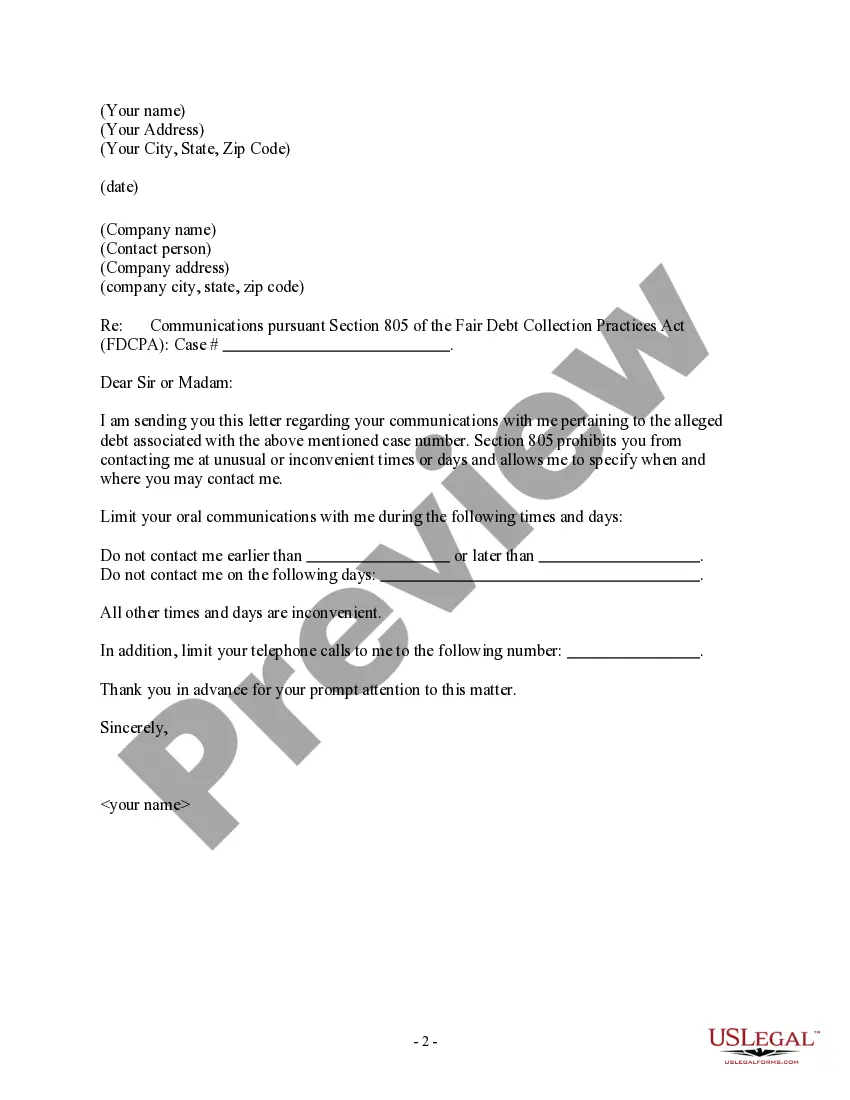

Guam Letter to Debt Collector - Only call me on the following days and times

Description

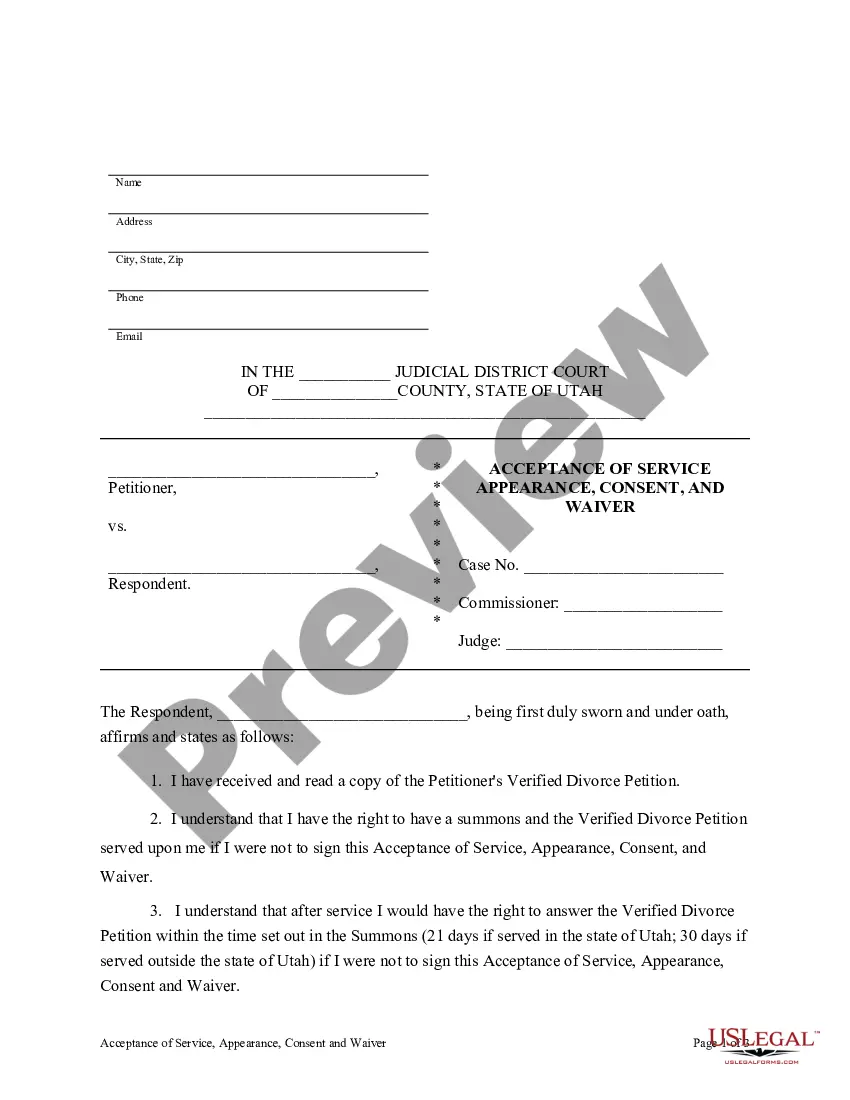

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

It is feasible to spend hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that can be reviewed by experts.

You can obtain or print the Guam Letter to Debt Collector - Only contact me on the specified days and times from your services.

If available, utilize the Preview option to review the document template as well.

- If you currently hold a US Legal Forms account, you may Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the Guam Letter to Debt Collector - Only contact me on the specified days and times.

- Each legal document template you purchase is yours indefinitely.

- To get another copy of the obtained form, visit the My documents tab and select the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city that you choose.

- Review the form summary to ensure you have chosen the right form.

Form popularity

FAQ

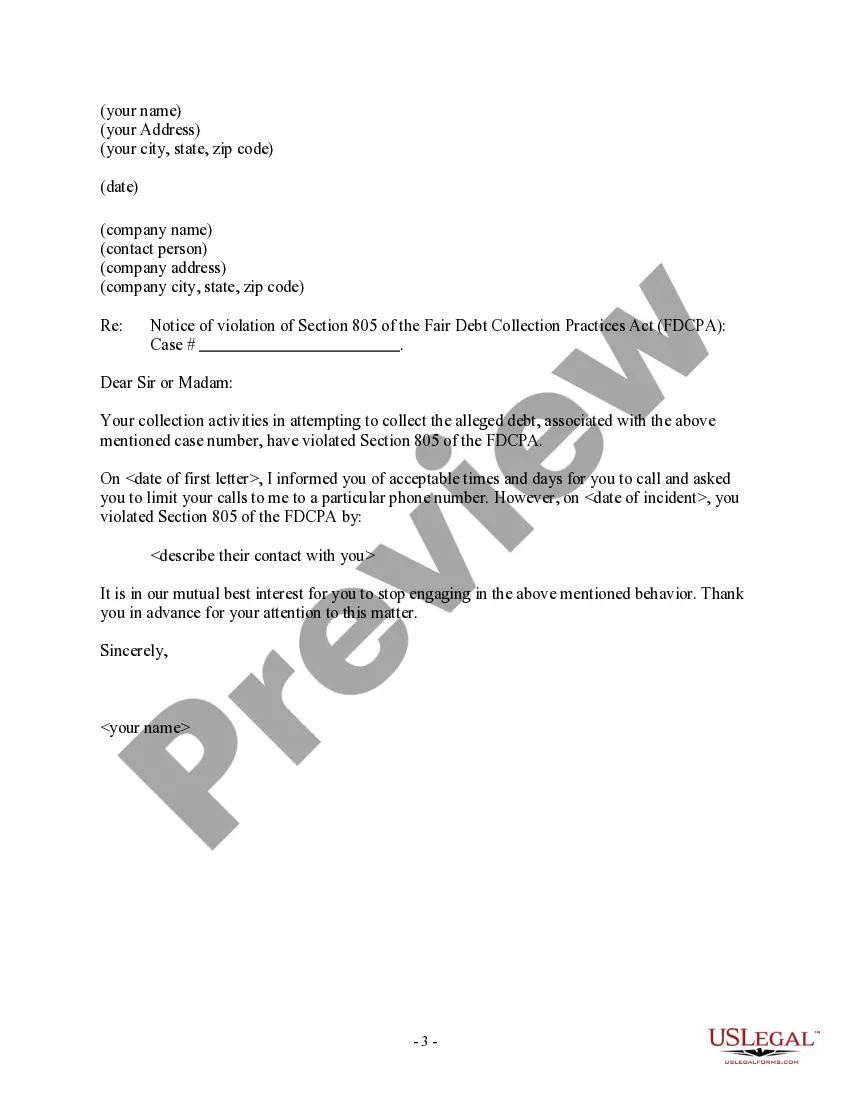

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

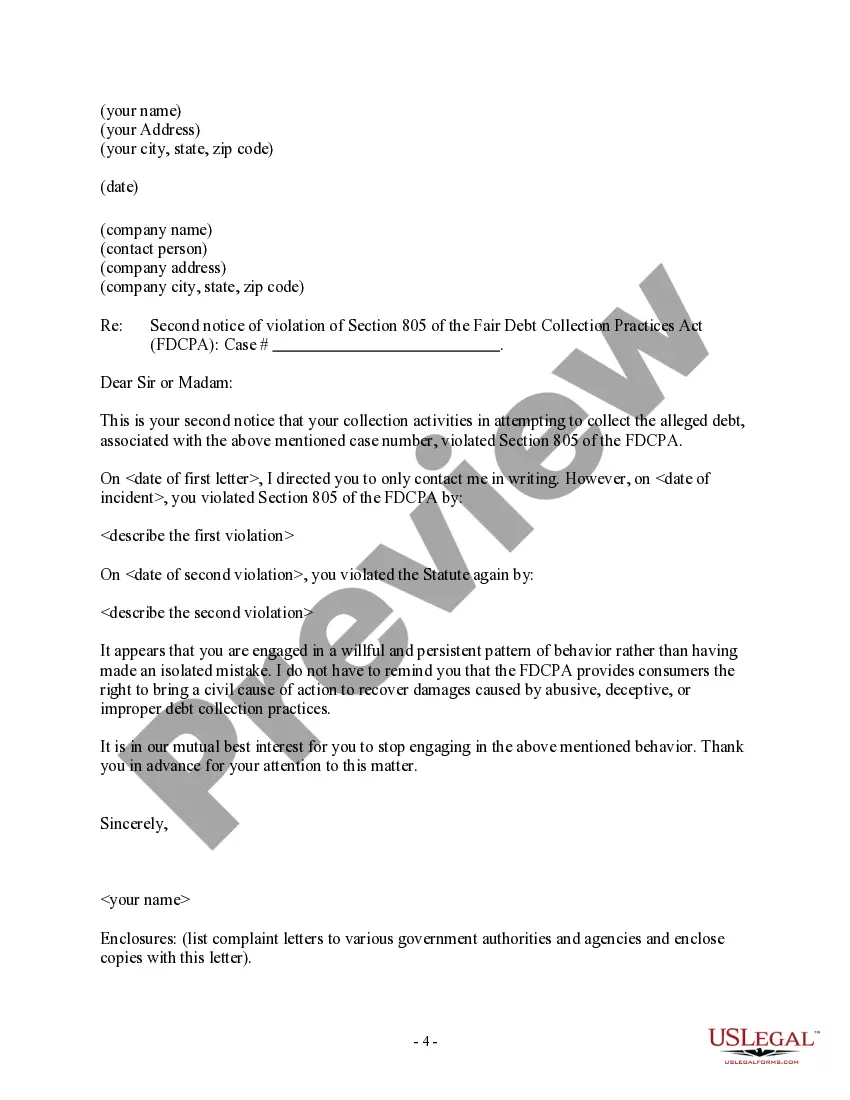

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

If a bill collector cannot locate you, it is allowed to reach out to third parties, such as relatives, neighbors or your employer, but only to find you. They aren't allowed to disclose that you owe a debt or discuss your finances with others.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

For example, if a person tells a debt collector to "stop calling," this statement means the person has requested that the debt collector not use telephone calls to communicate with the person and prohibits the debt collector from communicating or attempting to communicate through telephone calls.