Guam Sample Environmental Indemnity Agreement

Description

How to fill out Sample Environmental Indemnity Agreement?

Are you now in a condition where you need documents for both organizational or personal reasons almost all the time.

There are numerous legitimate file templates accessible on the web, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, such as the Guam Sample Environmental Indemnity Agreement, which can be tailored to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive repository of legal forms, to save time and eliminate mistakes.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Guam Sample Environmental Indemnity Agreement template.

- If you don't have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct state/region.

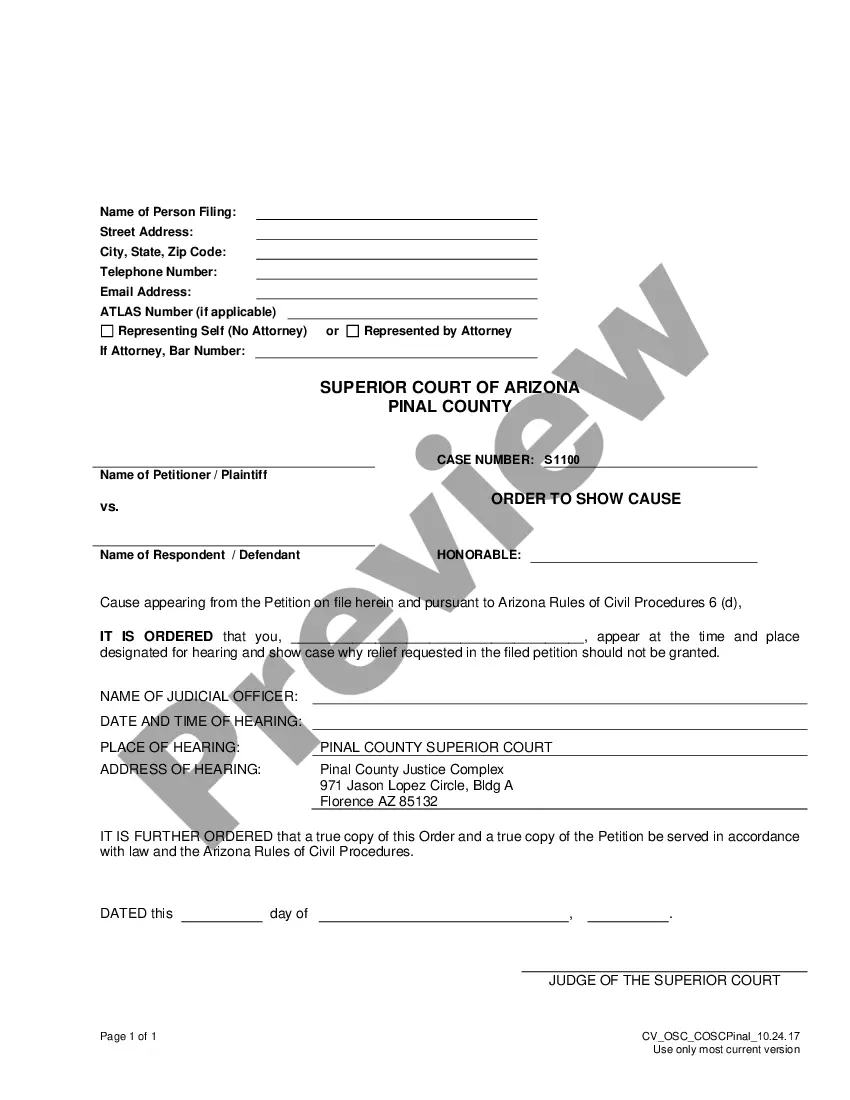

- Utilize the Preview button to check the form.

- Examine the details to confirm that you have selected the right form.

- If the form isn’t what you are seeking, use the Search box to locate the form that fulfills your needs and criteria.

- Once you find the appropriate form, simply click Get now.

- Select the pricing plan you want, enter the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Find all the file templates you have purchased in the My documents menu. You can obtain an additional copy of Guam Sample Environmental Indemnity Agreement at any time if needed. Just click the necessary form to download or print the document template.

Form popularity

FAQ

Title the letter as a "Letter of Indemnity" to make it clear what the document is about. Include a statement that the agreement will be governed by the laws of the specific state (where the agreement would be taken to court). Begin the letter confirming the contract already in place with the other party.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Definition: Indemnity means making compensation payments to one party by the other for the loss occurred. Description: Indemnity is based on a mutual contract between two parties (one insured and the other insurer) where one promises the other to compensate for the loss against payment of premiums.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

In a mutual indemnification, both parties agree to compensate the other party for losses arising out of the agreement to the extent those losses are caused by the indemnifying party's breach of the contract. In a one-way indemnification, only one party provides this indemnity in favor of the other party.