Guam Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

How to fill out Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s easy and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have located the form you need, click on the Get now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Guam Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and then click the Download button to locate the Guam Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

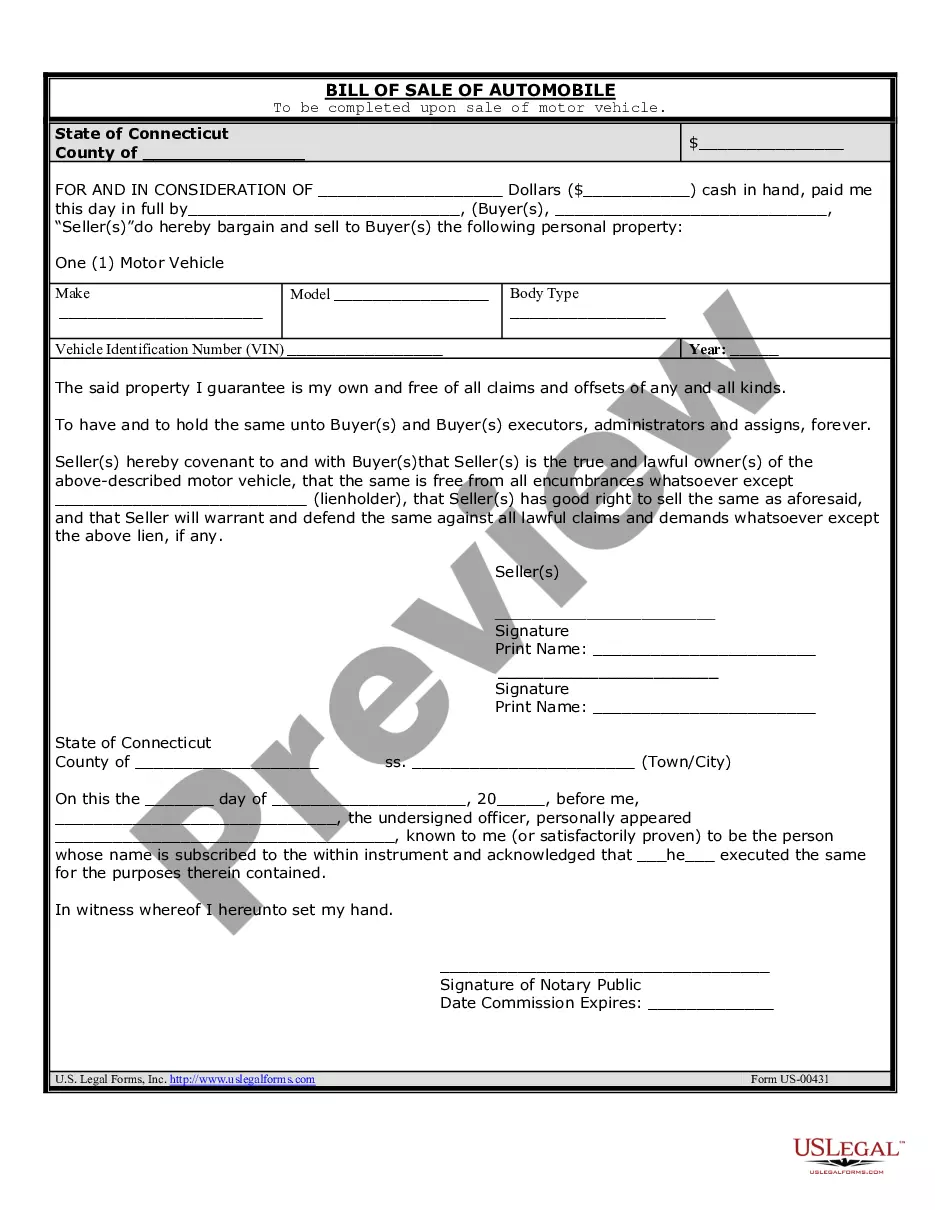

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to locate alternative versions of the legal document template.

Form popularity

FAQ

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

A qualified joint and survivor annuity (QJSA) provides a lifetime payment to an annuitant and spouse, child, or dependent from a qualified plan. QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

Spousal Waiver Form means that form established by the Plan Administrator, in its sole discretion, for use by a spouse to consent to the designation of another person as the Beneficiary or Beneficiaries under a Participant's Account.

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

A qualified pre-retirement survivor annuity (QPSA) is a death benefit that is paid to the surviving spouse of a deceased employee.