Guam Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

If you need to full, download, or produce legitimate file web templates, use US Legal Forms, the most important variety of legitimate types, which can be found on the Internet. Take advantage of the site`s simple and convenient look for to discover the paperwork you need. Different web templates for enterprise and person functions are sorted by categories and says, or keywords and phrases. Use US Legal Forms to discover the Guam Sample Identity Theft Policy for FCRA and FACTA Compliance in just a couple of click throughs.

If you are already a US Legal Forms customer, log in to the accounts and click the Download option to obtain the Guam Sample Identity Theft Policy for FCRA and FACTA Compliance. You can even accessibility types you previously acquired inside the My Forms tab of your own accounts.

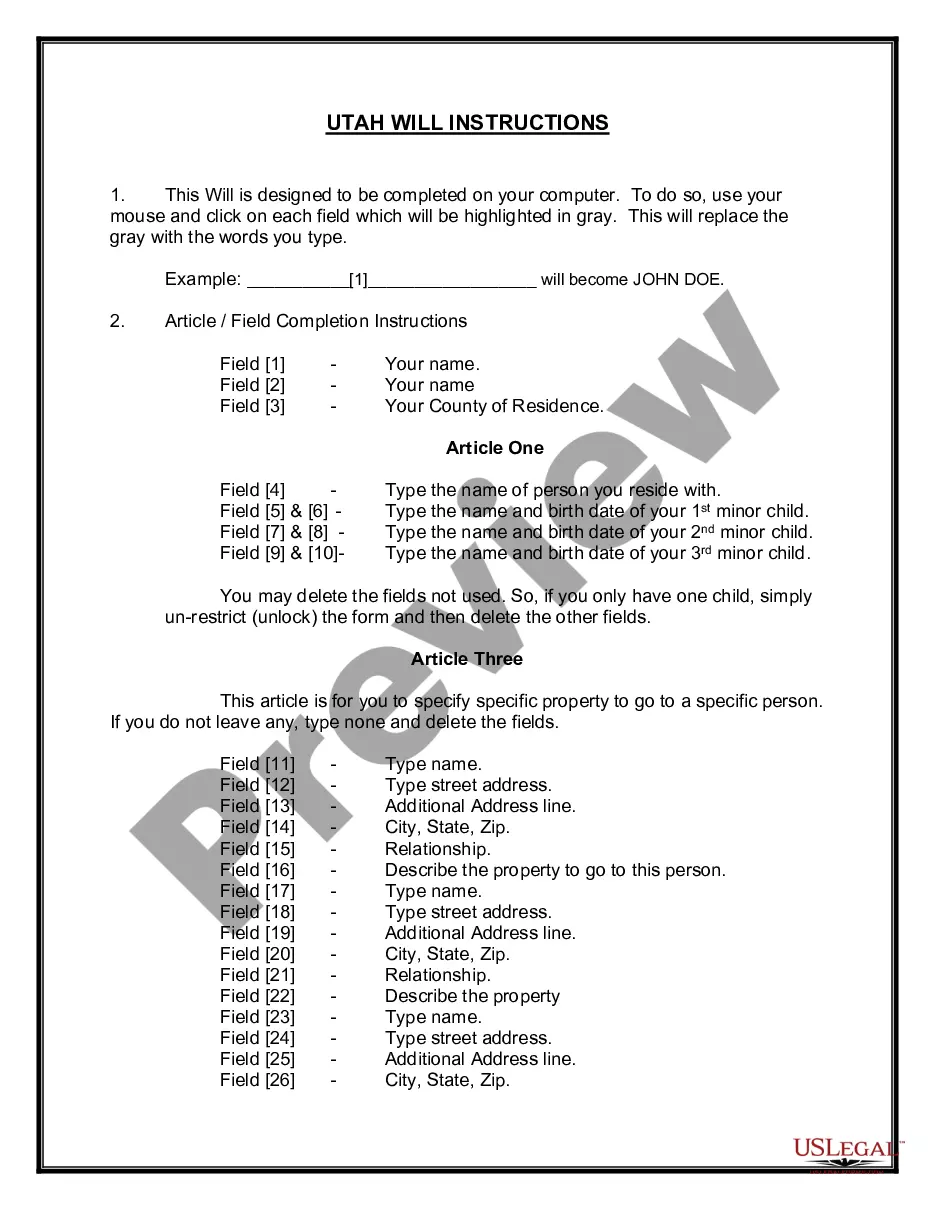

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for the right metropolis/nation.

- Step 2. Utilize the Preview choice to check out the form`s information. Never neglect to read through the outline.

- Step 3. If you are not satisfied with the form, take advantage of the Search industry at the top of the display screen to get other versions of your legitimate form design.

- Step 4. Once you have discovered the shape you need, click the Purchase now option. Choose the pricing program you prefer and include your qualifications to sign up on an accounts.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal accounts to finish the deal.

- Step 6. Select the structure of your legitimate form and download it on your own system.

- Step 7. Full, revise and produce or sign the Guam Sample Identity Theft Policy for FCRA and FACTA Compliance.

Each legitimate file design you get is your own property for a long time. You possess acces to every single form you acquired inside your acccount. Go through the My Forms area and select a form to produce or download yet again.

Contend and download, and produce the Guam Sample Identity Theft Policy for FCRA and FACTA Compliance with US Legal Forms. There are many skilled and express-specific types you may use for your enterprise or person requires.

Form popularity

FAQ

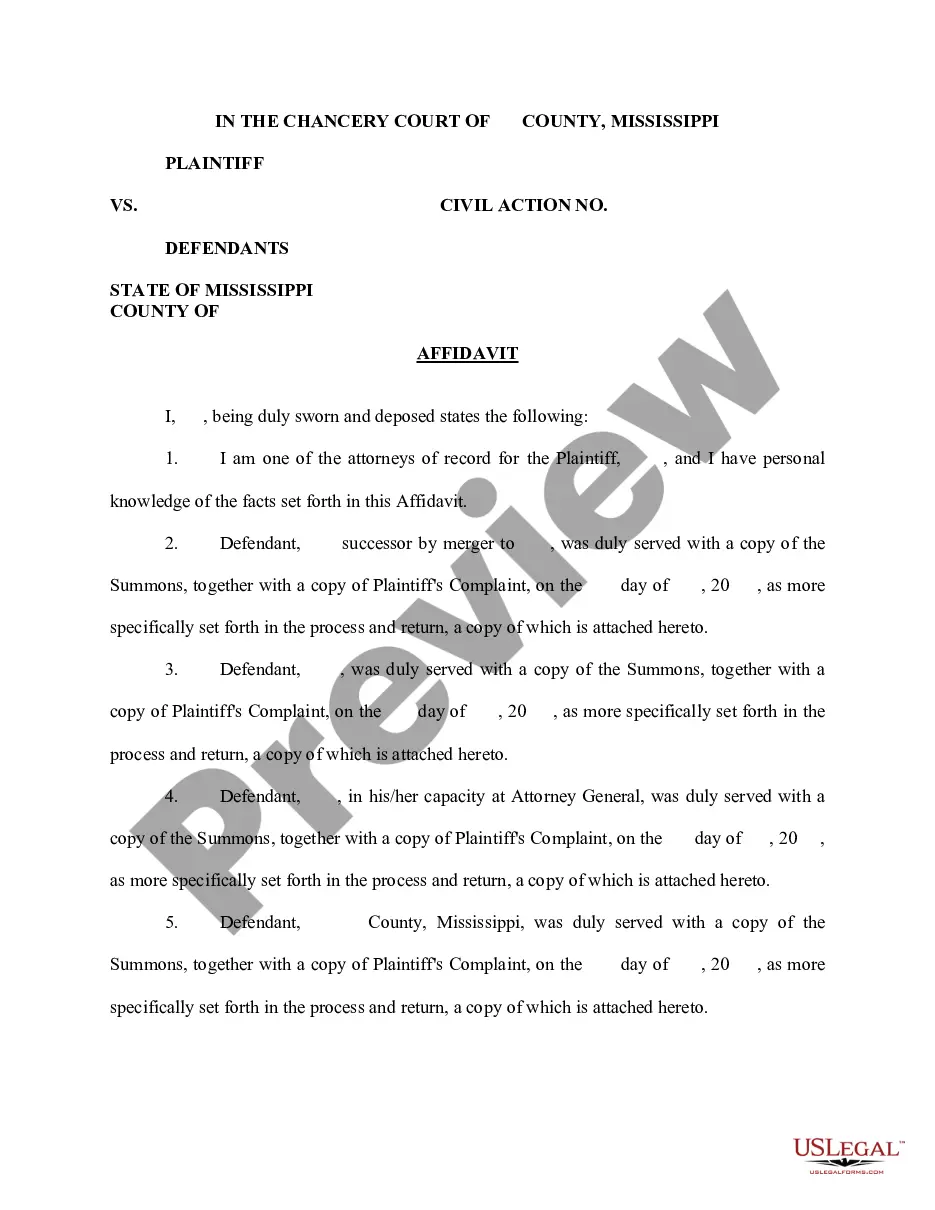

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. It was passed in 1970 to address the fairness, accuracy, and privacy of the personal information contained in the files of the credit reporting agencies.

FACTA amends the Fair Credit Reporting Act (FCRA) to: help consumers combat identity theft; establish national standards for the regulation of consumer report information; assist consumers in controlling the type and amount of marketing solicitations they receive; and.

Complying with the FCRA Tell the applicant or employee that you might use information in their consumer report for decisions related to their employment. ... Get written permission from the applicant or employee. ... Certify compliance to the company from which you are getting the applicant or employee's information.

The term ?consumer reporting agency? means any person which, for monetary fees, dues, or on a cooperative nonprofit basis, regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information or other information on consumers for the purpose of furnishing consumer reports to ...

The provisions in the Fair and Accurate Credit Transactions Act impacting banks include those related to: requirements that furnishers adopt identity theft prevention policies; fraud and active duty alerts; blocking the reporting of information a consumer identifies as related to identity theft; creditor requirements ...

FACTA allows consumers to request and obtain a free credit report once every 12 months. It also includes provisions to reduce identity theft such as the ability for individuals to place alerts on their credit histories.

For example, if someone hacks your email account they could potentially: Request password resets for your other accounts ? including your online bank account or social media accounts. Send phishing scam emails to your friends and family. Steal your identity and lock you out of your other online accounts.