Guam Qualified Investor Certification Application

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

If you wish to complete, down load, or print authorized record web templates, use US Legal Forms, the greatest assortment of authorized types, which can be found on the Internet. Make use of the site`s easy and hassle-free lookup to get the documents you require. A variety of web templates for organization and person functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to get the Guam Qualified Investor Certification Application in a number of click throughs.

Should you be currently a US Legal Forms buyer, log in to the profile and then click the Download button to find the Guam Qualified Investor Certification Application. You can even gain access to types you earlier downloaded from the My Forms tab of the profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for the right city/land.

- Step 2. Make use of the Preview method to examine the form`s content material. Never forget to learn the outline.

- Step 3. Should you be unsatisfied using the develop, take advantage of the Lookup field at the top of the monitor to locate other variations in the authorized develop design.

- Step 4. When you have located the form you require, click the Get now button. Select the costs prepare you like and include your references to sign up for an profile.

- Step 5. Process the purchase. You may use your charge card or PayPal profile to accomplish the purchase.

- Step 6. Pick the format in the authorized develop and down load it on your system.

- Step 7. Complete, change and print or sign the Guam Qualified Investor Certification Application.

Each and every authorized record design you buy is the one you have for a long time. You have acces to every develop you downloaded in your acccount. Click on the My Forms area and pick a develop to print or down load yet again.

Remain competitive and down load, and print the Guam Qualified Investor Certification Application with US Legal Forms. There are many professional and express-distinct types you can utilize for the organization or person needs.

Form popularity

FAQ

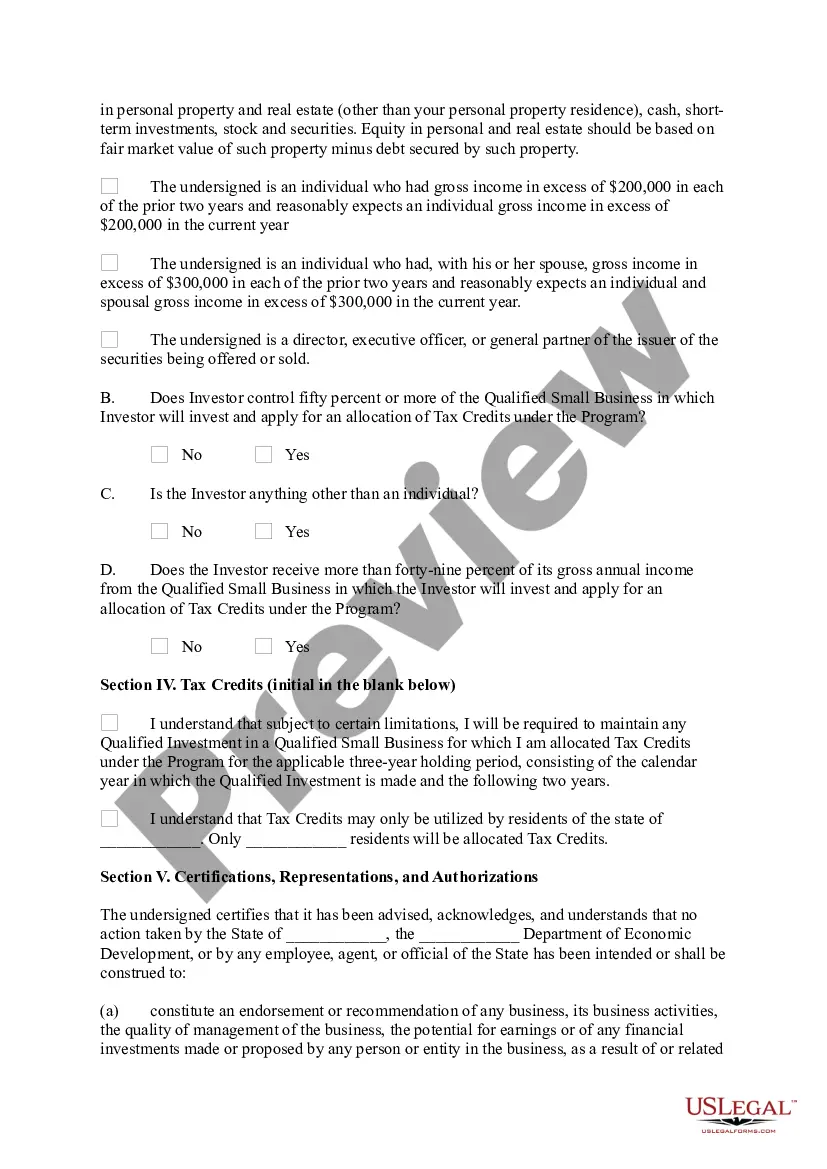

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor. To do this, they would ask you to fill out a questionnaire and possibly provide certain documents, such as financial statements, credit reports, or tax returns.

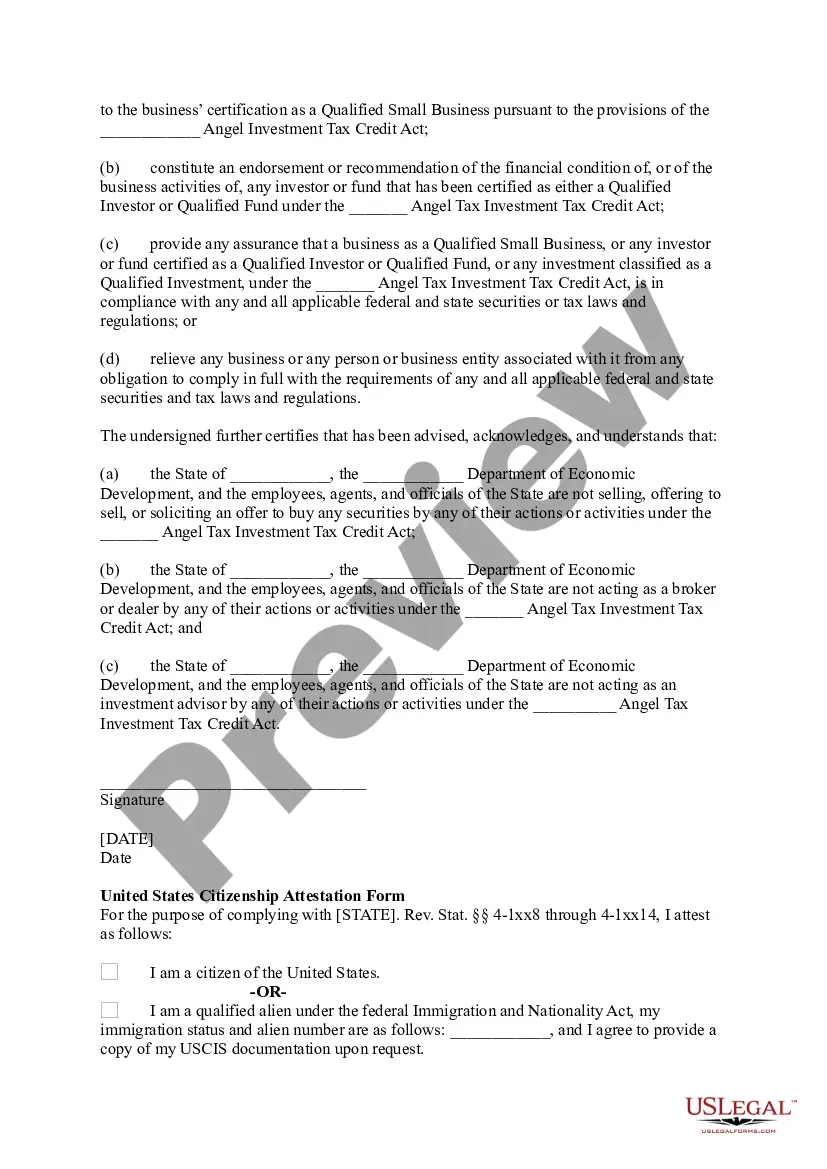

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

Since there is no actual accreditation process, there's no need for self-certification. Of course, accredited investors may secure the required financial statements ahead of time so that it is easier to prove their status during the investor verification process.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...