to check the form`s content. Read the kind information to actually have chosen the correct kind.

- When the kind doesn`t match your specifications, utilize the Look for area towards the top of the display to obtain the one which does.

- If you are pleased with the form, validate your decision by clicking on the Get now option. Then, select the pricing plan you want and give your qualifications to sign up on an profile.

- Method the transaction. Utilize your charge card or PayPal profile to complete the transaction.

- Pick the file format and obtain the form in your system.

- Make adjustments. Fill up, modify and printing and sign the acquired District of Columbia Agreement Designating Agent to Lease Mineral Interests.

Every single format you included in your bank account does not have an expiration date which is your own property forever. So, if you would like obtain or printing yet another version, just check out the My Forms section and click in the kind you will need.

Gain access to the District of Columbia Agreement Designating Agent to Lease Mineral Interests with US Legal Forms, one of the most comprehensive local library of authorized document templates. Use 1000s of professional and condition-particular templates that fulfill your small business or specific demands and specifications.

Form popularity

FAQ

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

The Fluid Mineral estate consists ofthe. subsurface resources ofHydrocarbons (Oil and natural gas, and various othFr gases such. as hydrogen, carbon dioxide, helium, and nitrogen) and Oeo1hermal (where the heat of. the earth can be captured). Fluid Mineral Estate Procedural Handbook - Indian Affairs Bureau of Indian Affairs (.gov) ? dup ? raca ? handbook ? pdf Bureau of Indian Affairs (.gov) ? dup ? raca ? handbook ? pdf PDF

Ownership of Real Property ? Investing in mineral rights grants ownership of a tangible and appreciating asset, often referred to as ?real? property. This type of ownership can provide a sense of security and stability, as well as potential tax advantages associated with real estate investments.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner. How To Understand Your Mineral Rights | Rocket Mortgage rocketmortgage.com ? learn ? mineral-rights rocketmortgage.com ? learn ? mineral-rights

The Mineral Leasing Act for Acquired Lands of 1947 (30 U.S.C. §§ 351 et seq.) extended the mineral leasing laws (the Mineral Leasing Act, etc.) to all lands acquired by the United States. The Act allowed the United States to maintain title to the land and establish lease terms for all minerals found on acquired land. Mining Law Revision (2) | U.S. Department of the Interior doi.gov ? ocl ? hearings ? MiningLawRevisi... doi.gov ? ocl ? hearings ? MiningLawRevisi...

Mineral rights are the rights to any natural resources that are present beneath a piece of property, such as oil, gas, coal or even gold.

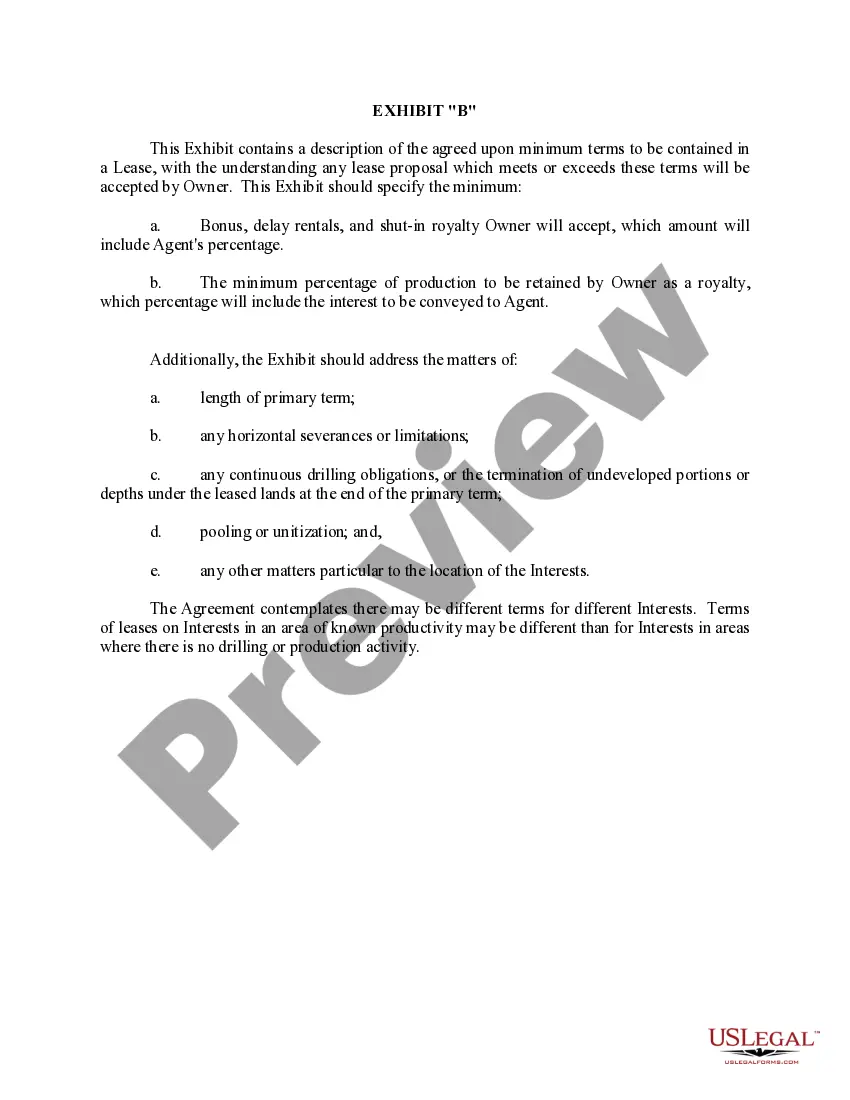

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.