Guam Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

US Legal Forms - one of several biggest libraries of lawful kinds in the USA - delivers a wide array of lawful papers themes it is possible to down load or produce. Making use of the web site, you may get a huge number of kinds for business and specific reasons, sorted by types, claims, or search phrases.You can get the latest versions of kinds just like the Guam Angel Fund Promissory Note Term Sheet in seconds.

If you already possess a registration, log in and down load Guam Angel Fund Promissory Note Term Sheet in the US Legal Forms library. The Obtain option will appear on each and every develop you perspective. You gain access to all formerly saved kinds from the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, allow me to share easy recommendations to help you started:

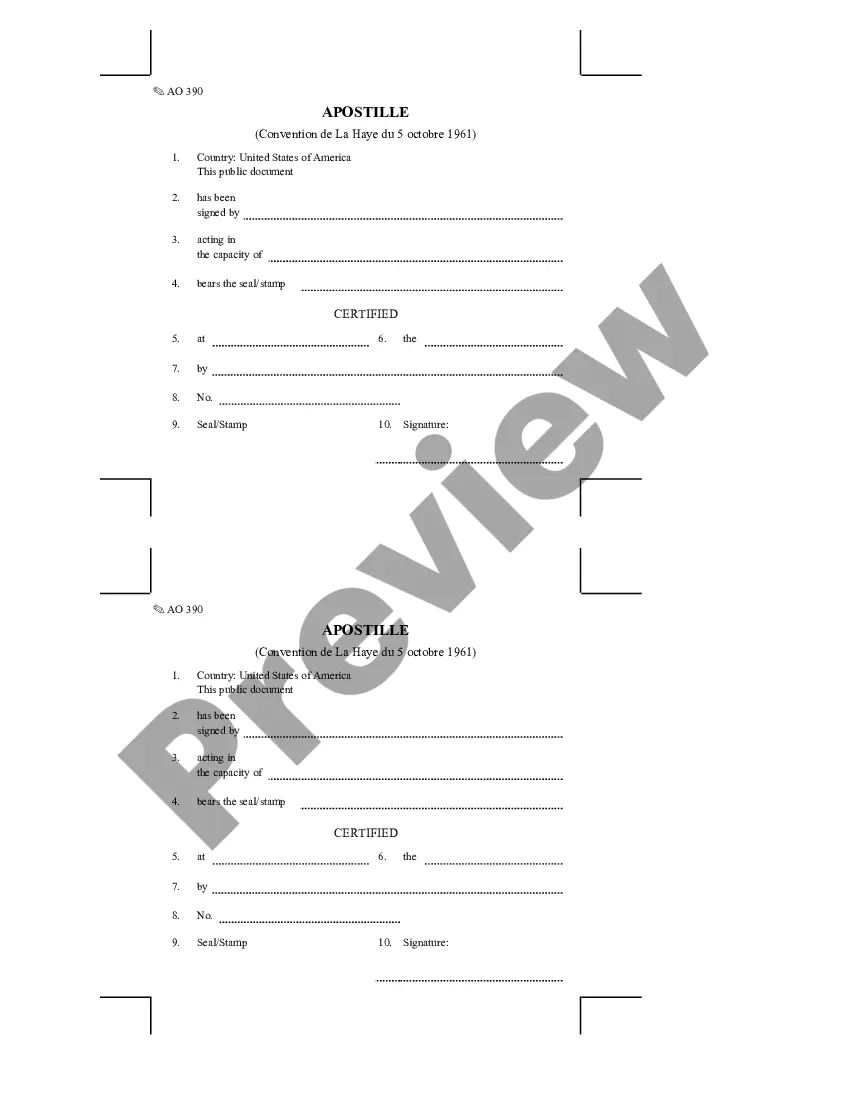

- Be sure you have chosen the best develop for the metropolis/area. Go through the Preview option to examine the form`s information. Read the develop explanation to ensure that you have selected the correct develop.

- In case the develop does not match your demands, utilize the Search area on top of the display to get the one who does.

- If you are content with the form, affirm your selection by clicking on the Purchase now option. Then, pick the pricing prepare you prefer and supply your credentials to register for an accounts.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal accounts to complete the purchase.

- Pick the file format and down load the form in your gadget.

- Make modifications. Fill out, edit and produce and indicator the saved Guam Angel Fund Promissory Note Term Sheet.

Every design you included in your money lacks an expiry date and is your own property permanently. So, if you wish to down load or produce one more backup, just visit the My Forms segment and then click around the develop you need.

Obtain access to the Guam Angel Fund Promissory Note Term Sheet with US Legal Forms, the most extensive library of lawful papers themes. Use a huge number of expert and status-specific themes that satisfy your business or specific requirements and demands.

Form popularity

FAQ

Angel investors are individuals who provide capital for business ventures and startups in need of funding. These are typically wealthy individuals, who are often business founders & CEOs themselves, and exchange their own money for a share of the company they are investing in.

Investment Profile 4 This may look good to investors and too expensive to entrepreneurs, but other sources of financing are not usually available for such business ventures. This makes angel investments a good fit for an entrepreneur with a good idea and little or no cash to pursue it.

To qualify as an eligible angel investor, Indian investors need to meet 1 of the following requirements: An individual investor who has net tangible assets of at least INR 2 crore excluding value of the investor's principal residence, and who: has early stage investment experience, or.

In exchange for investing a certain amount of funding, angel investors receive a minority ownership stake in the company. This proportion is typically no larger than 20 to 30 percent across all investors, since the founders need to retain majority ownership and also reserve some shares for employee stock options.

Not every would-be angel can participate. The Securities and Exchange Commission allows onlyaccredited investors to take part. They must have net assets of at least $1 million, not including their home, or annual income of more than $200,000 or $300,00 for married couples.

Angel investors are wealthy private investors focused on financing small business ventures in exchange for equity. Unlike a venture capital firm that uses an investment fund, angels use their own net worth.