Guam Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.

Description

How to fill out Agreement And Plan Of Merger By Filtertek, Inc., Filtertek De Puerto Rico, And Filtertek USA, Inc.?

Are you inside a place in which you will need papers for either company or individual functions nearly every day time? There are a lot of lawful papers web templates available online, but finding types you can trust is not effortless. US Legal Forms gives 1000s of develop web templates, like the Guam Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc., that happen to be written to satisfy state and federal demands.

When you are already knowledgeable about US Legal Forms site and also have your account, merely log in. Following that, you can down load the Guam Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. template.

Unless you provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is to the proper town/region.

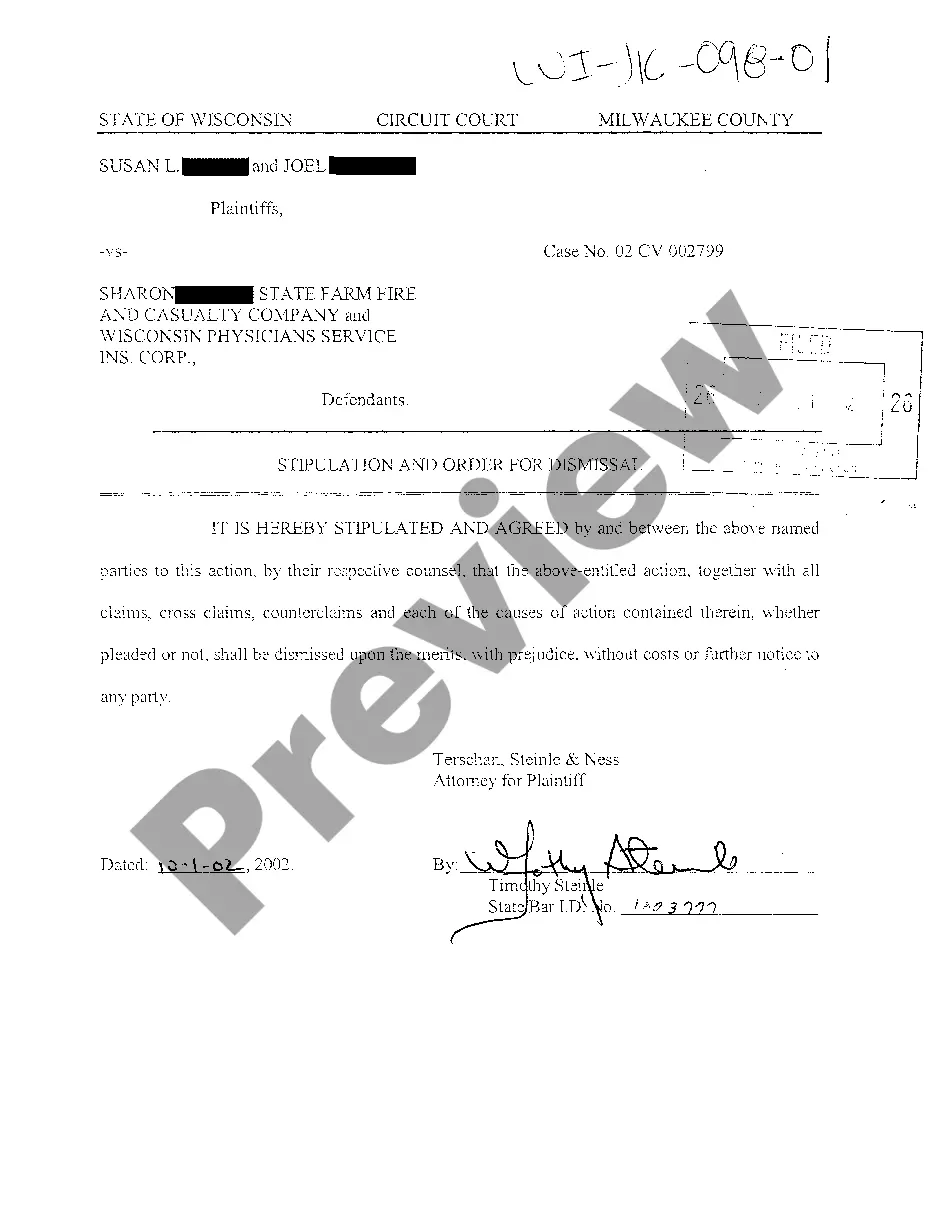

- Use the Review option to examine the shape.

- Read the outline to actually have chosen the right develop.

- In the event the develop is not what you`re looking for, make use of the Lookup discipline to find the develop that fits your needs and demands.

- If you get the proper develop, click on Get now.

- Opt for the rates strategy you would like, complete the desired details to make your money, and buy the transaction using your PayPal or credit card.

- Choose a handy paper file format and down load your duplicate.

Find each of the papers web templates you may have bought in the My Forms food selection. You can get a additional duplicate of Guam Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. anytime, if needed. Just go through the necessary develop to down load or produce the papers template.

Use US Legal Forms, by far the most comprehensive selection of lawful kinds, in order to save time and stay away from errors. The assistance gives appropriately manufactured lawful papers web templates that you can use for an array of functions. Produce your account on US Legal Forms and start making your life a little easier.