Guam Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

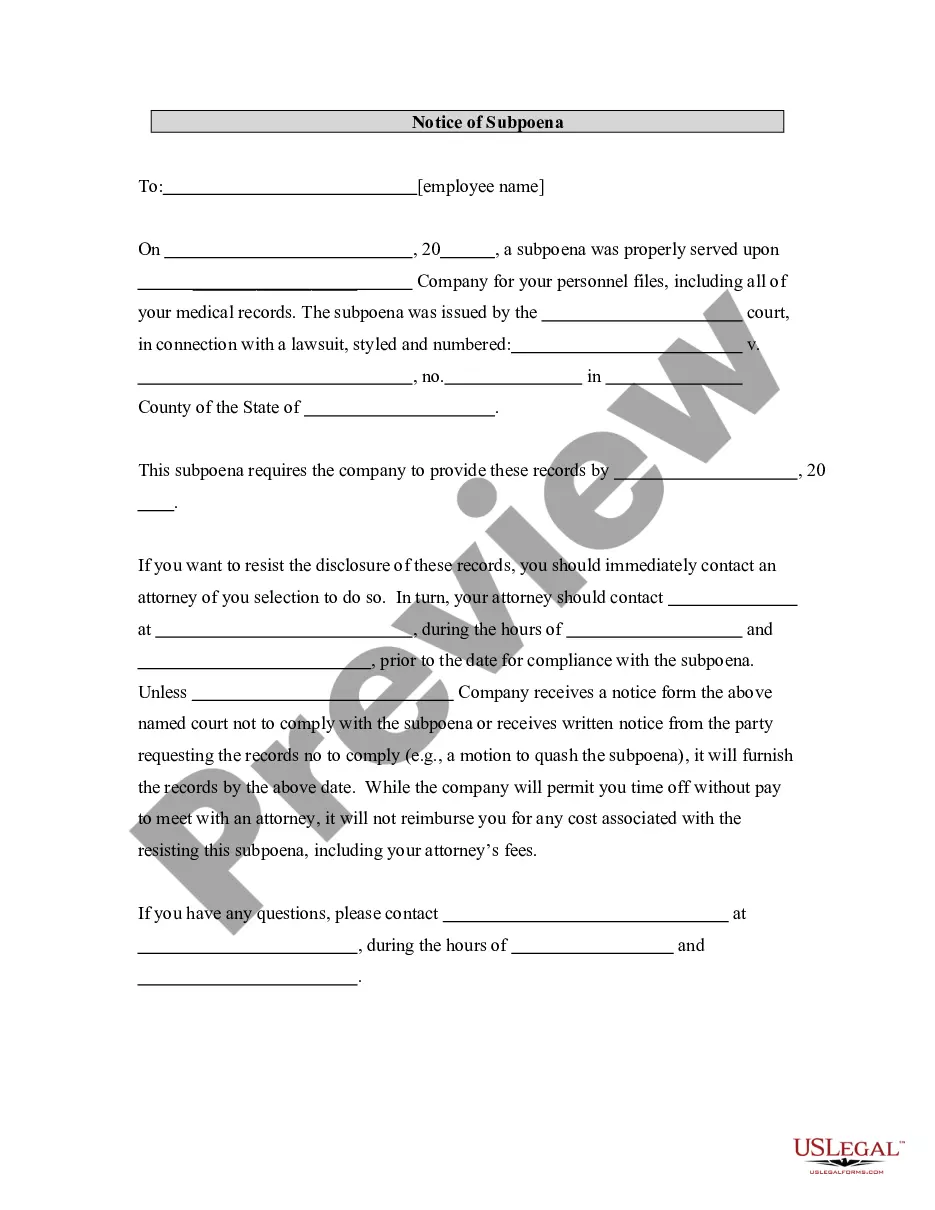

Finding the correct valid document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how can you obtain the valid form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Guam Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which can be used for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to acquire the Guam Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. Use your account to view the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the documents you require.

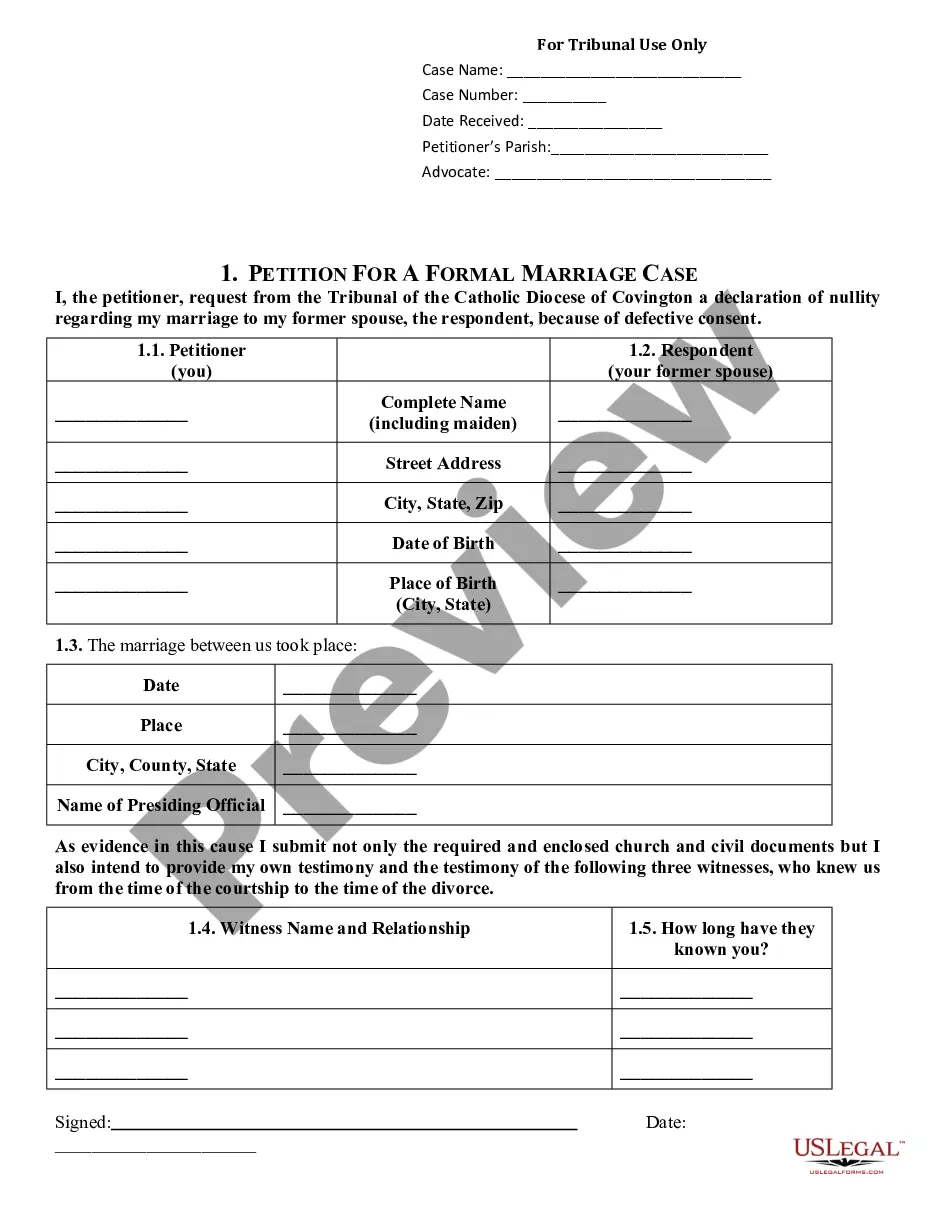

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality/state. You can preview the document using the Preview button and review the document details to ensure it fits your needs. If the form does not meet your requirements, utilize the Search feature to find the appropriate form. Once you are sure the form is suitable, click the Get now button to retrieve the form. Choose the payment plan you prefer and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, edit, print, and sign the completed Guam Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Use this service to download expertly created papers that adhere to state regulations.

- Check the selected template for accuracy.

- Preview the form details to confirm suitability.

- Utilize the search function for alternative options.

- Proceed with downloading once confirmed appropriate.

- Select your preferred payment option.

- Download the template in your desired format.

Form popularity

FAQ

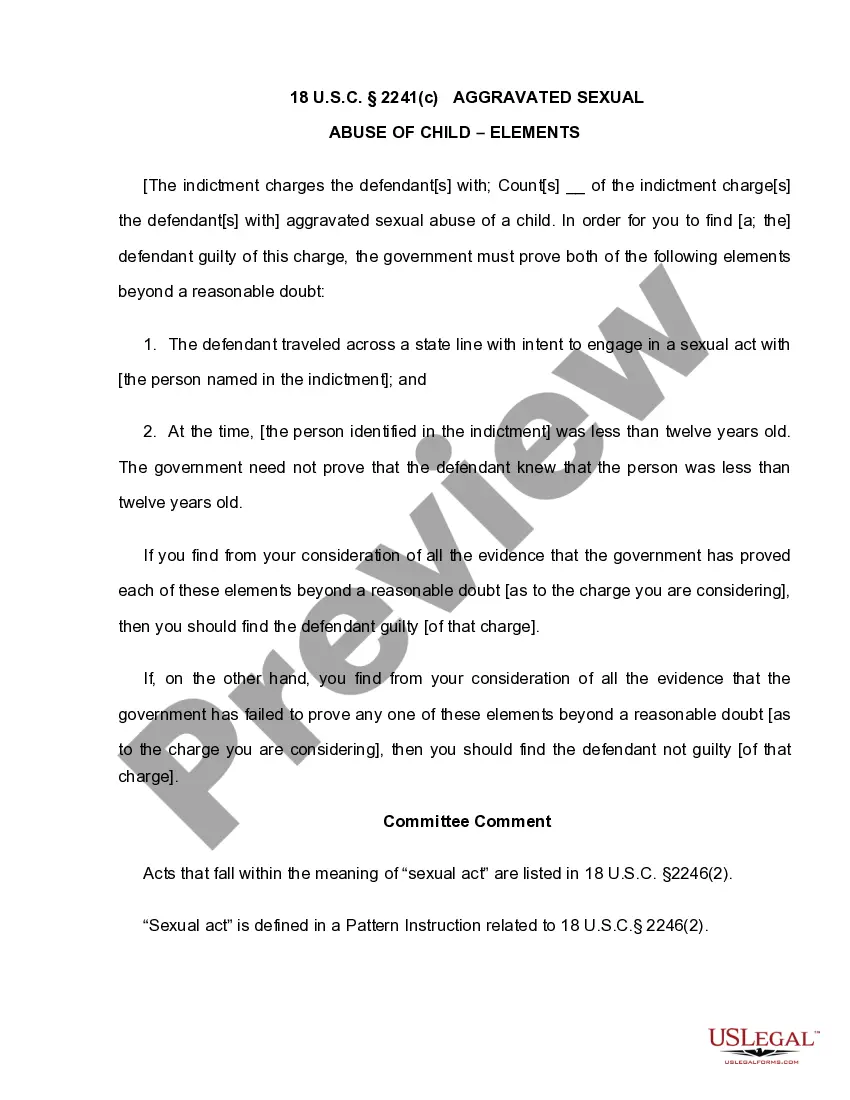

Yes, a Guam Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time can be subject to the 5-year rule concerning Medicaid eligibility. This rule affects how assets are treated regarding eligibility for public assistance. Understanding this rule is crucial, so consult with a financial or legal professional for tailored advice.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

The trustee of an irrevocable trust must complete and file Form 1041 to report trust income, as long as the trust earned more than $600 during the tax year. Irrevocable trusts are taxed on income in much the same way as individuals.

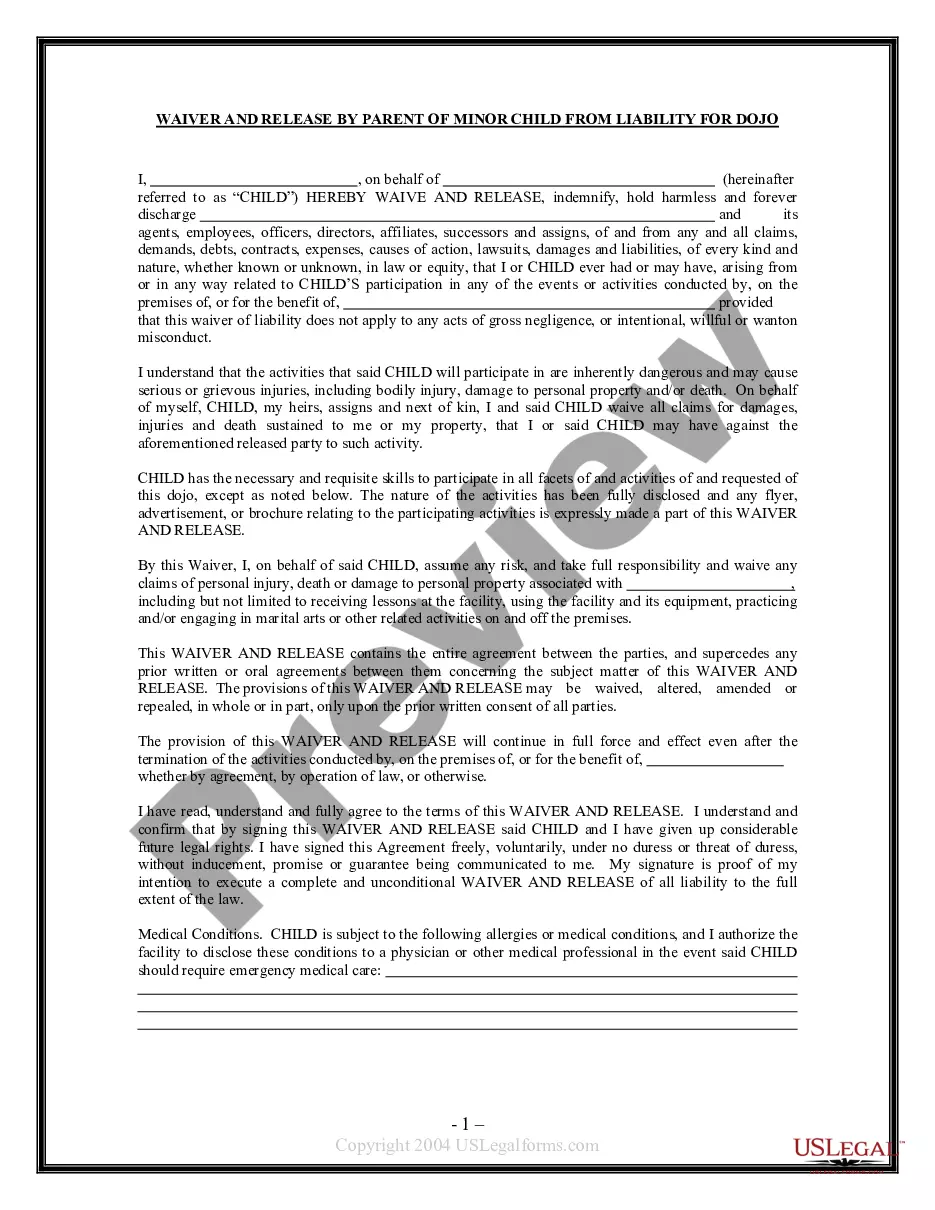

Irrevocable trusts can be used to protect assets, reduce estate taxes, get government benefits and access government benefits.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

Distributing assets from an irrevocable trust requires that the assets first be part of the trust's corpus. Tax laws allow trusts to recover the after-tax money locked up in the corpus as tax-free return of principal. Trusts pass this benefit along to their beneficiaries in the form of tax-free distributions.

Can a beneficiary withdraw money from an irrevocable trust? The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.