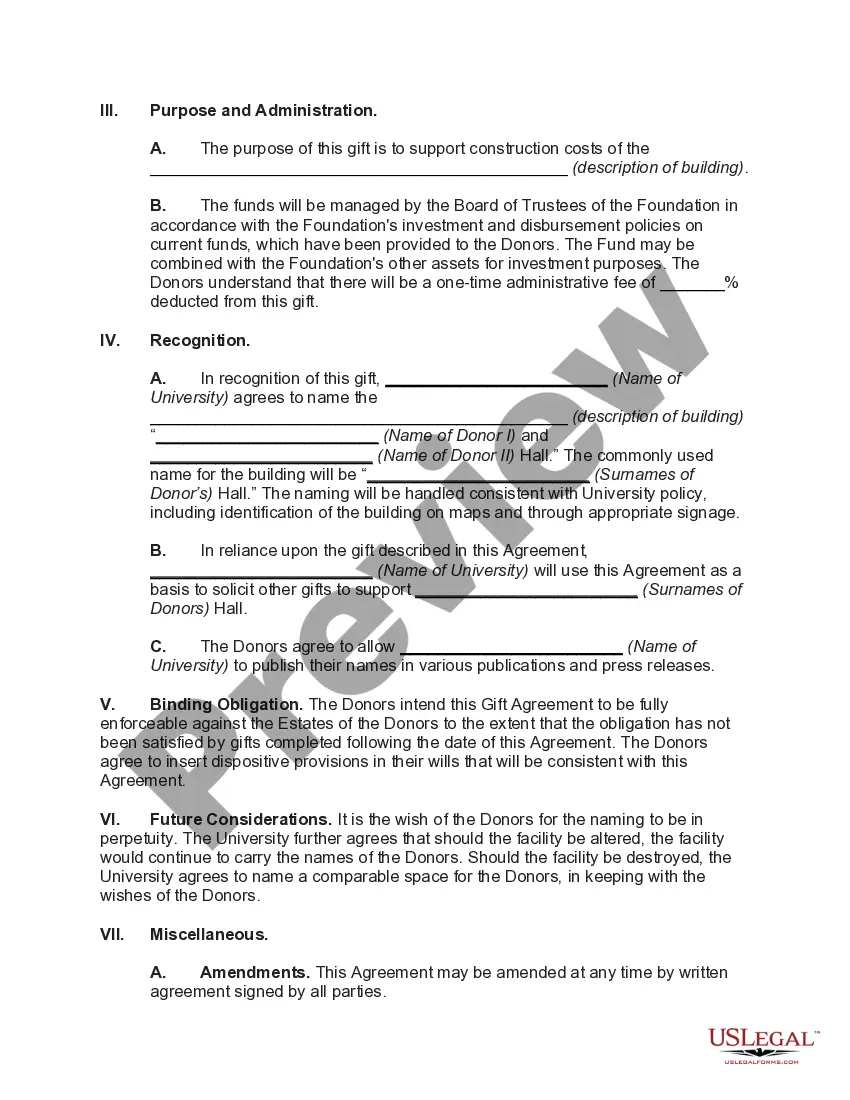

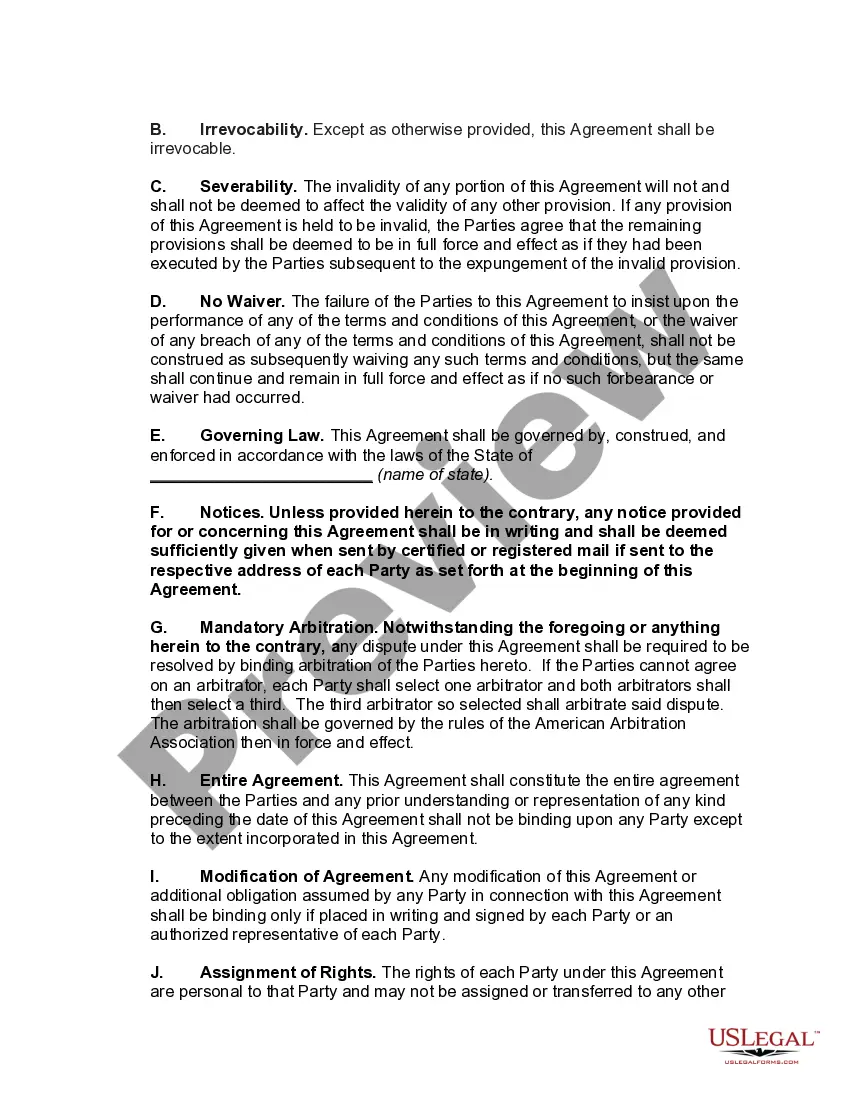

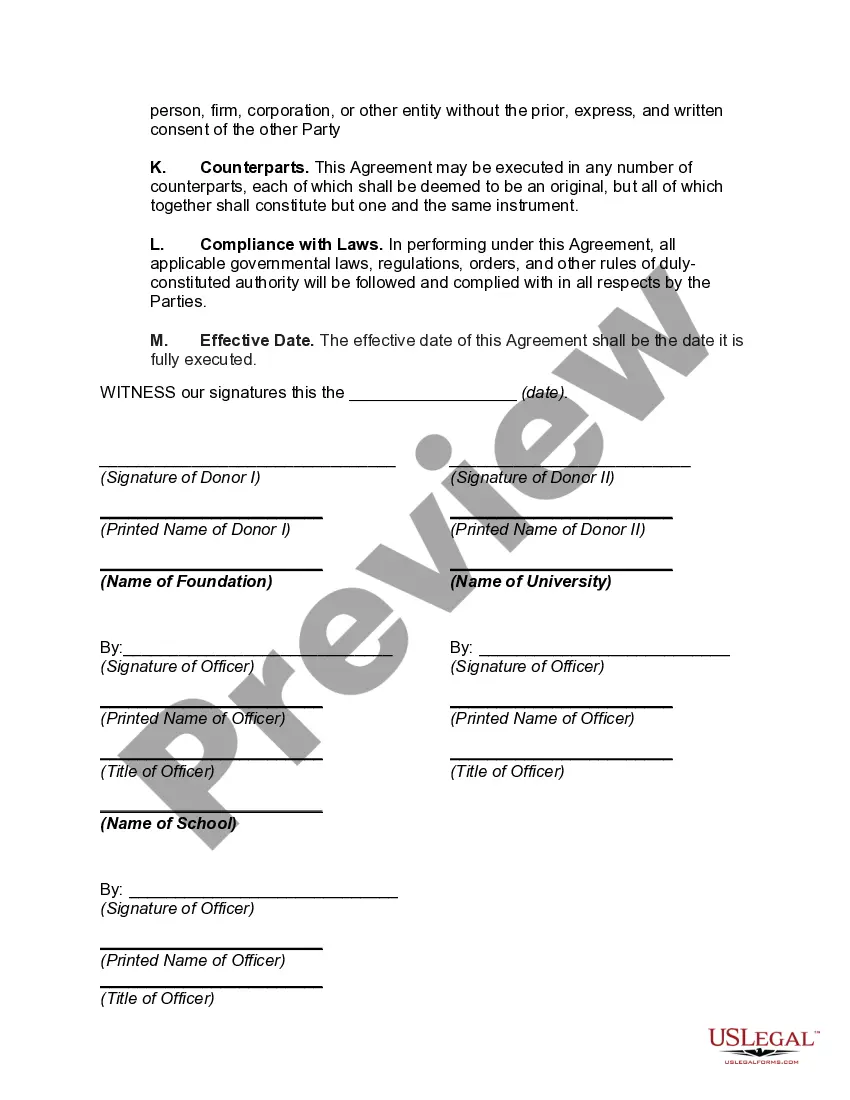

Guam Gift Agreement Between Donors and University Foundation with Purpose of Gift to Construct Building to be Named after Donors

Description

How to fill out Gift Agreement Between Donors And University Foundation With Purpose Of Gift To Construct Building To Be Named After Donors?

If you intend to accumulate, acquire, or produce legal document forms, utilize US Legal Forms, the most extensive selection of legal documents available online.

Leverage the site's straightforward and convenient search to discover the documents you require.

Various templates for corporate and personal purposes are classified by categories and claims, or keywords.

Step 4. Once you have found the document you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment. You may use your Visa, Mastercard, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Guam Gift Agreement Between Donors and University Foundation with the Objective of Donation to Build a Facility to be Named after Donors in merely a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to obtain the Guam Gift Agreement Between Donors and University Foundation with the Objective of Donation to Build a Facility to be Named after Donors.

- You can also access documents you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your correct city/region.

- Step 2. Use the Preview feature to review the content of the form. Don't forget to read the description.

- Step 3. If you're dissatisfied with the document, utilize the Search field at the top of the screen to find alternative versions of your legal document design.

Form popularity

FAQ

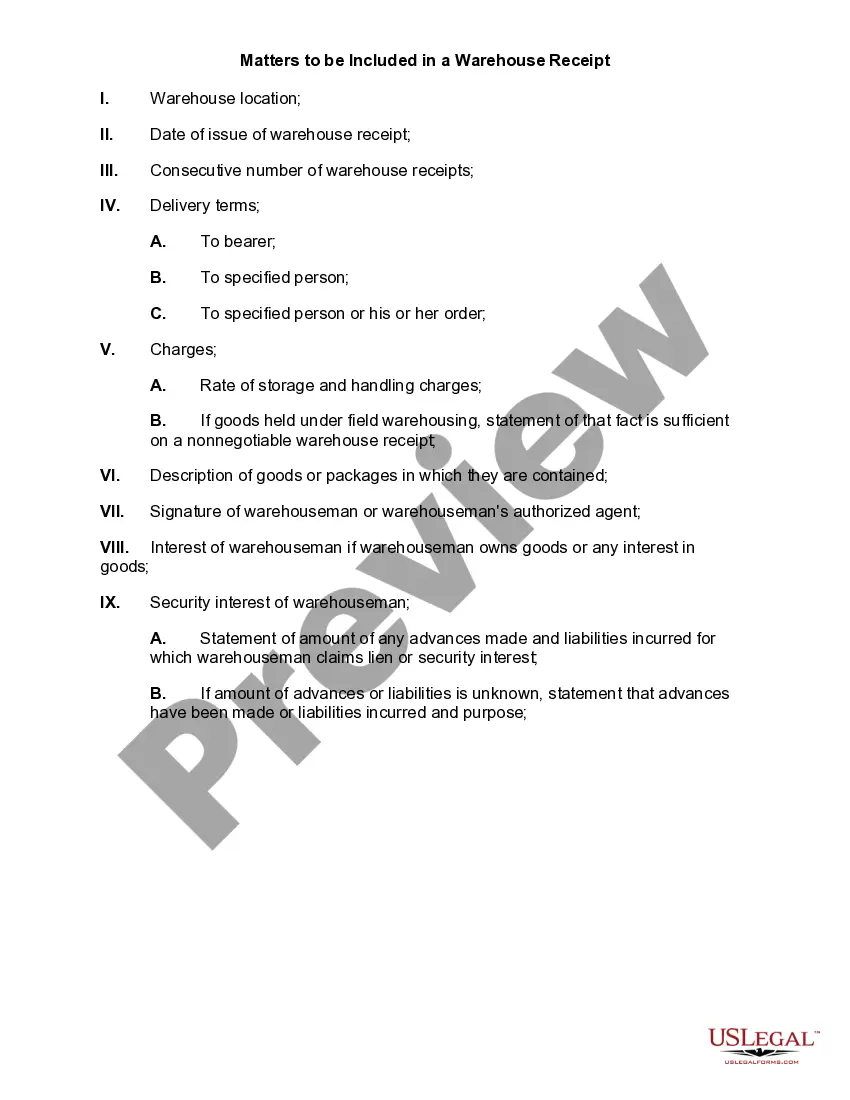

Some nonprofits offer their donors a premium (a small gift) when they make a contribution at a certain level or become members of the organization. Offering your donors a gift has several benefits.

Planned giving is also referred to as gift planning or legacy giving. In a nutshell, it is a donor's intention to contribute a major gift to an organization, beyond their lifetime. So, unlike an annual gift (an outright gift made for current use), a planned gift is for the future.

Non-Cash Donations Generally speaking, to acknowledge the receipt of a gift with an estimated value of $250 or more, the charity should provide at a minimum: A description of non-cash property transferred to the charity. The charity should not attempt to value the property; that is donor's responsibility.

A gift comes into effect during the lifetime of the donor unlike the will that takes effect after the death of the testator. The person giving the gift is called the donor and the person receiving the gift is the donee. Gift deeds are irrevocable and can be revoked only by the donee.

Nonprofits often look for ways to reward their volunteers for their services. There is no tax problem when a volunteer is given rewards of nominal value such as free food and drink at a thank-you party or a certificate of appreciation. However, more substantial rewards could result in taxable income to the volunteers.

In order to constitute a valid gift, the pivotal requirement is acceptance thereof. No particular mode of acceptance is required and the circumstances throw light on that aspect. A transaction of gift in order to be complete must be accepted by the donee during the lifetime of the donor.

The person gifting his/her property is called the donor, and the person accepting the gift is the donee. The donor must voluntarily gift the property to the donee without considering the gift to be valid under the Act.

Gift is a transfer of property that has been gratuitously given to any person without any consideration. This condition is an exception to Section 25 of the Indian Contract Act, 1872. Under that section it states that any contract or agreement entered into without any consideration is considered to be void.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

As nouns the difference between donation and gift is that donation is a voluntary gift or contribution for a specific cause while gift is something given to another voluntarily, without charge.