Guam Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

Have you been inside a position where you need documents for sometimes company or personal reasons virtually every working day? There are a lot of legal document themes available on the net, but finding versions you can rely on isn`t simple. US Legal Forms offers 1000s of develop themes, much like the Guam Assignment of Note and Deed of Trust as Security for Debt of Third Party, that are written in order to meet federal and state needs.

In case you are already familiar with US Legal Forms web site and also have your account, basically log in. Following that, it is possible to acquire the Guam Assignment of Note and Deed of Trust as Security for Debt of Third Party template.

If you do not have an bank account and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is for that proper metropolis/county.

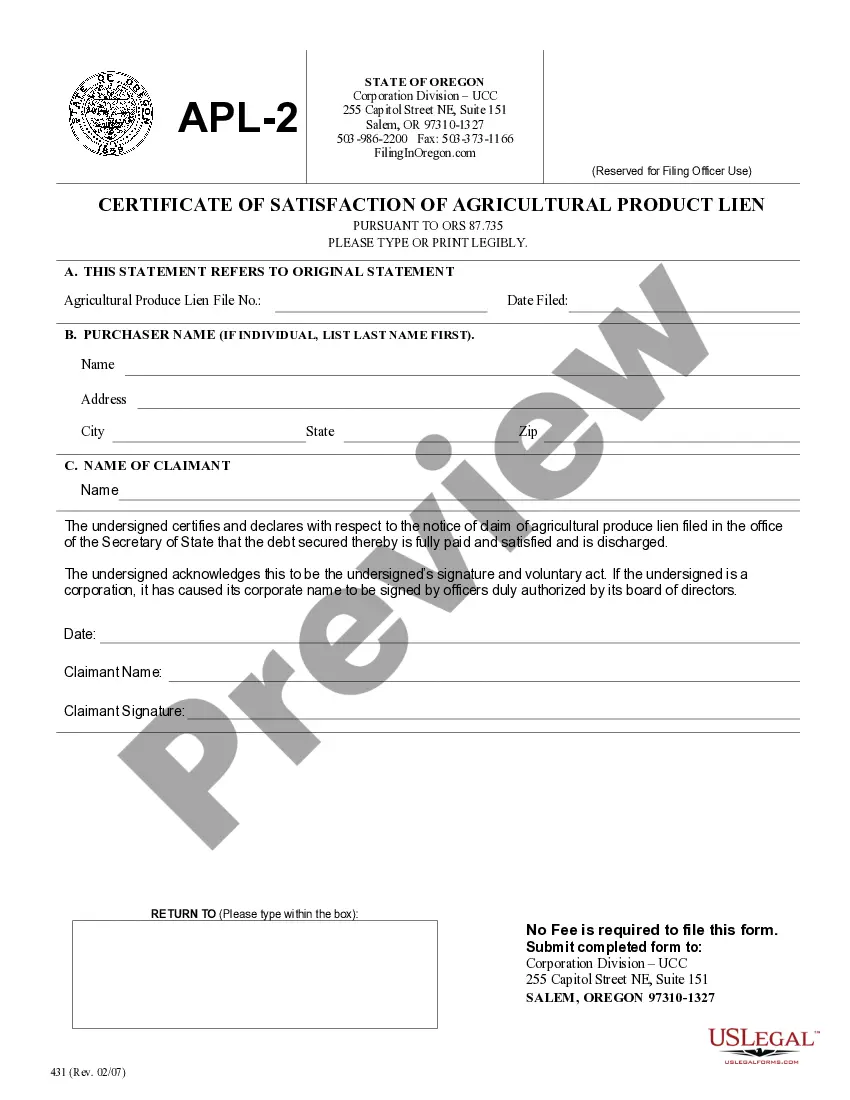

- Take advantage of the Preview button to check the form.

- Read the description to actually have selected the right develop.

- In the event the develop isn`t what you are trying to find, use the Search field to get the develop that suits you and needs.

- Once you find the proper develop, just click Buy now.

- Opt for the pricing program you want, complete the desired details to make your account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Choose a convenient paper format and acquire your backup.

Locate every one of the document themes you may have purchased in the My Forms menus. You can aquire a further backup of Guam Assignment of Note and Deed of Trust as Security for Debt of Third Party any time, if needed. Just select the needed develop to acquire or print the document template.

Use US Legal Forms, probably the most substantial variety of legal kinds, to save lots of time as well as stay away from mistakes. The support offers appropriately manufactured legal document themes that can be used for a selection of reasons. Create your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Full reconveyance. document stating debt secured by the deed of trust has been discharged, releases security property from lien created by deed of trust, trustee must record this when borrower has paid debt within 21 days.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

A deed of trust is satisfied when the debt it secures is paid or when the obligation it secures is fulfilled. A deed of trust is no longer a lien on the property if the debt or obligation it secures has been satisfied but it will remain a cloud on title until removed from the chain of title.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!