Guam Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Are you currently in a circumstance that you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can rely on is not easy.

US Legal Forms provides thousands of template forms, including the Guam Waiver of the Right to be Spouse's Beneficiary, which are designed to meet state and federal guidelines.

Once you find the correct form, click Download now.

Choose the payment plan you prefer, fill out the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Guam Waiver of the Right to be Spouse's Beneficiary template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

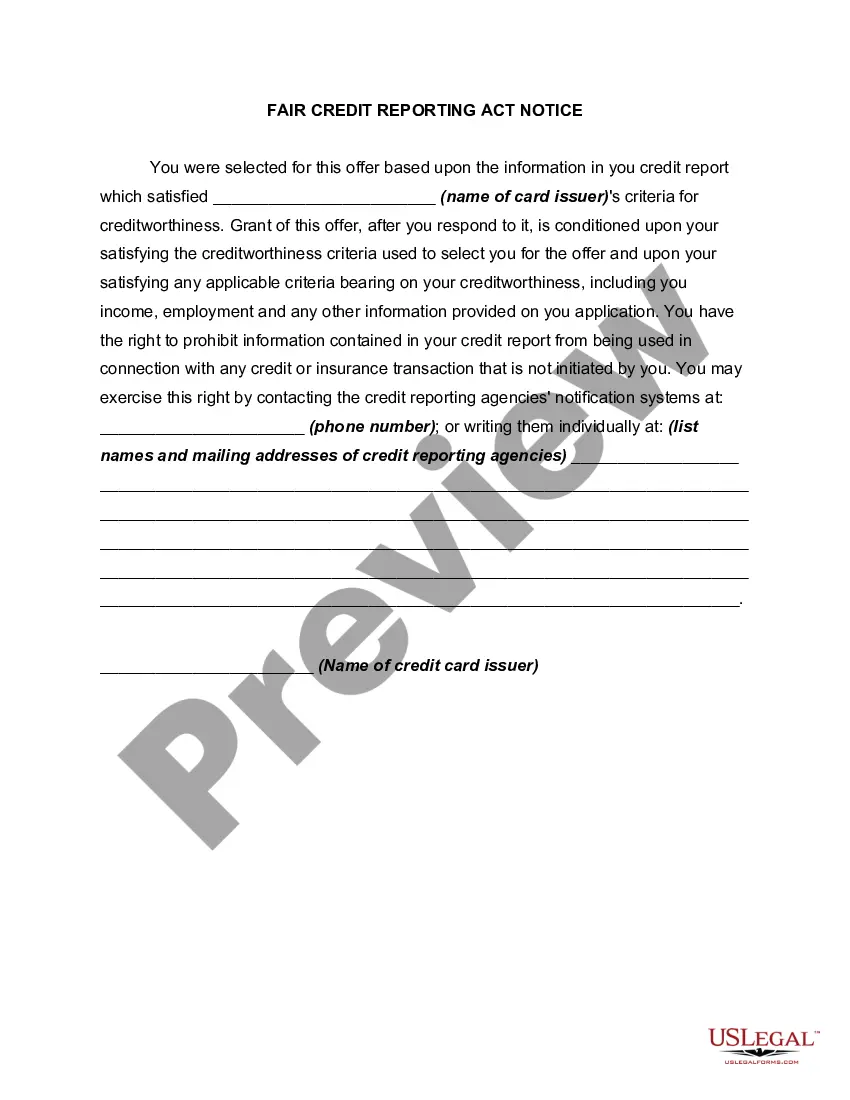

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs.

Form popularity

FAQ

Form of spousal consent to be used to enforce transfer and voting restrictions contained in a shareholders' agreement, voting agreement, operating agreement, or similar document against the spouse or domestic partner of a shareholder or member in California.

Related Definitions Spousal Waiver Form means that form established by the Plan Administrator, in its sole discretion, for use by a spouse to consent to the designation of another person as the Beneficiary or Beneficiaries under a Participant's Account.

Qualified Joint and Survivor Annuity If your spouse consents to change the way the Plan's retirement benefits are paid, your spouse gives up his or her right to the QJSA payments. This is referred to as a waiver of the QJSA payment form.

A married participant is required to obtain written spousal consent if she chooses to name a primary beneficiary other than her spouse. This rule is in effect for all qualified retirement plans, regardless of whether they are subject to the REA or designed as an REA safe harbor plan.

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.

If you are married and your spouse is not named as your sole primary beneficiary, spousal consent is required in the following states of residence, which are community property states: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas and Washington.

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.

Under federal law, spousal consent is not necessary to name an IRA beneficiary. However, spouses have rights under state law. For example, if you live in a community or marital property state, spousal consent is generally required to name someone other than the spouse as the beneficiary of an IRA.

Form 4 is used when the spouse of a member/former member of a pension plan agrees to waive or give up his or her right to receive survivor's benefits to permit the member/former member to designate a beneficiary other than the spouse for benefits in 2022 a pension plan, if pension payments have not started, 2022 a locked-in

Form of spousal consent to be used to enforce transfer and voting restrictions contained in a shareholders' agreement, voting agreement, operating agreement, or similar document against the spouse or domestic partner of a shareholder or member in California.