Guam Indemnification of Surety on Contractor's Bond by Subcontractor

Description

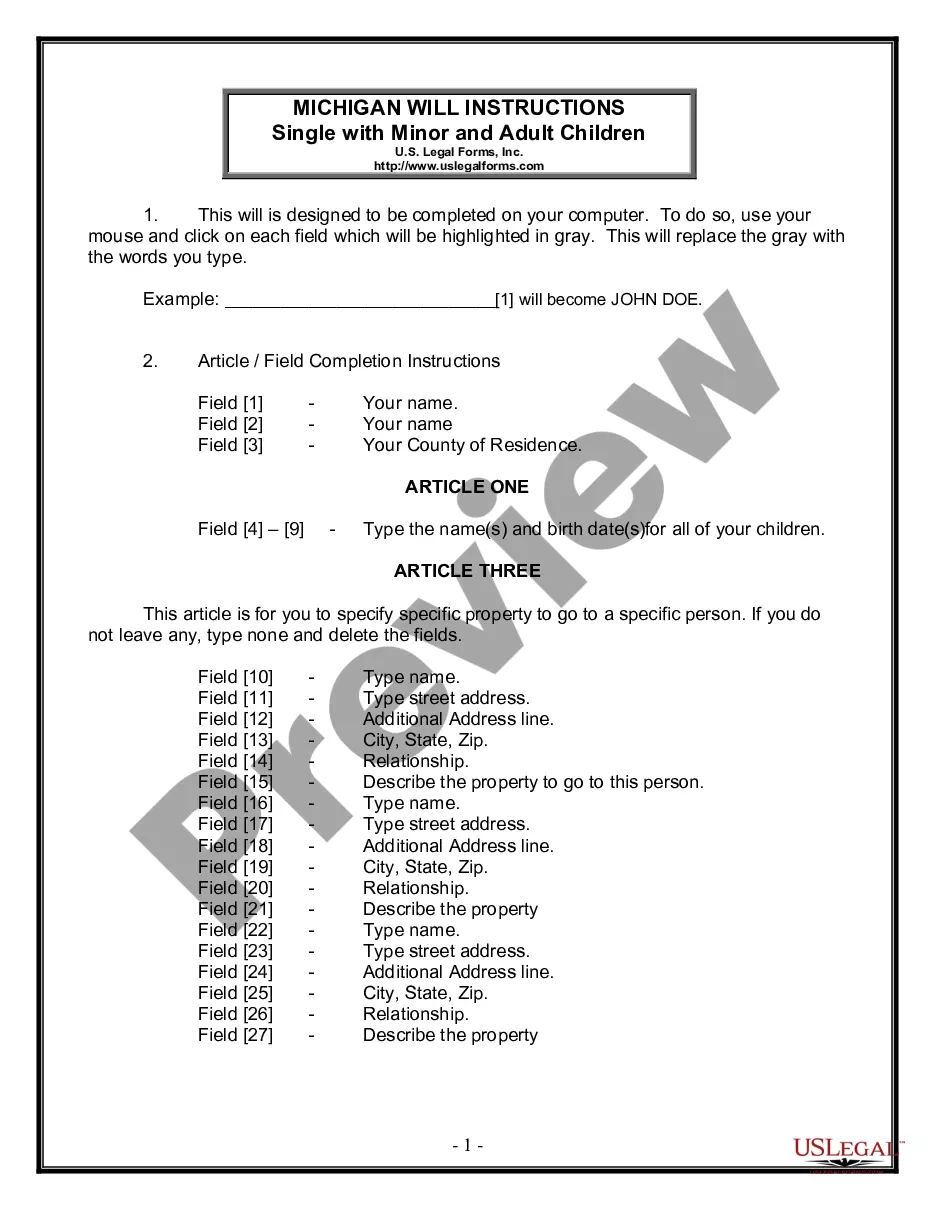

How to fill out Indemnification Of Surety On Contractor's Bond By Subcontractor?

Have you been in the position in which you require paperwork for both organization or specific uses virtually every day? There are tons of authorized document templates accessible on the Internet, but locating ones you can rely on isn`t effortless. US Legal Forms delivers 1000s of form templates, like the Guam Indemnification of Surety on Contractor's Bond by Subcontractor, that happen to be composed to fulfill state and federal requirements.

When you are already informed about US Legal Forms internet site and possess your account, basically log in. After that, you may down load the Guam Indemnification of Surety on Contractor's Bond by Subcontractor format.

Should you not offer an profile and need to begin to use US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is to the correct metropolis/region.

- Use the Review button to analyze the form.

- See the information to ensure that you have selected the appropriate form.

- When the form isn`t what you are searching for, use the Lookup discipline to discover the form that meets your needs and requirements.

- Whenever you discover the correct form, click on Get now.

- Pick the pricing plan you would like, fill out the desired information to create your account, and pay money for the transaction utilizing your PayPal or credit card.

- Decide on a hassle-free document formatting and down load your copy.

Locate every one of the document templates you possess bought in the My Forms menus. You can obtain a additional copy of Guam Indemnification of Surety on Contractor's Bond by Subcontractor anytime, if possible. Just click the necessary form to down load or printing the document format.

Use US Legal Forms, by far the most substantial assortment of authorized varieties, in order to save time and avoid mistakes. The assistance delivers professionally manufactured authorized document templates that you can use for a selection of uses. Generate your account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

A General Indemnity Agreement, also called a GIA, is a signed contract between the surety company, the obligee, and the principal that outlines an agreement between the three parties. These protect the surety from loss and expenses following any claims against the bonds.

What is an indemnity agreement for surety? Generally speaking, the indemnity provision in the agreement grants the surety the broad legal right to recover from the indemnitor whatever it pays on the principal's behalf under the related bonds, as well as those amounts for which it remains liable.

What is an indemnity agreement for surety? Generally speaking, the indemnity provision in the agreement grants the surety the broad legal right to recover from the indemnitor whatever it pays on the principal's behalf under the related bonds, as well as those amounts for which it remains liable.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

An indemnity bond is a specific type of surety bond that's often used in situations where someone is borrowing money. However, you might also be required to purchase an indemnity bond if you lose a cashier's check and need to get a replacement from the bank.

A general agreement of indemnity, or GIA, is a contract between the surety company and the contractor and the other indemnitors. The GIA obligates the named indemnitors to protect the surety company from any loss or expense that the surety sustains as a result of having issued bonds on behalf of the bond principal.

A general indemnity clause is a hold harmless agreement that refers exclusively to fault or negligence of the indemnitor, without explicitly mentioning how it will respond with respect to fault of the indemnitee.

Indemnity is the backbone of many surety bonds. In short, indemnity compels a party to compensate another party. Regarding a surety bond, this means that the obligee has the legal right to collect from the surety if the principal of the bond fails to uphold their end of the bond.

In every contract of guarantee there is an implied promise by the principal debtor to indemnify the surety, and the surety is entitled to recover from the principal debtor whatever sum he has rightfully paid under the guarantee, but, no sums which he has paid wrongfully.

An indemnity bond is a surety bond that creates a financial contract between two parties. Indemnity bonds are designed to ensure that if one party doesn't uphold their obligations, the other party can seek a remedy. In a sense, an indemnity bond is similar to an insurance policy.