Guam Demand for Payment of Account by Business to Debtor

Description

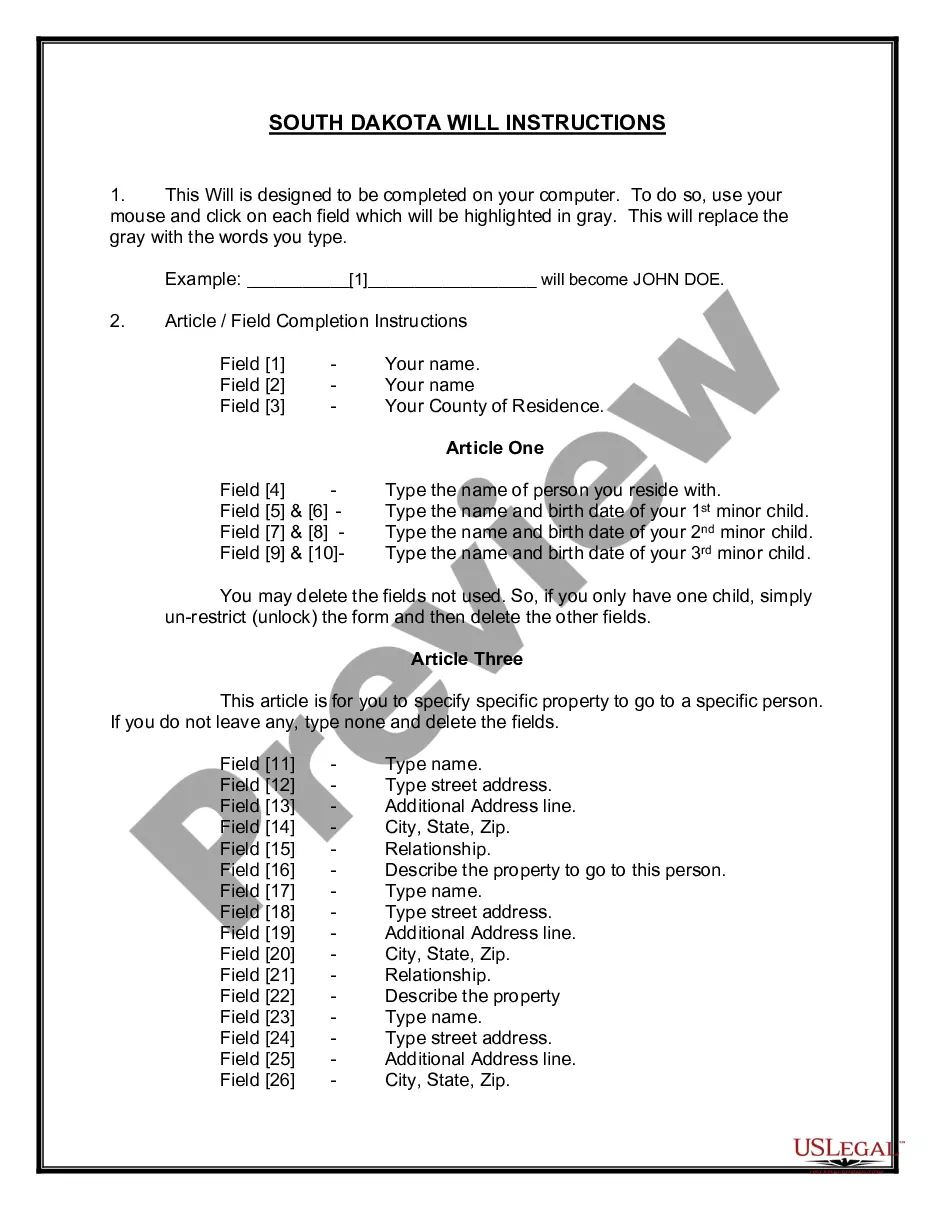

How to fill out Demand For Payment Of Account By Business To Debtor?

Finding the appropriate legal document template can be challenging. Obviously, there is a multitude of templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers numerous templates, including the Guam Demand for Payment of Account by Business to Debtor, suitable for both business and personal purposes. All templates are reviewed by experts to meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to obtain the Guam Demand for Payment of Account by Business to Debtor. Use your account to search through the legal forms you have previously purchased. Go to the My documents tab of your account and download another copy of the document you require.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded Guam Demand for Payment of Account by Business to Debtor. US Legal Forms is the largest library of legal forms where you can find various document templates. Use this service to obtain professionally crafted documents that comply with state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the right form.

- Once you are confident the form is correct, choose the Acquire now button to obtain the form.

- Select the pricing plan you need and input the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Of course, that isn't without risk: if a borrower fails to make required payments, the lender can foreclose on the borrower's home. Unsecured loans can curtail extra expenses. If you take out a home or car loan, the lender will require that you carry insurance on the asset.

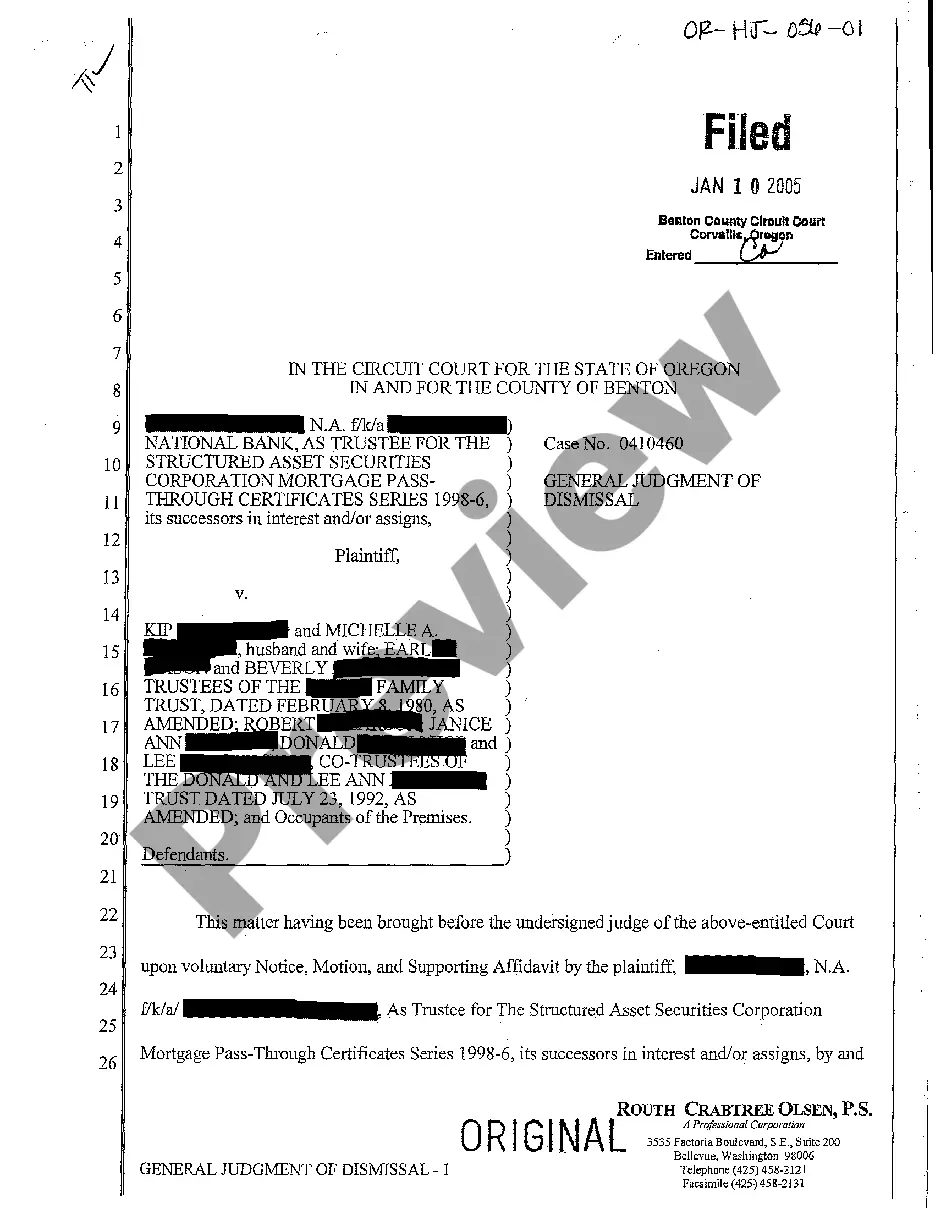

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

In the credit card industry, any account past due is a delinquent account. But many creditors won't report an account as delinquent to credit bureaus until at least 30 days after the missed due date.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

Get Your Free TemplatesBe Flexible With Payment Type.Provide a Discount for Early Payment.Put Penalties in Your Contract.Don't Waiver on Payment Terms.Make Polite Contact.Keep a Good Rapport With Clients.Outsource to a Debt Collector Quickly.

If a borrower fails to make timely payments, the loan could go into default and the asset used to secure it would then be in jeopardy. Similarly, a company unable to make required coupon payments on its bonds would be in default. Defaults can also occur on unsecured debt such as credit card balances.

Try the following seven tips for getting what's owed you.Be mentally prepared.Follow up.Start by sending a reminder letter.Next, make a phone call.Don't threaten the client or get angry.Take legal action.Consider taking your customer to court or hiring a collection agency.

Technically, a consumer becomes delinquent after missing a single monthly payment. However, delinquency is not generally reported to the major credit bureaus until two consecutive payments have been missed.