Guam Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

Are you presently in a circumstance where you require documents for either business or personal reasons almost all the time.

There are numerous authentic form templates available on the internet, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Guam Indemnification Agreement for a Trust, which can be filled out to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Guam Indemnification Agreement for a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

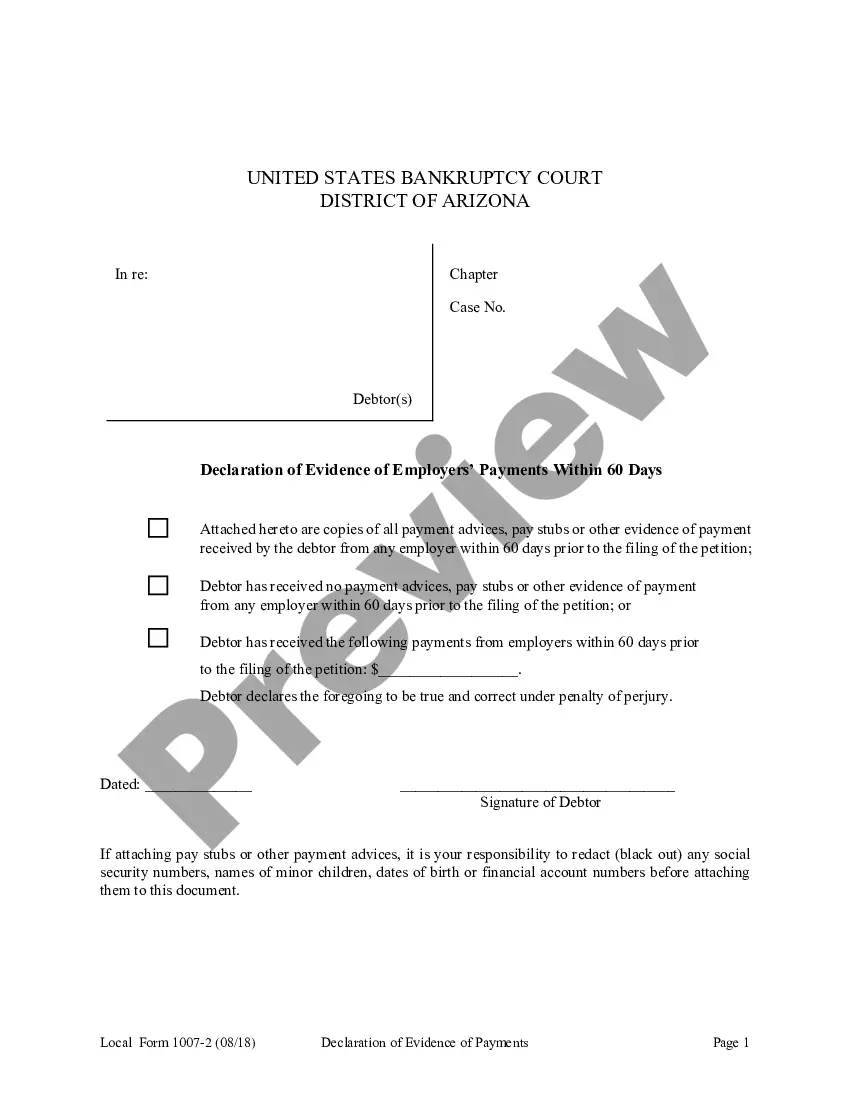

- Utilize the Preview option to review the form.

- Check the details to confirm that you have selected the right form.

- If the form is not what you're looking for, take advantage of the Search field to find the form that suits your needs and requirements.

- Once you find the suitable form, click on Purchase now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the form templates you have purchased in the My documents list.

- You can obtain another copy of the Guam Indemnification Agreement for a Trust at any time, if needed. Just click on the desired form to download or print the document template.

Form popularity

FAQ

Yes, there are several strategies to avoid probate. Establishing a revocable living trust is one effective method, as assets in the trust pass directly to beneficiaries outside of probate. Additionally, creating a Guam Indemnification Agreement for a Trust can facilitate this process by clearly defining asset transfer protocols. Exploring these options can help you streamline the distribution of your estate.

To indemnify means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

An agreement to compensate for a loss or damage incurred by an individual or business.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.