Guam Notice of Annual Report of Employee Benefits Plans

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Are you in a situation where you require documents for regular organization or particular tasks every day.

There are many legitimate document templates accessible online, but locating ones you can trust isn’t easy.

US Legal Forms offers a vast selection of form templates, such as the Guam Notice of Annual Report of Employee Benefits Plans, which are designed to comply with federal and state requirements.

When you find the right form, click Acquire now.

Select the pricing plan you require, enter the necessary details to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Guam Notice of Annual Report of Employee Benefits Plans at any time if needed. Click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Notice of Annual Report of Employee Benefits Plans template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and make sure it's for the correct city/area.

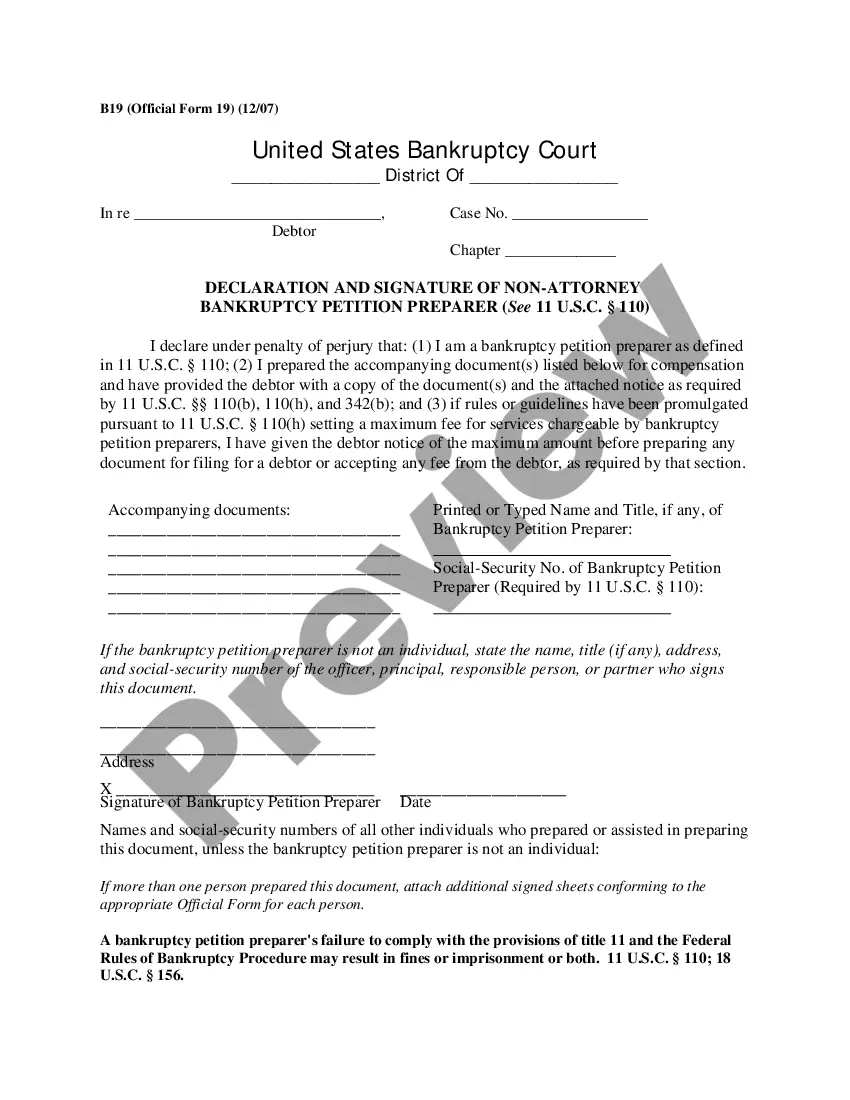

- Use the Preview option to check the form.

- Review the description to ensure you have selected the correct form.

- If the form isn’t what you are seeking, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

An annual summary refers to a yearly document that consolidates key information about an employee benefits plan, highlighting its performance, coverage, and financials. This summary serves to inform employees about their rights, obligations, and the benefits available to them. The term is often associated with the Guam Notice of Annual Report of Employee Benefits Plans, which ensures that employees are kept up-to-date on their benefits.

The 5500 annual return is a report required for employee benefit plans, detailing financial information to the Department of Labor. This report helps ensure compliance with federal regulations. If you're involved with a plan that includes the Guam Notice of Annual Report of Employee Benefits Plans, maintaining accurate records will be beneficial.

There are 3 types of Form 5500: Form 5500-EZfor one-participant plans only; Form 5500-SF for plans with fewer than 100 participants; and Form 5500for plans with 100 or more participants. Forms 5500 and 5500-SF must be filed electronically using the DOL ERISA Filing Acceptance System (EFAST2)Opens in a new window.

How to Electronically FileStep 1: Register with EFAST2: Go to the EFAST2 website ( ) and click Register on the left hand side under the Main section.Step 2: Electronically File Form 5500: Log in to the EFAST2 website ( )

How To Fill Out Form 5500Enter Annual Report Information. The first step in completing IRS Form 5500 is to enter the Annual Report Identification Information necessary for Part 1.Complete Plan Information.Identify & Complete Relevant Additional Schedules.Sign and Submit Form 5500.

You can easily do this very simple tax filing yourself and save the money. There are two ways to file: by postal mail using IRS Form 5500-EZ, Annual Return of One-Participant (Owners and Their Spouses) Retirement Plan to the IRS, or. electronically, by filing IRS Form 5500-SF.

All pension benefit plans and welfare benefit plans covered by ERISA must file a Form 5500 or Form 5500-SF for a plan year unless they are eligible for a filing exemption. (See Code sections 6058 and 6059 and ERISA sections 104 and 4065).

File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Must file electronically through EFAST2. Due date: the last day of the seventh month after the plan year ends (July 31 for a calendar year plan).

Each year, the plan administrator of a plan that is not exempt from filing a Form 5500 must provide a summary annual report (SAR) to the participants within nine months after the end of the plan year.

This notice is intended to provide a summary of plan information to participating employers and employee representatives of the Alaska Ironworkers Pension Plan (Plan). This notice is required to be provided by Section 104(d) of the Employee Retirement Income Security Act (ERISA).