Guam Educator Agreement - Self-Employed Independent Contractor

Description

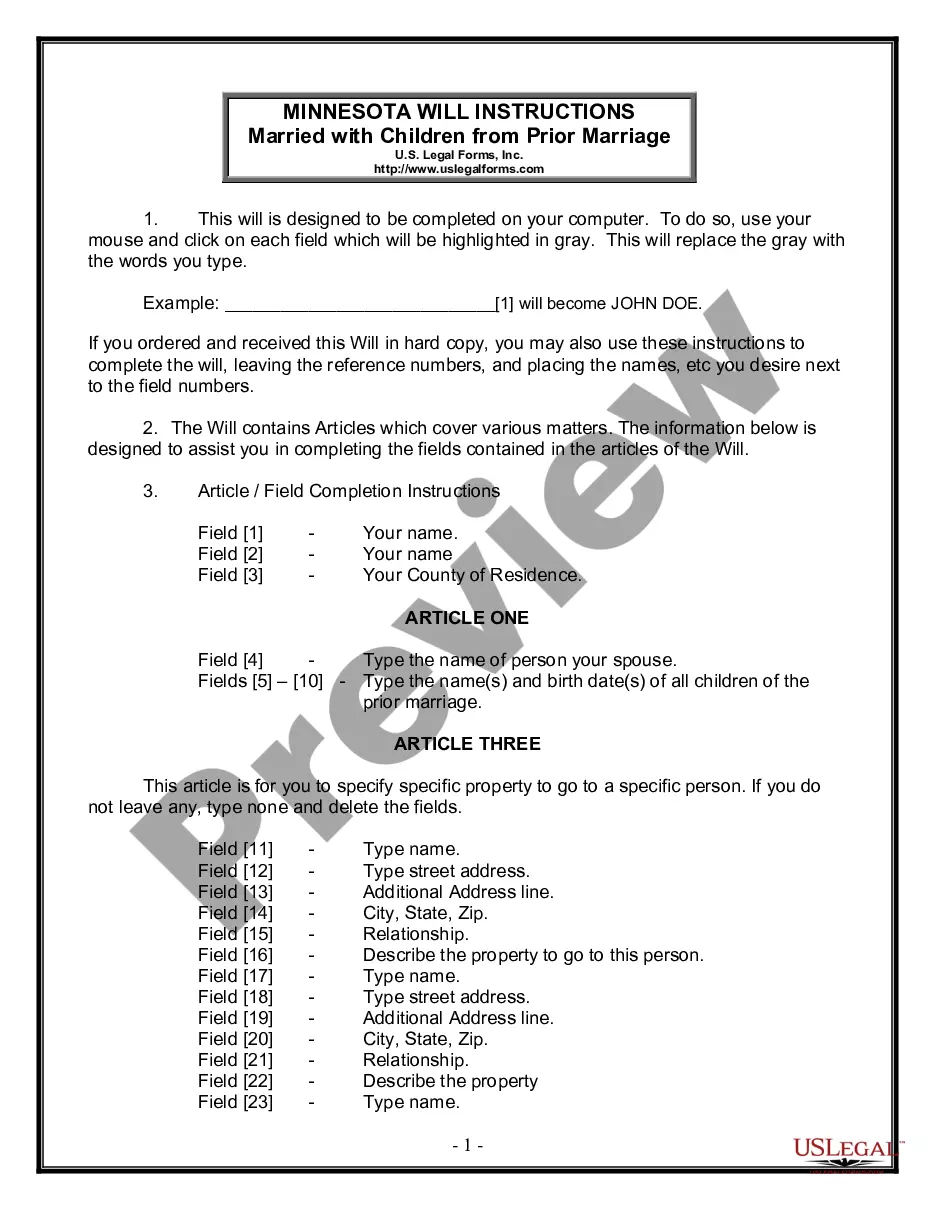

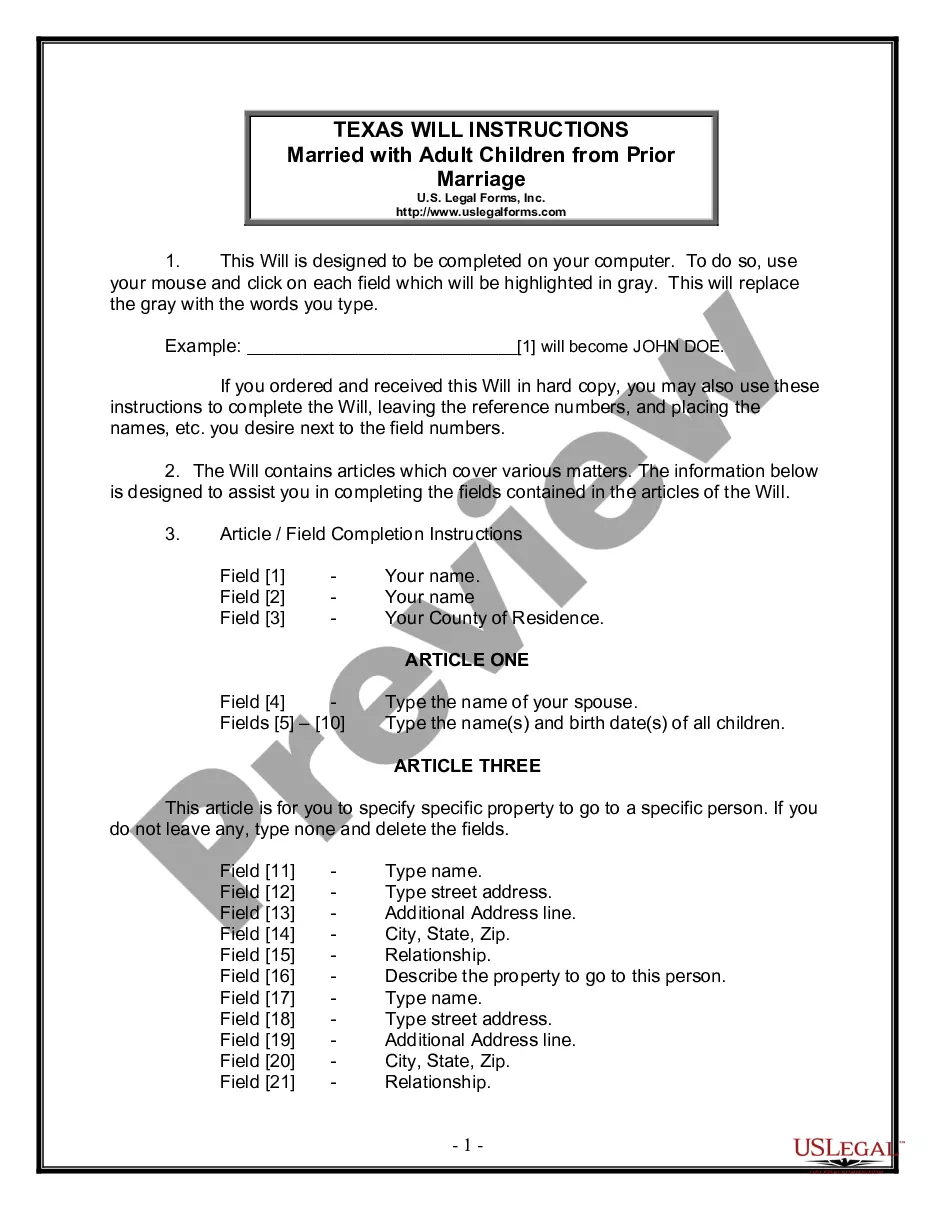

How to fill out Educator Agreement - Self-Employed Independent Contractor?

Are you presently within a position that you require documents for either business or personal reasons nearly every day? There are numerous lawful document templates available on the web, but locating ones you can trust is challenging.

US Legal Forms provides thousands of document templates, such as the Guam Educator Agreement - Self-Employed Independent Contractor, which can be customized to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Guam Educator Agreement - Self-Employed Independent Contractor template.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Guam Educator Agreement - Self-Employed Independent Contractor at any time, if needed. Click the desired document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you require and ensure it is for the correct city/state.

- Utilize the Review option to inspect the document.

- Read the description to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs and requirements.

- Once you find the appropriate document, click Get now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and place an order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Form 5074 is a tax form used to report income earned in foreign countries for U.S. tax purposes. It helps determine your eligibility for certain exclusions or credits related to foreign-earned income. If you're working under the Guam Educator Agreement - Self-Employed Independent Contractor, understanding Form 5074 can help you maximize your tax advantages.

Choosing between 'self-employed' and 'independent contractor' often depends on the context. 'Self-employed' can convey a broader sense of running a business, while 'independent contractor' specifically refers to a work arrangement. Under the Guam Educator Agreement - Self-Employed Independent Contractor, both terms are valid, but selecting the one most relevant to your situation is beneficial.

You can prove you are an independent contractor by maintaining contracts, invoices, and records of payments from clients. Additionally, documentation that showcases your services and business operations can support your status. The Guam Educator Agreement - Self-Employed Independent Contractor enhances your credibility as an independent professional.

Yes, independent contractors file their taxes as self-employed individuals. This involves reporting income and potentially paying self-employment taxes. With the Guam Educator Agreement - Self-Employed Independent Contractor, you can easily navigate tax responsibilities while enjoying the independence that comes with your role.

To report foreign self-employment income in the US, you must file the appropriate tax forms, such as Schedule C, along with your income tax return. Be sure to include all income earned and consider any tax treaties that may apply. The Guam Educator Agreement - Self-Employed Independent Contractor can guide you through this unique situation, ensuring you comply with tax regulations safely.

Yes, an independent contractor is indeed self-employed. This status means you operate your own business services and are not classified as an employee of a company. Under the Guam Educator Agreement - Self-Employed Independent Contractor, this classification allows you to navigate your work more freely and directly benefit from your labor.

To be considered self-employed, you must work for yourself rather than for an employer. This means you independently manage your business activities, set your schedule, and keep the profits. Under the Guam Educator Agreement - Self-Employed Independent Contractor, you have the freedom to choose your projects and clients.

The Dave Santos exemption allows certain educators in Guam to be considered as self-employed independent contractors. This exemption helps to clarify their status and ensure they receive appropriate tax treatment. Understanding this exemption can enhance your experience under the Guam Educator Agreement - Self-Employed Independent Contractor, providing peace of mind regarding compliance.

Creating an independent contractor agreement starts with defining the scope of the work and payment terms clearly. The Guam Educator Agreement - Self-Employed Independent Contractor should include essential elements such as duration, responsibilities, and confidentiality clauses. You can draft this agreement using templates available online or consult legal professionals for personalized guidance. Platforms like USLegalForms provide user-friendly templates that help you easily create comprehensive agreements tailored to your unique situation.

To become an independent contractor, you must meet specific requirements that may include registering your business, obtaining necessary licenses, and understanding local tax obligations. In many cases, the Guam Educator Agreement - Self-Employed Independent Contractor may outline specific qualifications or certifications required by educational institutions. It’s advisable to research state or federal regulations applicable to your field. Ensuring compliance with these requirements is crucial to operate legally and effectively.