Guam Psychic Services Contract - Self-Employed Independent Contractor

Description

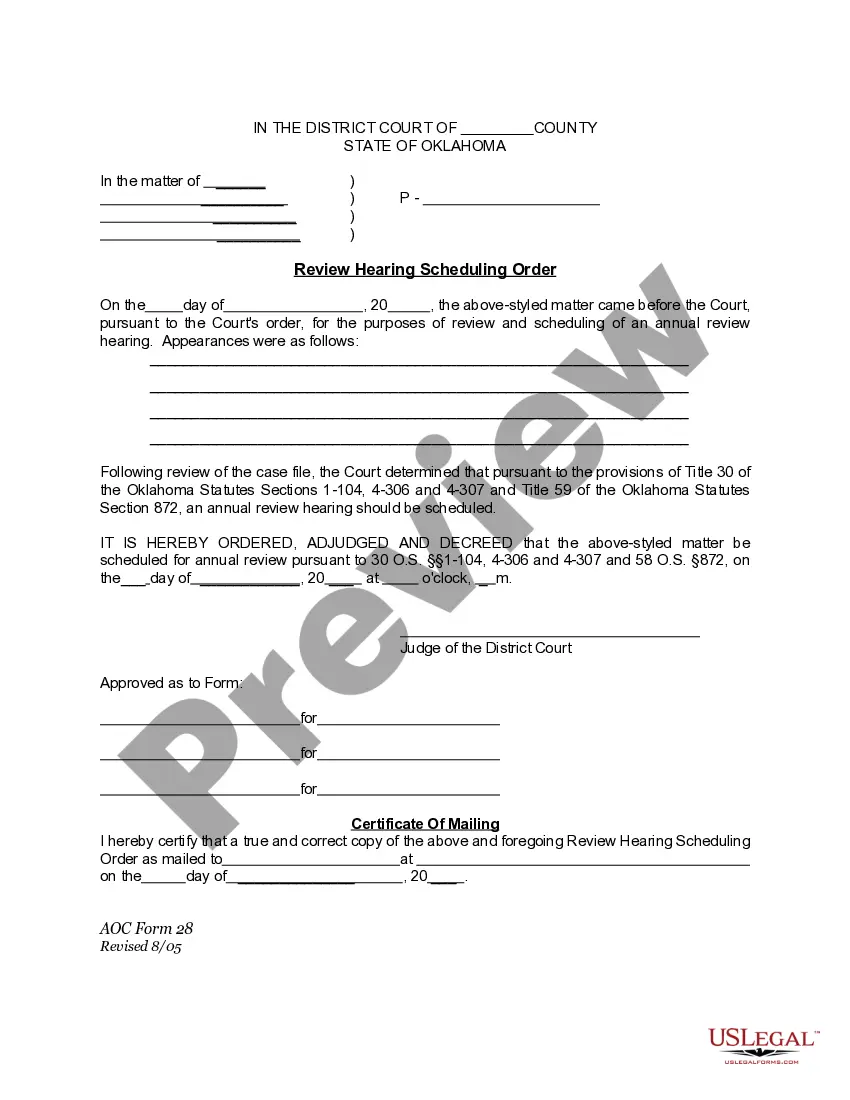

How to fill out Psychic Services Contract - Self-Employed Independent Contractor?

If you need to acquire, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s simple and convenient search to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Guam Psychic Services Contract - Self-Employed Independent Contractor with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Guam Psychic Services Contract - Self-Employed Independent Contractor. You can also access forms you previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have chosen the form for your specific city/state. Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of your legal form template. Step 4. Once you have located the form you need, click the Purchase now button. Select the payment plan you prefer and enter your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Guam Psychic Services Contract - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- You have access to every form you downloaded with your account.

- Select the My documents section and choose a form to print or download again.

- Complete and download, and print the Guam Psychic Services Contract - Self-Employed Independent Contractor with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Yes, self-employed individuals can absolutely have contracts. Having a contract protects your rights and ensures that both parties understand their obligations. Using a Guam Psychic Services Contract - Self-Employed Independent Contractor can help delineate your services, rates, and other vital details essential for a successful business relationship.

New rules for self-employed individuals often include changes in tax policies and regulations regarding benefits. It is essential to stay informed about these changes to maintain compliance and benefit from available resources. Platforms like uslegalforms can guide you in creating a Guam Psychic Services Contract - Self-Employed Independent Contractor that complies with current rules.

Absolutely, self-employed individuals can and should have contracts. These contracts protect both the service provider and the client by clearly outlining the terms of engagement. A Guam Psychic Services Contract - Self-Employed Independent Contractor is an excellent tool for self-employed individuals to establish clear expectations and terms of service.

Yes, therapists can work as independent contractors. This arrangement allows therapists to manage their own practices while providing services to clients. A Guam Psychic Services Contract - Self-Employed Independent Contractor can help define the terms of the engagement, ensuring both liability protection and clarity in service delivery.

Yes, you can enter into a private contract with yourself. This type of agreement is often referred to as a personal contract and is valid as long as you follow applicable laws. Utilizing a Guam Psychic Services Contract - Self-Employed Independent Contractor can provide a clear framework, outlining your responsibilities and expectations effectively.

Yes, when you work as an independent contractor, you are generally considered to be self-employed. This means you have the freedom to operate your own business and set your own schedule, while being responsible for managing your own taxes. Additionally, the Guam Psychic Services Contract - Self-Employed Independent Contractor can help clarify your responsibilities and rights as a contractor. Utilizing this contract ensures that you have a clear agreement and protection, allowing you to focus on your services.

Filling out an independent contractor form typically requires you to provide your personal information, details of the services you will perform, and payment agreements. Make sure to review the requirements outlined in the Guam Psychic Services Contract - Self-Employed Independent Contractor, as they guide you on the essential information needed. US Legal Forms offers user-friendly forms, making this process simpler for you.

Writing an independent contractor agreement involves outlining the scope of work, payment details, and specific terms governing the relationship. It's important to include critical clauses such as confidentiality, work timelines, and termination conditions. Using the Guam Psychic Services Contract - Self-Employed Independent Contractor template from US Legal Forms can streamline this process and ensure all necessary points are covered.

Yes, an independent contractor is generally classified as self-employed. This classification means they operate their business independently and are responsible for their taxes and legal obligations. The Guam Psychic Services Contract - Self-Employed Independent Contractor is a key document that solidifies this status, ensuring you understand your rights and responsibilities in your business.

To be authorized as an independent contractor in the US, you need to register your business if required, obtain any necessary licenses, and comply with your state’s regulations. Additionally, understand the terms of the Guam Psychic Services Contract - Self-Employed Independent Contractor, which often outline compliance requirements. On our platform, US Legal Forms offers templates to assist you with the registration process.