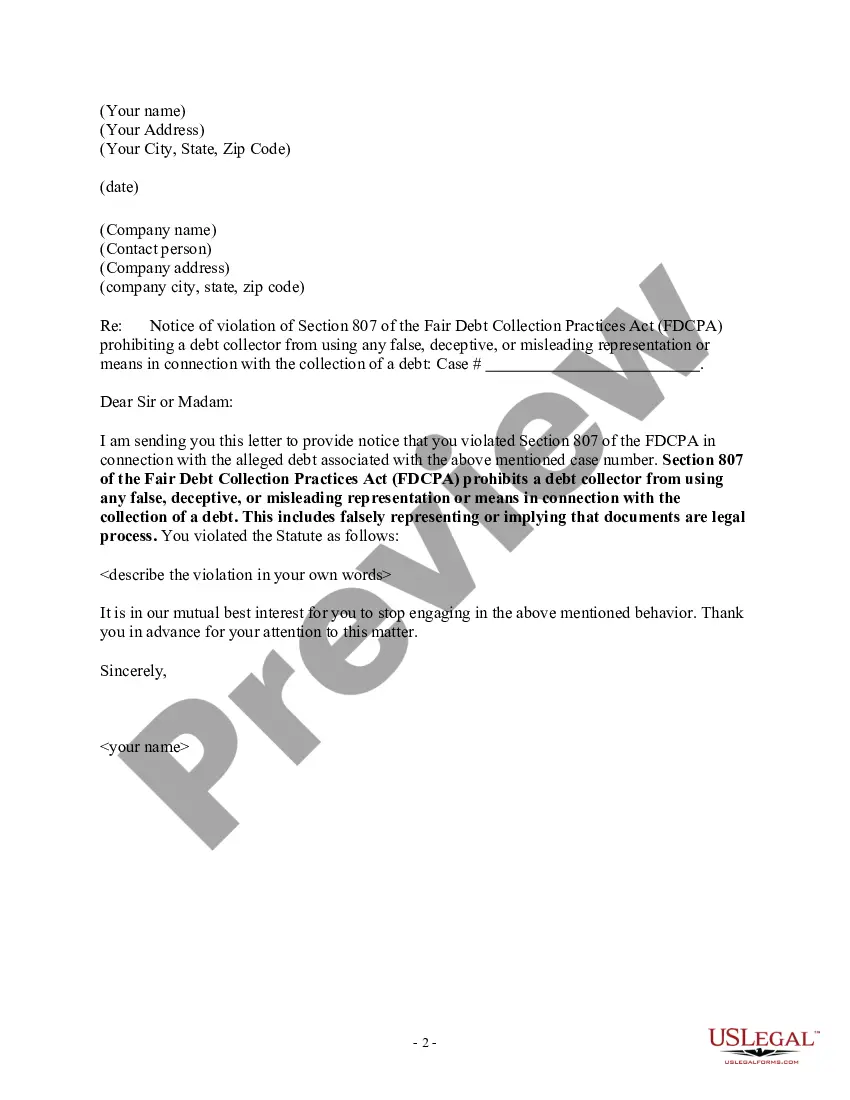

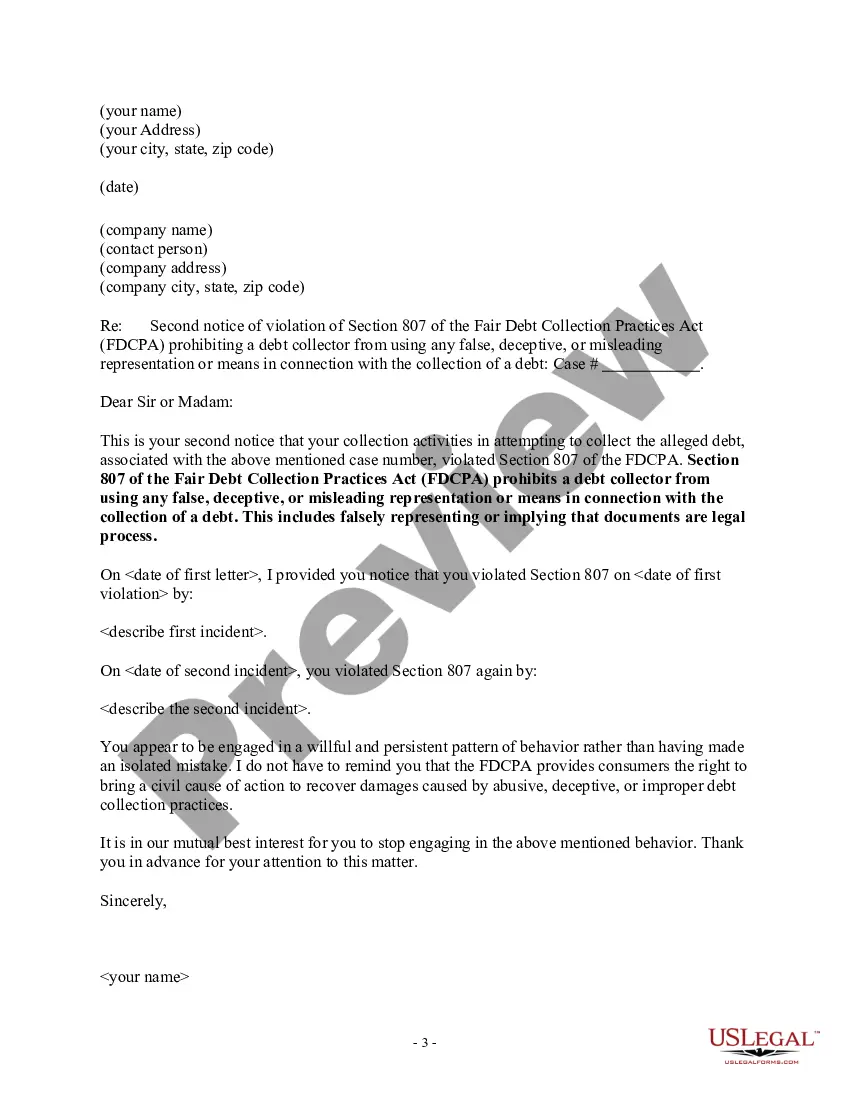

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Guam Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

Selecting the appropriate legal documents template can be an ordeal.

Of course, there are numerous patterns available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your needs, utilize the Search area to find the appropriate form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Select the pricing plan you desire and enter the necessary details. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal documents template to your device. Complete, edit, and print, then sign the acquired Guam Notice to Debt Collector - Falsely Representing a Document as Legal Process. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain well-crafted paperwork that complies with state requirements.

- The service offers thousands of templates, including the Guam Notice to Debt Collector - Falsely Representing a Document as Legal Process, which you can use for both business and personal needs.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Acquire button to obtain the Guam Notice to Debt Collector - Falsely Representing a Document as Legal Process.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents section of your account and retrieve another copy of the document you require.

Form popularity

FAQ

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?