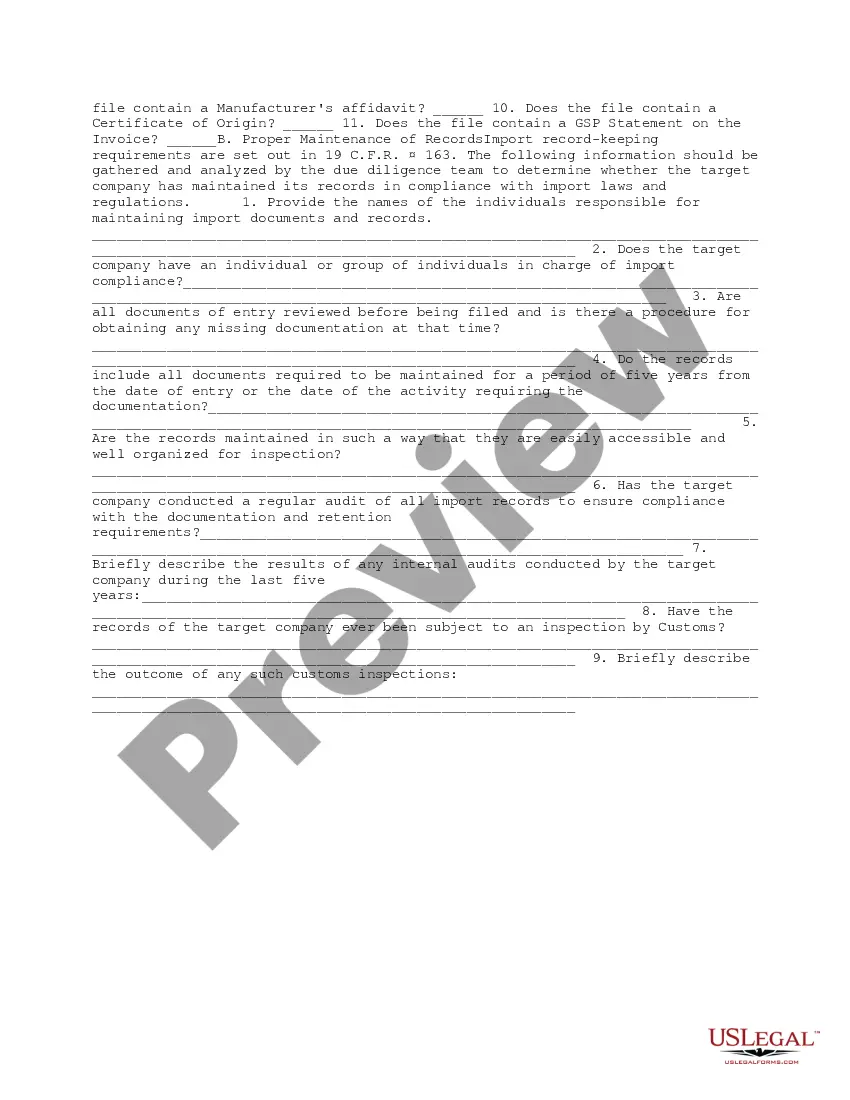

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Guam Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

You can invest hours online attempting to locate the authentic document template that fulfills the state and federal requirements you will need.

US Legal Forms offers thousands of authentic forms that have been vetted by experts.

You can truly download or print the Guam Import Compliance and Records Review Due Diligence from our service.

First, make sure you have chosen the correct document template for the state/city that you prefer. Review the form details to ensure you have selected the right one. If available, use the Preview button to look through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you may complete, modify, print, or sign the Guam Import Compliance and Records Review Due Diligence.

- Every authentic document template you purchase is yours permanently.

- To get another copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

An EEI filing is not required for shipments to other U.S. territories (American Samoa, Commonwealth of the Northern Mariana Islands, Guam, Howland Islands and Wake Island) or from the U.S. Virgin Islands to the U.S., a U.S. territory, or Puerto Rico.

What Does an Importer of Record Do? The importer of record is responsible for ensuring all the legal requirements are met before goods can be cleared through customs. During this process, the IOR must ensure that the product classification is accurate, making sure that imported goods have been appropriately valued.

When importing a good or product, it is the responsibility of the importer of record to be compliant with import regulations.

(Shipments between the U.S. and American Samoa, Commonwealth of the Northern Mariana Islands, Guam, Howland Islands, and Wake Island do not have to be filed.)

An owner or purchaser may make entry on their own behalf or designate a licensed Customs broker to make entry and be shown as the Importer of Record. For a Customs broker to be the Importer of Record, they must be granted Power of Attorney (POA) to get authorization to do clearance for an importer.

There are four basic import documents you need in order to clear customs quickly and easily.Commercial Invoice. This document is used for foreign trade.Packing List. Provided by the shipper or freight forwarder, the packing list may be used by customs to check the cargo.Bill of Lading (BOL)Arrival Notice.

The bottom line: You do not have to file EEI when sending products state to state but you do when shipping from the United States to Puerto Rico and vice versa. Puerto Rico's territorial status does provide some privileges, though, such as EEI exemptions in some cases.

Shipments to U.S. Territories which includes Guam, Puerto Rico, U.S. Virgin Islands, American Samoa, Swains Island and the Commonwealth of the Northern Mariana Islands (CNMI) are not considered exports and tariff exempt.

What is an Importer of Record? The party responsible for ensuring that imported goods comply with all customs and legal requirements of the country of import. This is usually the owner of the goods, but may also be a designated individual or customs broker.

If the U.S. Principal Party in Interest (USPPI) is sending goods through the U.S. Postal Service they are required to file the EEI only if the entire shipment is valued over $2,500 per Schedule B or if it requires an export license.