Guam Pump Installation And Repair Services Contract - Self-Employed

Description

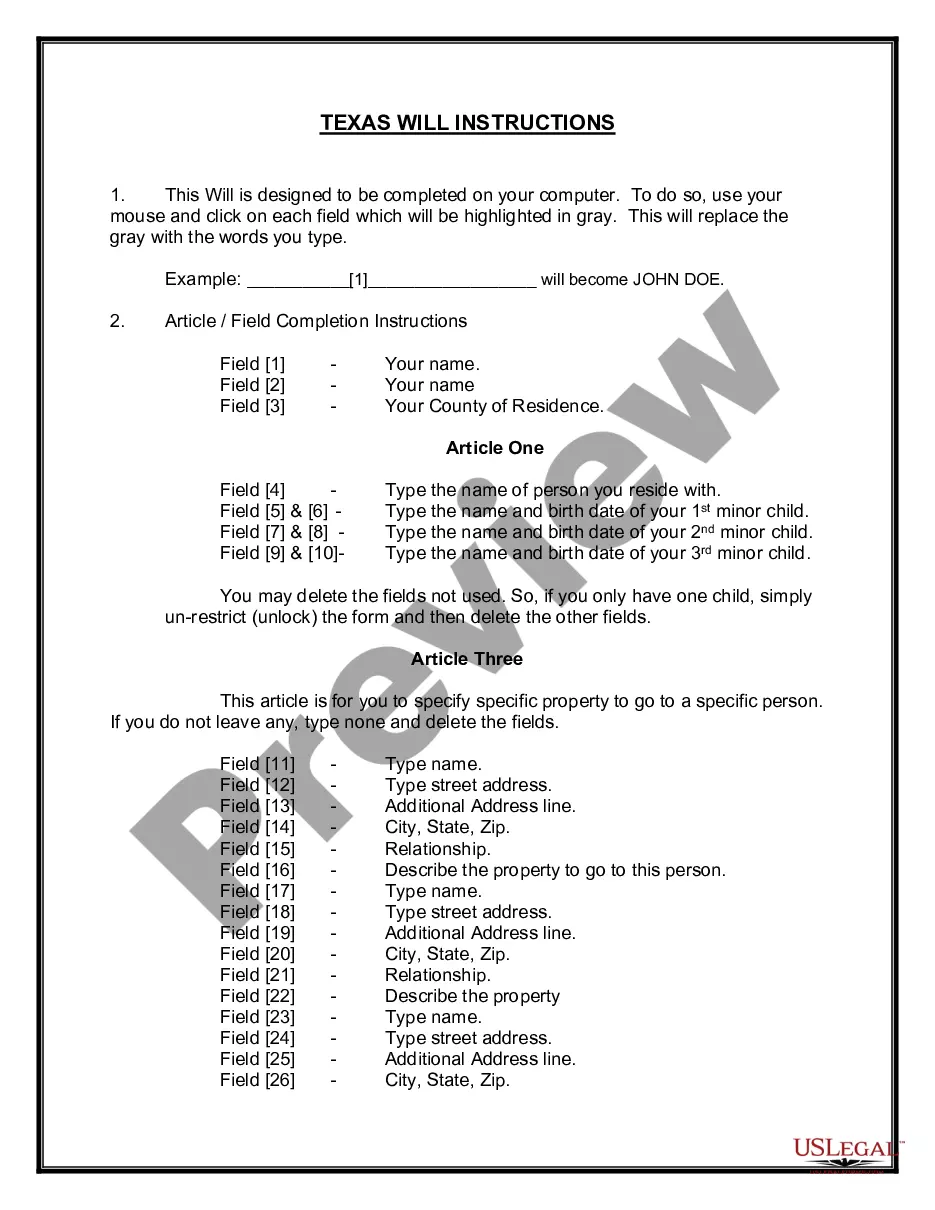

How to fill out Pump Installation And Repair Services Contract - Self-Employed?

You can dedicate time online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been evaluated by professionals.

You can download or print the Guam Pump Installation And Repair Services Contract - Self-Employed from the service.

If available, use the Preview button to view the document template as well. If you wish to find another version of the form, utilize the Search area to locate the template that meets your needs and requirements. Once you have found the template you desire, click on Purchase now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to purchase the legal form. Select the format of the document and download it to your device. Make adjustments to the document if necessary. You can fill out, edit, and sign and print the Guam Pump Installation And Repair Services Contract - Self-Employed. Access and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Guam Pump Installation And Repair Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Setting yourself up as an independent contractor for the Guam Pump Installation And Repair Services Contract - Self-Employed requires systematic planning. Start by defining your niche, like pump installation or repair, and market yourself to potential clients. Use platforms like uslegalforms to access templates and resources that help with contracts and compliance. Just remember, clarity in your services and contracts will lead to better professional relationships.

To be an independent contractor under the Guam Pump Installation And Repair Services Contract - Self-Employed, you must meet certain legal criteria. This includes having a clear contract with your clients detailing the services provided and payment terms. Additionally, you must handle your taxes, maintain your own insurance, and operate independently from the client. Understanding the legalities of independent contracting is essential to your success.

Setting up as a self-employed contractor for the Guam Pump Installation And Repair Services Contract - Self-Employed involves several key steps. Begin by deciding on your services and target market, then create a business plan outlining your goals. After establishing your services, register for an Employer Identification Number (EIN) with the IRS to handle tax matters efficiently. Make sure you comply with local regulations and licensing requirements for your business type.

To set up yourself as a contractor under the Guam Pump Installation And Repair Services Contract - Self-Employed, start by registering your business with the local government. You will need to choose a business structure, such as sole proprietorship or LLC, and acquire necessary licenses or permits. After that, consider obtaining liability insurance to protect yourself and your clients. Finally, open a dedicated business bank account to manage your finances effectively.

If you receive a 1099-NEC but believe you are not self-employed, promptly address the situation. You may need to contact the issuer for clarification, as this form indicates you've earned income as a contractor. If your situation is complex, consider using platforms like USLegalForms for guidance on your rights and obligations.

To prove you are an independent contractor, gather documentation that reflects your work arrangement. This includes contracts, invoices, and payment records that relate to your Guam Pump Installation And Repair Services Contract - Self-Employed. Keeping this documentation organized can simplify your proof in case of any inquiries.

Filing taxes as an independent contractor involves reporting your income and expenses on Schedule C. If you operate under a Guam Pump Installation And Repair Services Contract - Self-Employed, you should track your expenses carefully, as they can often be deducted from your taxable income. Using tax software or hiring a professional can help ease this process.

As an independent contractor operating under a Guam Pump Installation And Repair Services Contract - Self-Employed, you must file taxes if you earn $400 or more in a year. This includes income from various sources, not just from Guam pump related services. Make sure to keep accurate records of your earnings to simplify the tax filing process when the time comes.

Contractors in North Carolina are classified according to their field of work, such as residential, commercial, or public utilities. Understanding these classifications helps contractors know the licensing requirements and project scopes they can engage in. When dealing with a Guam Pump Installation And Repair Services Contract - Self-Employed, recognizing your classification ensures you meet all legal obligations while effectively promoting your services.

General contractors in North Carolina are classified by levels based on their experience and the complexity of the work they can manage. These levels include limited, intermediate, and unlimited categories, corresponding to the maximum monetary value of projects they can undertake. If your focus includes a Guam Pump Installation And Repair Services Contract - Self-Employed, understanding these levels can direct you toward appropriate work opportunities.