Connecticut Annual Meeting Minutes of Directors

Description

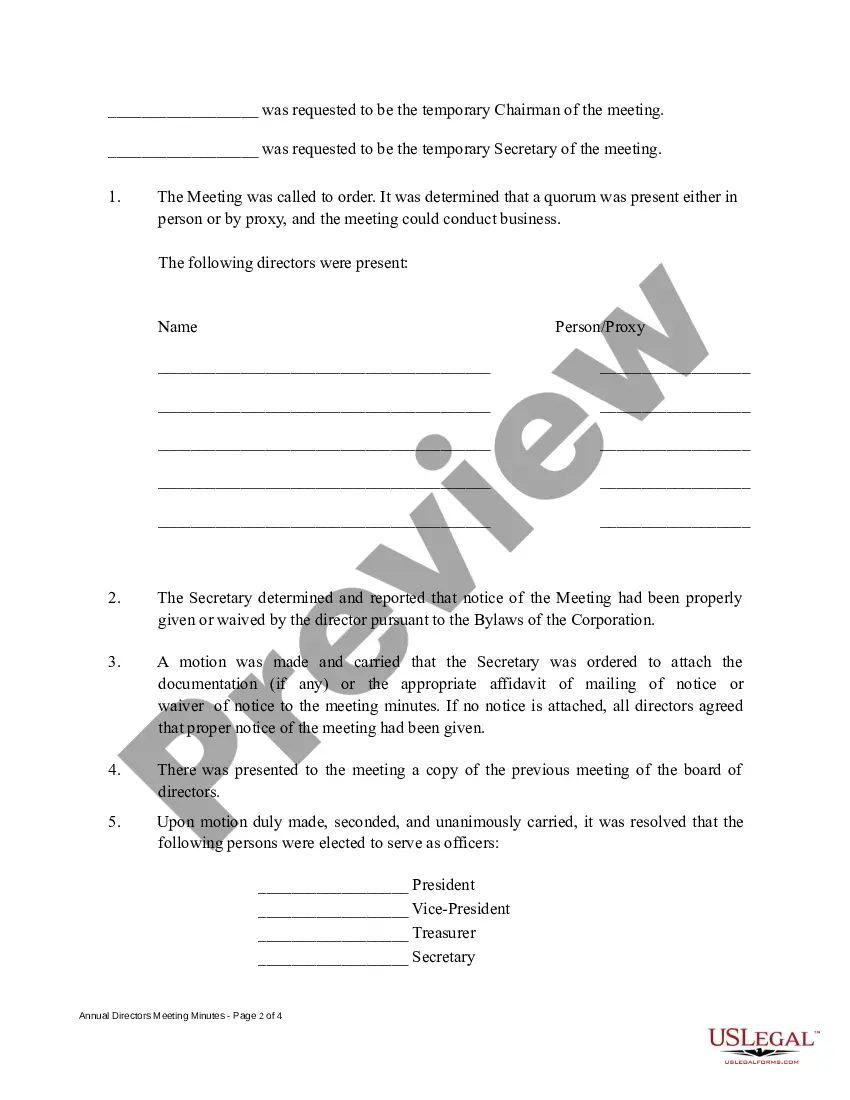

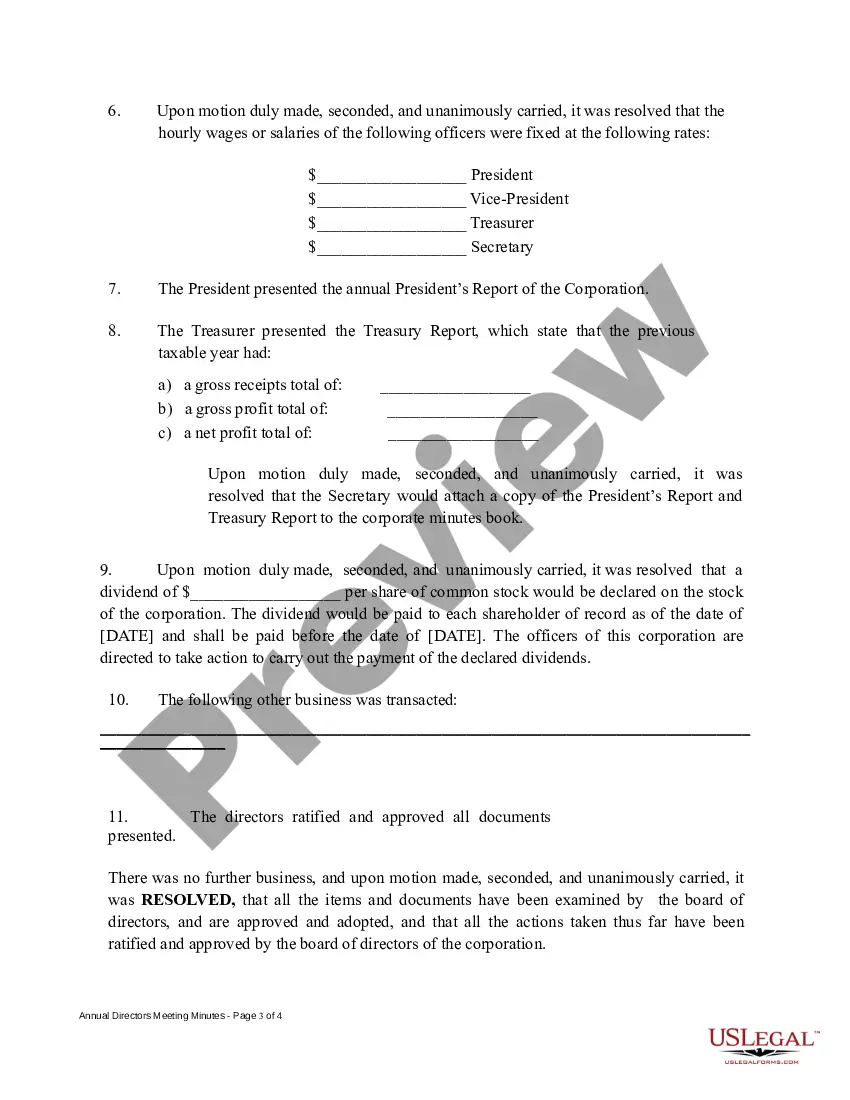

How to fill out Annual Meeting Minutes Of Directors?

US Legal Forms - one of many greatest libraries of lawful varieties in America - delivers a wide array of lawful document themes you may acquire or produce. Making use of the site, you may get 1000s of varieties for company and personal purposes, categorized by categories, states, or keywords and phrases.You will find the latest variations of varieties much like the Connecticut Annual Meeting Minutes of Directors within minutes.

If you already possess a registration, log in and acquire Connecticut Annual Meeting Minutes of Directors from your US Legal Forms local library. The Down load button can look on every single kind you see. You have access to all in the past saved varieties within the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed here are basic recommendations to obtain started out:

- Be sure to have selected the proper kind for your metropolis/county. Select the Review button to examine the form`s content. Browse the kind description to ensure that you have selected the right kind.

- In case the kind does not suit your specifications, utilize the Look for field near the top of the display screen to find the one which does.

- If you are content with the shape, validate your choice by visiting the Acquire now button. Then, choose the pricing plan you favor and give your accreditations to register to have an bank account.

- Procedure the transaction. Make use of your charge card or PayPal bank account to accomplish the transaction.

- Pick the formatting and acquire the shape on your own system.

- Make adjustments. Complete, change and produce and sign the saved Connecticut Annual Meeting Minutes of Directors.

Every design you put into your bank account does not have an expiry day and it is your own permanently. So, if you would like acquire or produce another backup, just check out the My Forms section and then click around the kind you want.

Obtain access to the Connecticut Annual Meeting Minutes of Directors with US Legal Forms, probably the most extensive local library of lawful document themes. Use 1000s of skilled and express-particular themes that fulfill your organization or personal requirements and specifications.

Form popularity

FAQ

A failure to do so can result in limited or no liability protection, which is often called "piercing the corporate veil."

Section 33-920. - Authority to transact business required. (a) A foreign corporation, other than an insurance, surety or indemnity company, may not transact business in this state until it obtains a certificate of authority from the Secretary of the State.

Can I be my own Registered Agent in Connecticut? You can be your own agent, as long as you are a resident of the state, over 18 years old, and are generally available during business hours.

Failure to keep meeting minutes The most severe consequence is the loss of liability protection. If this happens, shareholders' personal assets may be exposed to liability for the corporation's debts.