Guam Merger Agreement for Type A Reorganization

Description

How to fill out Merger Agreement For Type A Reorganization?

Have you been within a position that you will need papers for possibly enterprise or individual functions almost every working day? There are a variety of legal record web templates accessible on the Internet, but getting versions you can rely is not easy. US Legal Forms delivers thousands of develop web templates, much like the Guam Merger Agreement for Type A Reorganization, that are composed to meet federal and state demands.

When you are previously knowledgeable about US Legal Forms site and possess a free account, merely log in. Afterward, it is possible to down load the Guam Merger Agreement for Type A Reorganization template.

Unless you offer an profile and would like to start using US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is to the right metropolis/county.

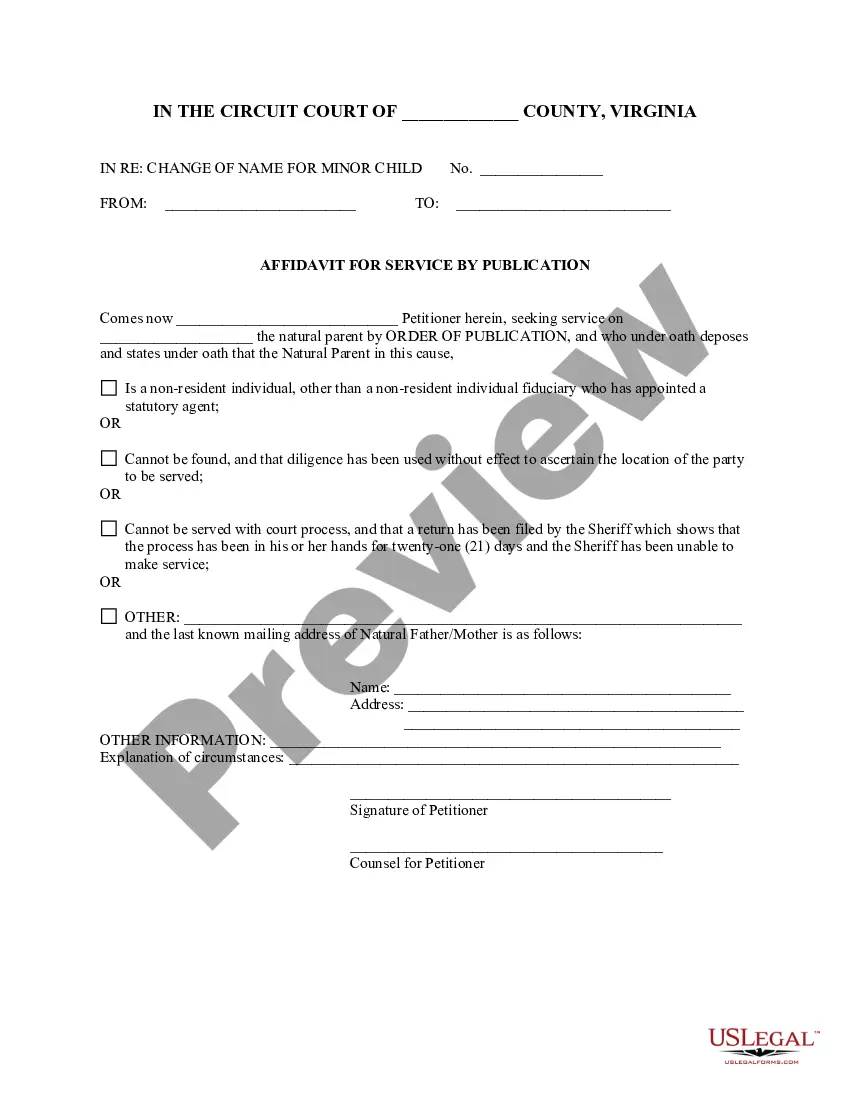

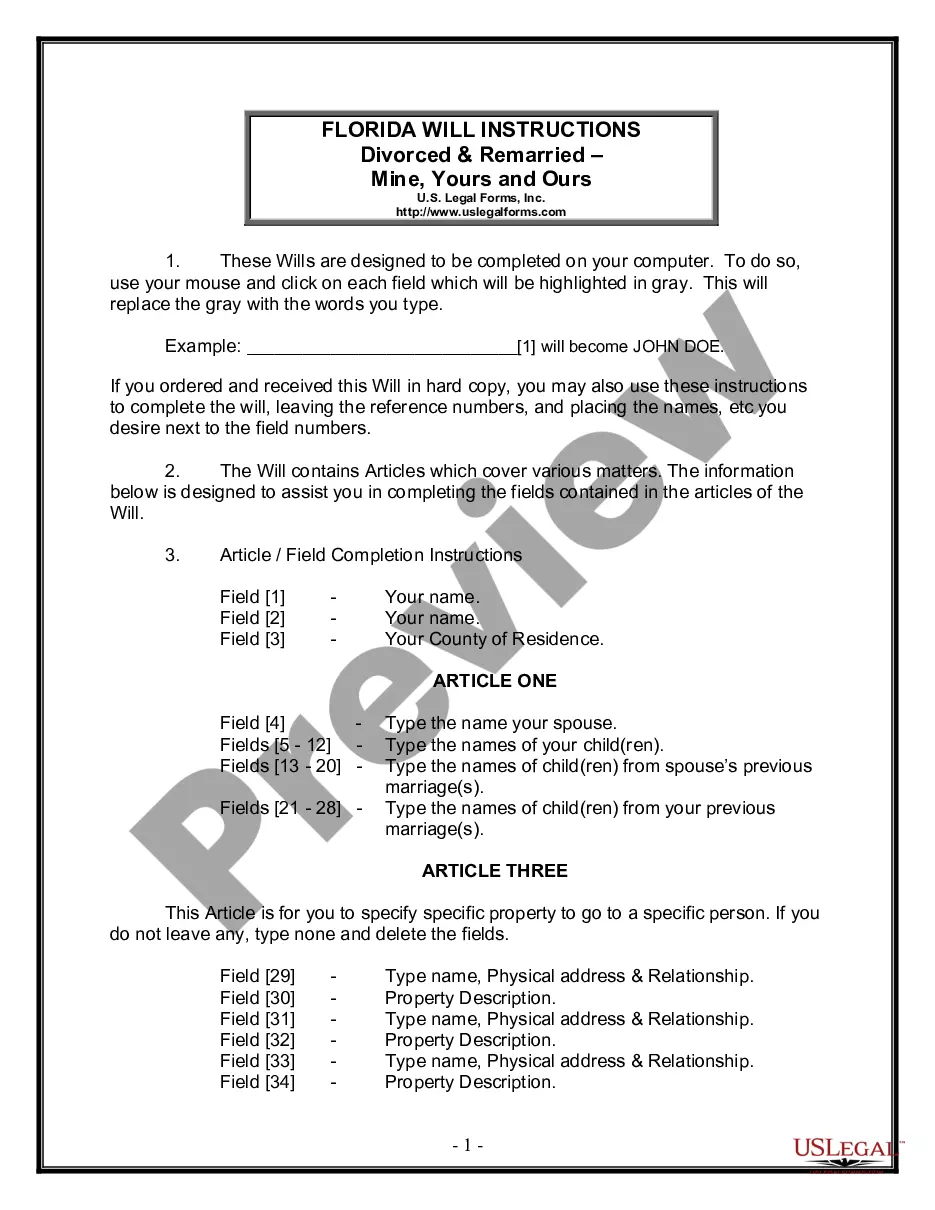

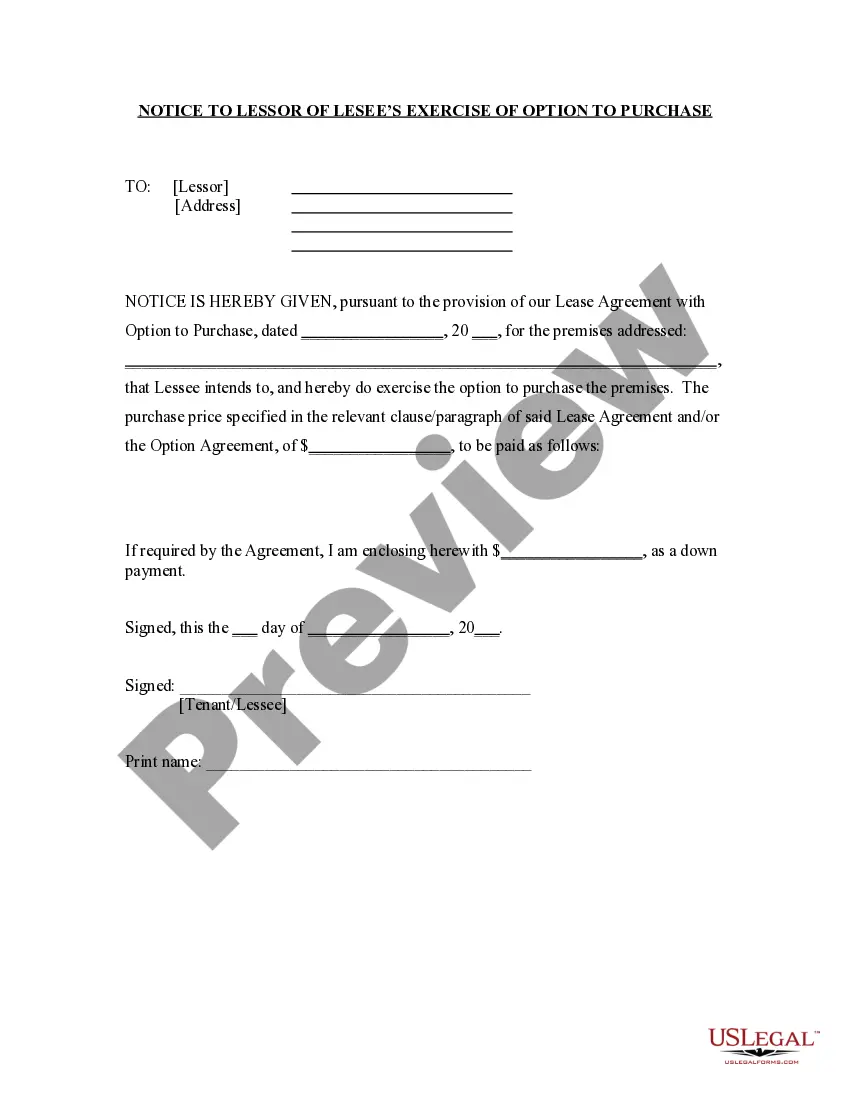

- Make use of the Preview option to check the shape.

- Read the explanation to actually have selected the right develop.

- In the event the develop is not what you are trying to find, use the Look for discipline to get the develop that suits you and demands.

- When you find the right develop, click on Purchase now.

- Pick the rates program you want, complete the specified information and facts to produce your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Pick a handy file file format and down load your duplicate.

Find all the record web templates you have bought in the My Forms menus. You may get a further duplicate of Guam Merger Agreement for Type A Reorganization anytime, if required. Just click the essential develop to down load or printing the record template.

Use US Legal Forms, one of the most extensive variety of legal forms, to conserve time as well as steer clear of errors. The support delivers expertly made legal record web templates which can be used for a variety of functions. Create a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

Parties enter into Restructuring and Reorganization Agreements when they want to change the financial, equity, legal or operational structures of a company (or companies within an affiliated group). Restructuring and Reorganization Agreements encompass a wide range of transactions.

Under IRC § 368(a)(1)(A), a Type A reorganization is a ?statutory merger or consolidation.? An ?A? reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas.

Overview. In a D reorganization, one corporation transfers all or part of its assets to another corporation. Immediately after the transfer, the transferring corporation or one or more of its shareholders must be in control of the corporation that acquired the assets.

A Type A reorganization must fulfill the continuity of interests requirement. That is, the shareholders in the acquired company must receive enough stock in the acquiring firm that they have a continuing financial interest in the buyer.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

The seven main types of company reorganization are mergers and consolidations, acquisitions, practical mergers, transfer spinoffs and split-offs, recapitalization, identity changes and transfers of assets.

While other consideration besides stock can be paid under a type A reorganization, the price paid under a type B reorganization must be solely in stock. And while the target is dissolved in a type A reorganization, it can be retained in a type B reorganization.