Guam Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Have you ever found yourself in a circumstance where you require documents for both business and personal purposes nearly every workday.

There are numerous legal document templates accessible online, but finding ones that you can trust is challenging.

US Legal Forms offers thousands of document templates, such as the Guam Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, which are designed to fulfill state and federal regulations.

Choose the pricing plan you desire, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Select a suitable file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can acquire the Guam Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

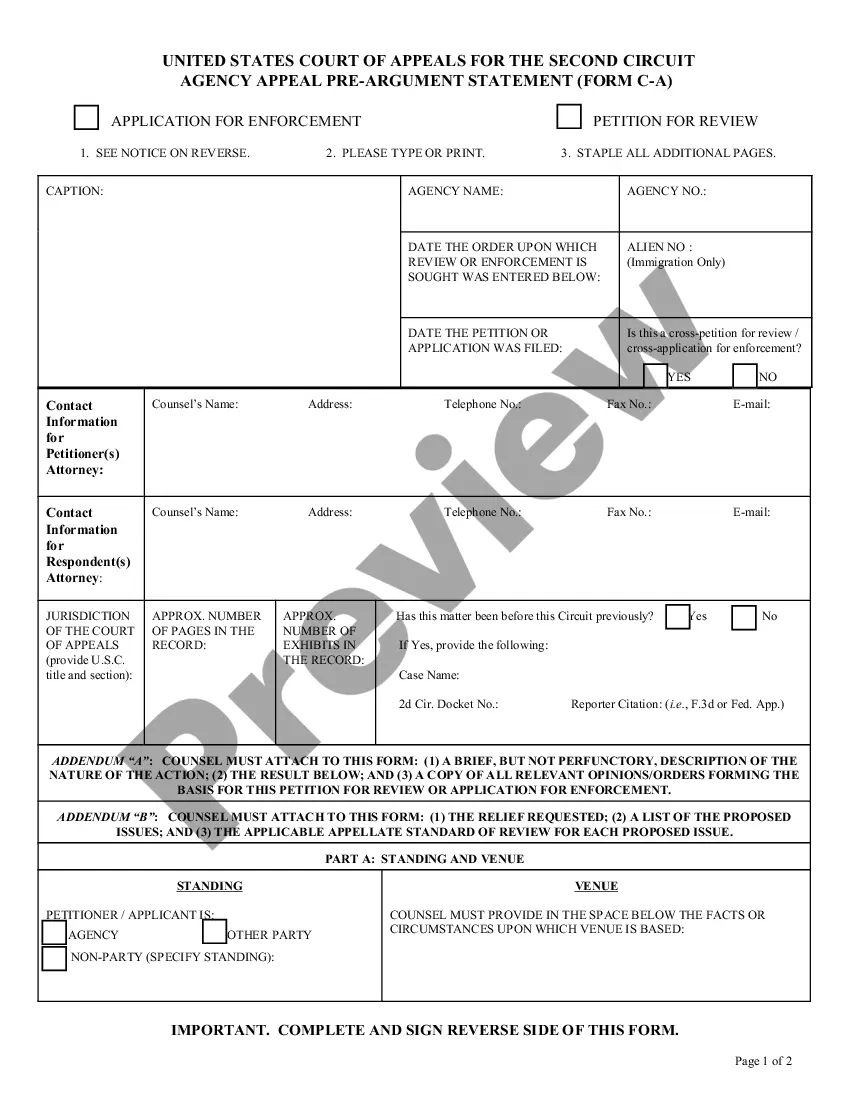

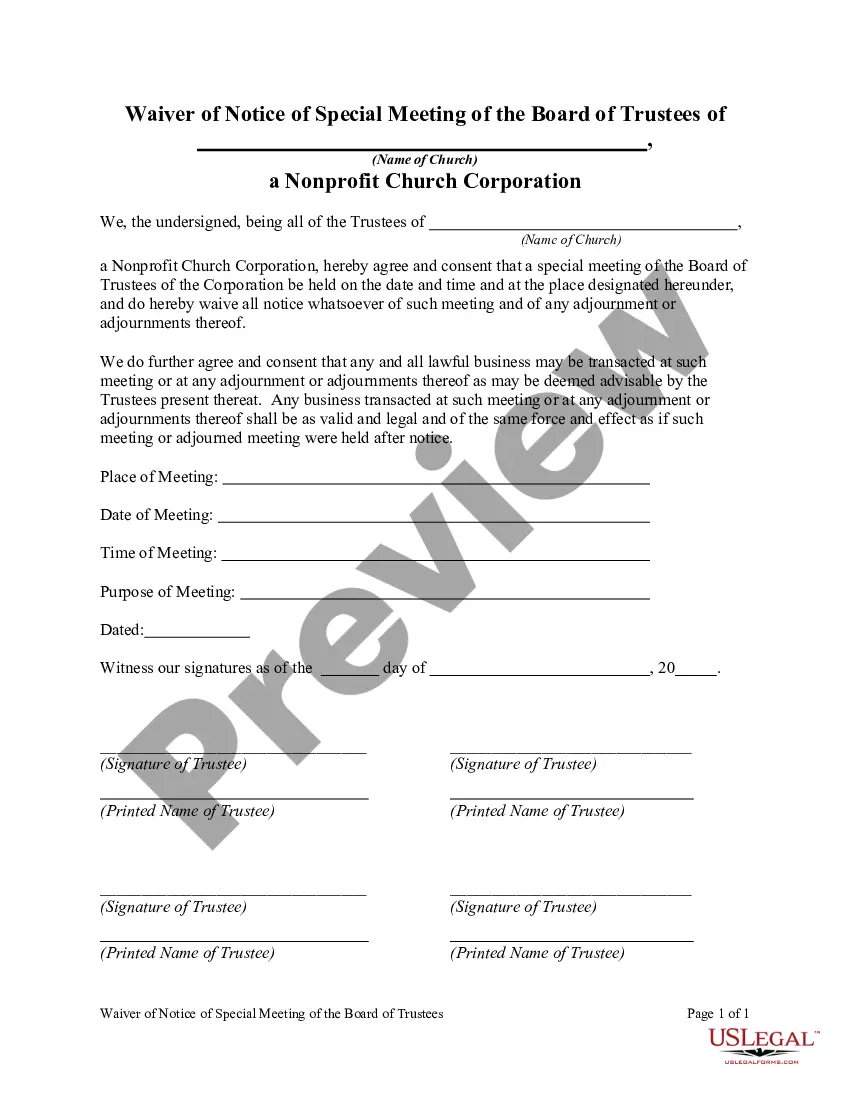

- Select the document you require and ensure it is for the correct city/state.

- Use the Preview feature to review the document.

- Read the description to ensure you have selected the right template.

- If the template is not what you are searching for, utilize the Search section to find the document that meets your needs.

- When you find the appropriate template, click Get now.

Form popularity

FAQ

The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing.

In each case, when the income interest of a CRT terminates, usually due to the death of the income beneficiary or the passage of a stated term of years, the remainder interest passes to one or more qualifying charities.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years. These income payments are calculated annually using a set percentage rate and the value of the trust's assets.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

A Charitable Remainder Trust (CRT) is a gift of cash or other property to an irrevocable trust. The donor receives an income stream from the trust for a term of years or for life and the named charity receives the remaining trust assets at the end of the trust term.

How long can the CRT last? A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

A charitable lead trust (CLT) is like the reverse of a charitable remainder trust. This type of trust disperses income to a named charity, while the noncharitable beneficiaries receive the remainder of the donated assets upon your death or at the end of a specific term, similar to a CRT.