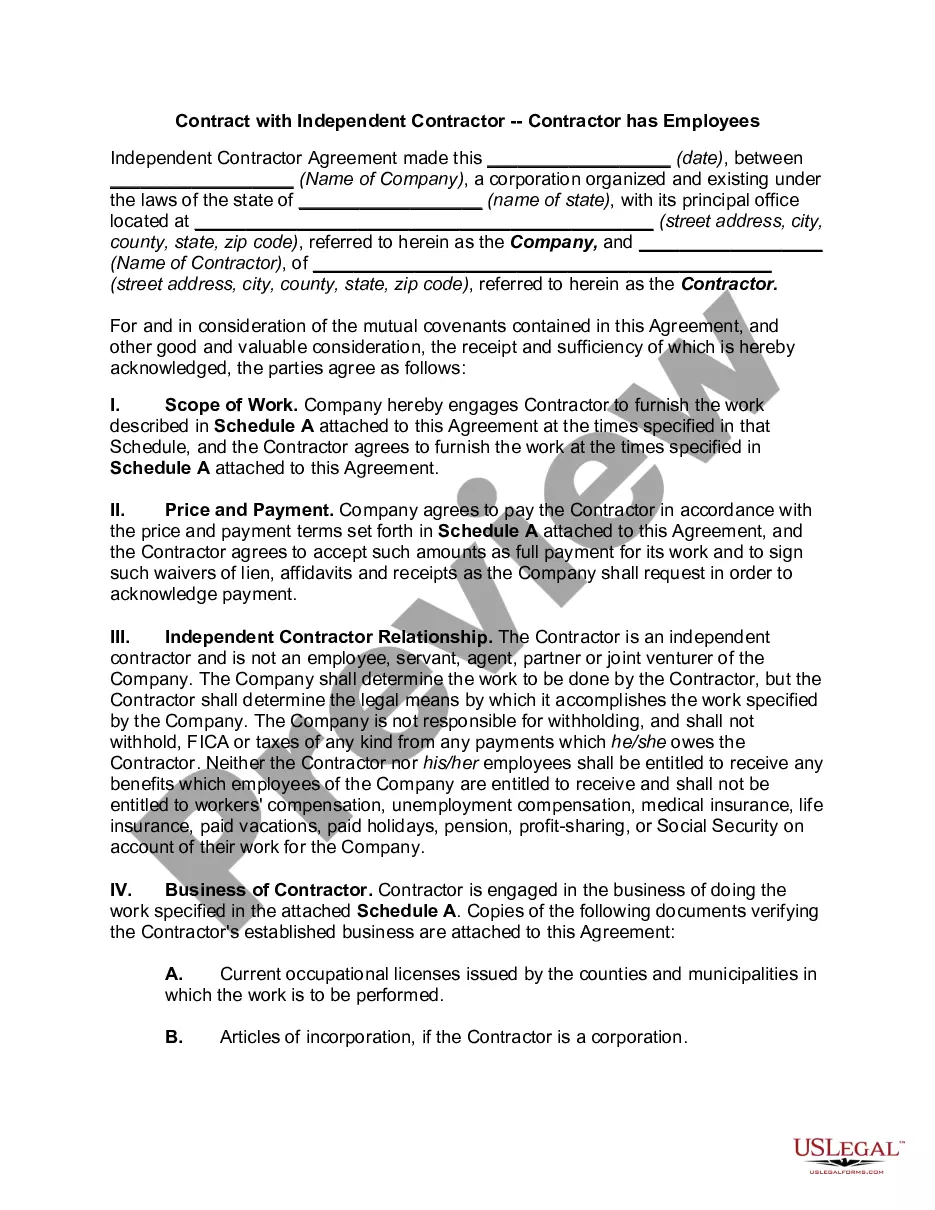

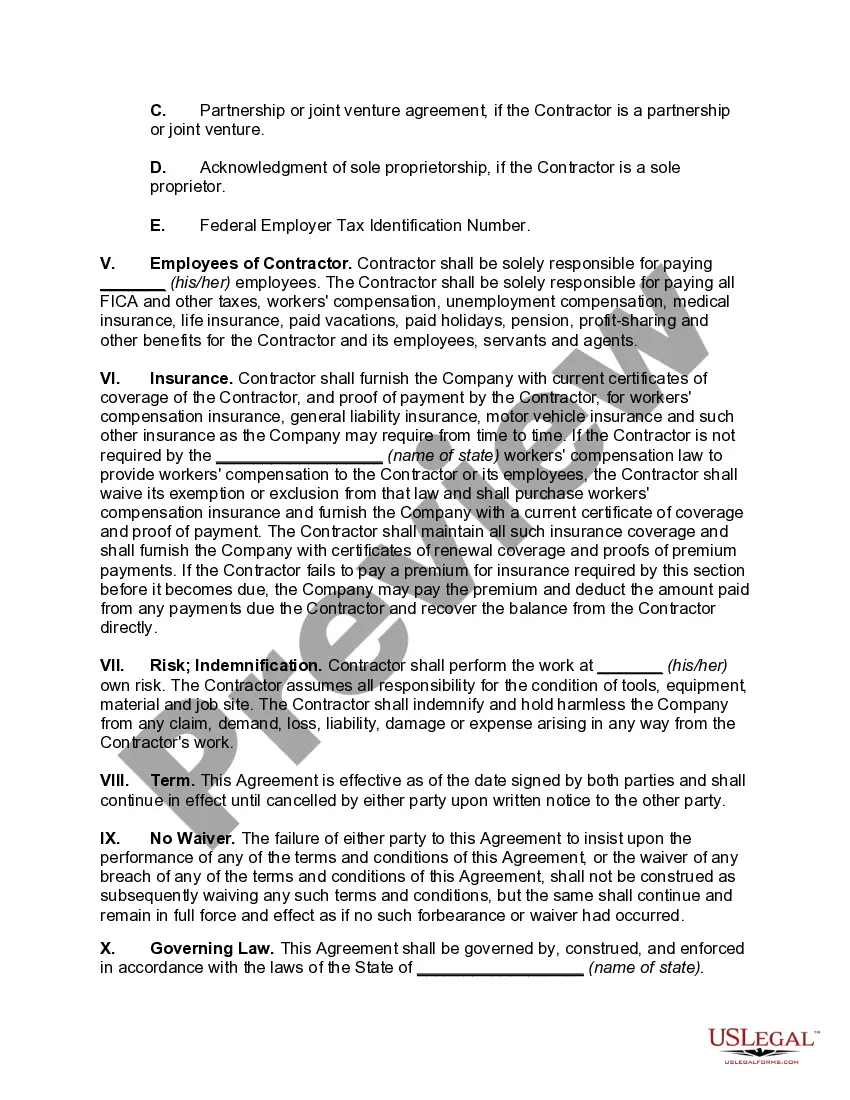

Guam Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Have you found yourself in a scenario where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Guam Contract with Independent Contractor - Contractor has Employees, which are designed to meet federal and state requirements.

Once you find the right template, click on Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Guam Contract with Independent Contractor - Contractor has Employees template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it matches the correct city/area.

- Utilize the Review option to scrutinize the form.

- Check the description to make sure you have chosen the correct template.

- If the form isn’t what you are looking for, use the Search field to find a form that fits your needs.

Form popularity

FAQ

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.