Guam Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out Collections Agreement - Self-Employed Independent Contractor?

Are you currently in a position where you need to obtain documents for various business or personal purposes almost every working day.

There are numerous legal document templates accessible on the web, but finding versions you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Guam Collections Agreement - Self-Employed Independent Contractor, which are designed to comply with federal and state regulations.

Once you find the correct form, simply click Buy now.

Choose the pricing plan you need, fill in the required details to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Guam Collections Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/state.

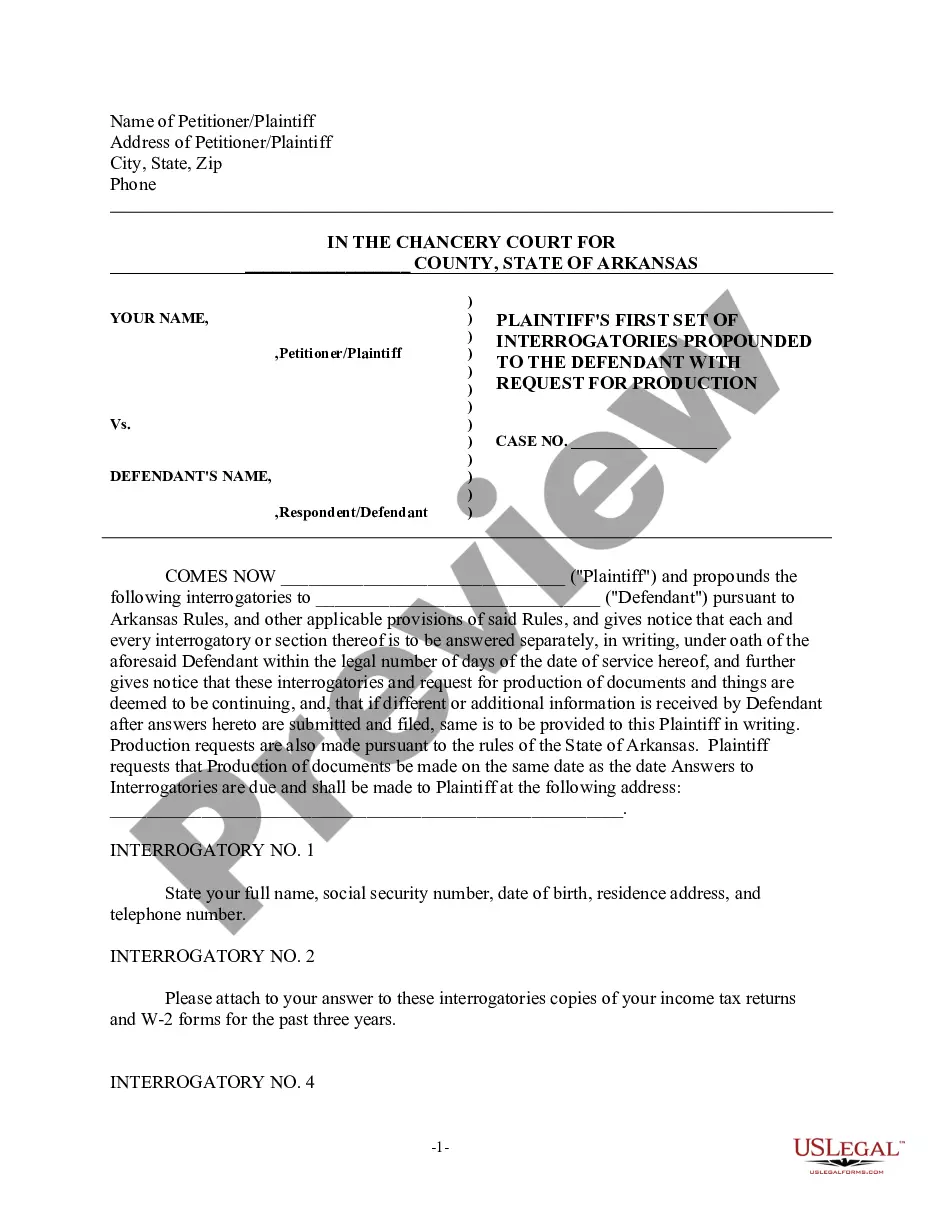

- Use the Preview option to check the form.

- Review the description to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

To receive payments as an independent contractor, you should specify your payment methods in your contract. Common options include bank transfers, checks, or electronic payment platforms. Incorporating a Guam Collections Agreement - Self-Employed Independent Contractor helps outline these payment terms clearly, ensuring you receive your compensation on time. US Legal Forms can assist you in drafting a contract that includes these essential details.

Yes, as a self-employed individual, you can and should have a contract. A well-drafted agreement protects your rights and clarifies your obligations with clients. Implementing a Guam Collections Agreement - Self-Employed Independent Contractor is essential for establishing a professional relationship and minimizing misunderstandings. By using resources from US Legal Forms, you can easily create a contract tailored to your needs.

To create an independent contractor agreement, start by defining the scope of work and the responsibilities of both parties. Include payment terms, deadlines, and any conditions for termination. Utilizing a Guam Collections Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring you cover all necessary legal aspects. Platforms like US Legal Forms offer ready-made templates that can guide you through the creation of your agreement.

Independent contractors must report all income earned and can deduct certain business expenses when filing taxes. Essential documents include a 1099 form detailing your earnings and a record of any deductible expenses, such as materials or travel. Furthermore, utilizing a Guam Collections Agreement for Self-Employed Independent Contractors helps document your work and can be beneficial for tax filing. It is wise to consult a tax professional to ensure compliance.

Yes, receiving a 1099 form typically indicates that you are self-employed. This form reports income earned from contracts, denoting that you are not classified as an employee. Therefore, as a self-employed individual receiving a 1099, you have specific tax obligations. Managing these responsibilities effectively can be simplified with a Guam Collections Agreement for Self-Employed Independent Contractors.

An independent contractor is not necessarily a separate business entity, but can operate as one. Many independent contractors register their businesses as sole proprietorships, LLCs, or corporations to limit personal liability. However, as a self-employed individual, you can provide services without forming an official business entity. Using a Guam Collections Agreement for Self-Employed Independent Contractors can still protect your interests.

The terms self-employed and independent contractor can often be used interchangeably, but they may imply different nuances. 'Self-employed' signifies a broader category, encompassing various business owners, while 'independent contractor' specifically refers to those who provide services under a contract. Depending on your situation, using the term Guam Collections Agreement for Self-Employed Independent Contractor might clarify your role in a transaction.

Yes, an independent contractor is considered self-employed. Unlike employees, independent contractors work for themselves and typically have multiple clients. They manage their own business operations and take on the risks associated with self-employment. Understanding the distinction is crucial, especially when dealing with agreements like the Guam Collections Agreement for Self-Employed Independent Contractors.

Writing an independent contractor agreement involves several key components. Start by clearly stating the names of both parties, the scope of work, and deadlines. You should also outline payment terms, confidentiality clauses, and the duration of the agreement. A well-drafted Guam Collections Agreement for a Self-Employed Independent Contractor ensures all parties understand their roles and responsibilities.

An independent contractor typically files Form 1040 with Schedule C to report their income. This form outlines your total earnings and expenses related to your work. When completing your Guam Collections Agreement - Self-Employed Independent Contractor, using the appropriate forms ensures proper tax treatment. You can find helpful templates and instructions through uslegalforms to aid in your filings.