Guam Proposal to amend the restated articles of incorporation to create a second class of common stock

Description

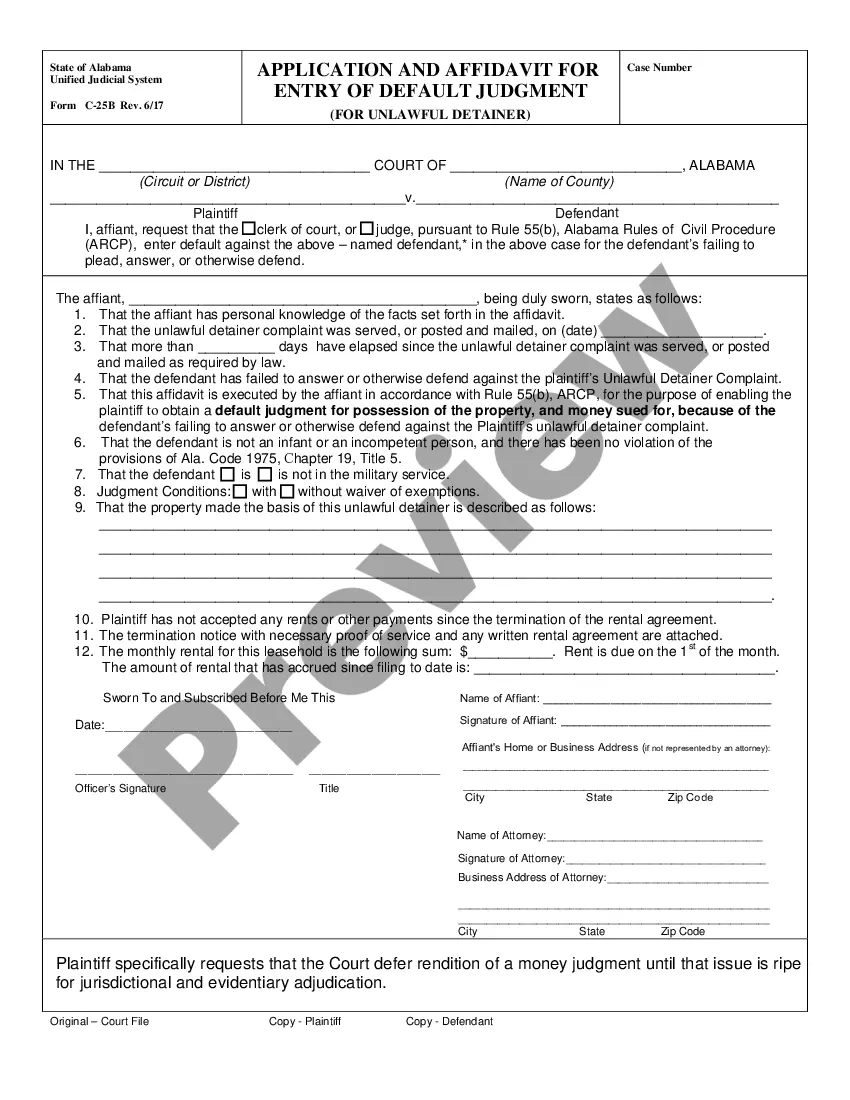

How to fill out Proposal To Amend The Restated Articles Of Incorporation To Create A Second Class Of Common Stock?

Are you presently inside a placement in which you require paperwork for either business or personal purposes almost every time? There are tons of authorized file themes accessible on the Internet, but finding kinds you can rely isn`t simple. US Legal Forms delivers thousands of kind themes, just like the Guam Proposal to amend the restated articles of incorporation to create a second class of common stock, which can be published in order to meet federal and state requirements.

Should you be previously familiar with US Legal Forms website and possess your account, simply log in. Afterward, it is possible to download the Guam Proposal to amend the restated articles of incorporation to create a second class of common stock format.

If you do not offer an bank account and wish to begin using US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is for the right town/county.

- Make use of the Preview key to check the shape.

- See the description to ensure that you have selected the right kind.

- When the kind isn`t what you are searching for, make use of the Lookup field to find the kind that meets your requirements and requirements.

- If you get the right kind, click on Get now.

- Opt for the prices plan you would like, fill out the desired details to make your money, and purchase your order with your PayPal or credit card.

- Choose a practical data file format and download your duplicate.

Get all the file themes you might have bought in the My Forms food selection. You can get a further duplicate of Guam Proposal to amend the restated articles of incorporation to create a second class of common stock whenever, if necessary. Just select the needed kind to download or print out the file format.

Use US Legal Forms, probably the most substantial variety of authorized kinds, to save lots of time as well as avoid faults. The services delivers skillfully manufactured authorized file themes which can be used for a selection of purposes. Make your account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

The Guam Business Corporation Act (the "Guam Act") updates Guam's general corporation laws, creating uniformity with the corporate laws of other jurisdictions, while tailoring certain statutes to accomplish Guam's long-standing objective to attract off-island interest and facilitate investment in local businesses.

An amendment is a change or addition to the terms of a contract or document. An amendment is often an addition or correction that leaves the original document substantially intact. Other times an amendment can strike the original text entirely and substitute it with new language.

Articles of incorporation (the ?articles) is the document filed with a state to create a corporation. Most states ask for only basic information about the corporation, but some require more information than others. All states require an in-state registered agent.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

The process of amending a corporation's articles is typically done through a special resolution. This can be achieved by a resolution approved by no less than two-thirds of the votes cast at a meeting of shareholders, or by a written resolution signed by all eligible shareholders.

Changes to the number of stocks or how the stocks are valued would also necessitate a change to the articles of incorporation. The most common reason that businesses need to change their articles of incorporation, however, is that there has been a change in personnel for the business.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

NON-AMENDABLE ITEMS Names of incorporators; Names of original subscribers to the capital stock of the corporation and their subscribed and paid up capital; Names of the original directors; Treasurer elected by the original subscribers; Members who contributed to the initial capital of the non?stock corporation; or.