Guam Underbrush Removal Contract

Description

** THIS IS NOT AN UNDERBRUSH REMOVAL CONTRACT. **

How to fill out Underbrush Removal Contract?

You are capable of allocating several hours online searching for the legal document format that satisfies the federal and state requirements you need.

US Legal Forms offers a vast collection of legal templates that are assessed by professionals.

It is easy to download or print the Guam Underbrush Removal Contract from the service.

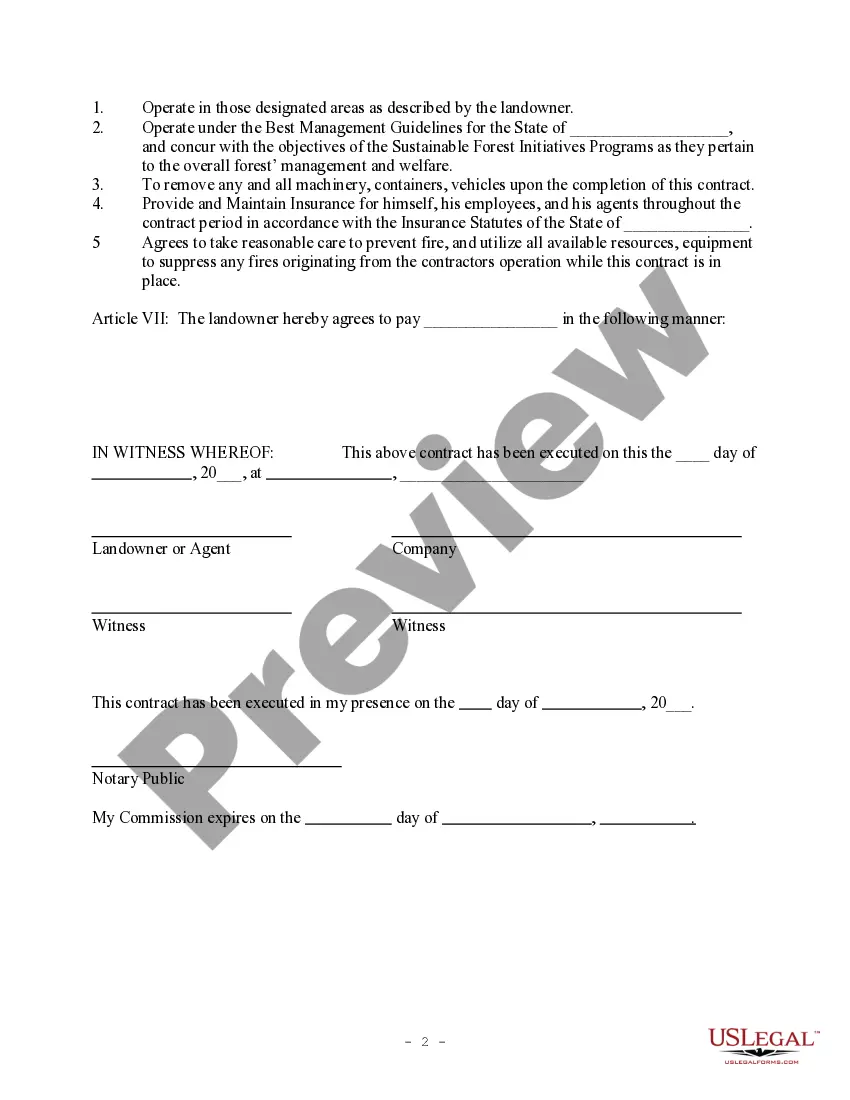

If available, use the Review button to browse the document format as well. If you want to find another version of the form, use the Search field to locate the format that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Guam Underbrush Removal Contract.

- Every legal document you purchase is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document format for the state/city you choose.

- Review the form description to make sure you have chosen the correct document.

Form popularity

FAQ

Guam is not classified as a tax haven, but it has unique tax incentives for businesses and residents. The territory offers favorable tax rates on certain types of income, which may attract investments, especially for contractors engaging in services like Guam Underbrush Removal Contracts. However, it is important to consult a tax professional to understand how Guam's tax structure applies to your specific situation and projects.

Contractor tax in Guam is based on the gross revenue generated from your contracting work. This includes income from services like Guam Underbrush Removal Contracts. Familiarizing yourself with the local tax rates and regulations is crucial to ensure compliance and avoid penalties. It’s beneficial to work with a local tax advisor who can help you navigate the specifics of contractor taxation in Guam.

To obtain a contractor's license in Guam, you must meet specific requirements set by the Guam Contractors License Board. Generally, this involves submitting an application, passing exams, and providing proof of experience and financial stability. If you're considering a Guam Underbrush Removal Contract, having the appropriate license ensures your work meets local standards. You can find detailed information and resources by visiting the Guam Contractors License Board's website.

Yes, Guam is considered a U.S. territory for tax purposes. This means that residents of Guam must comply with U.S. tax laws, while also following some specific local regulations. If you plan to engage in a Guam Underbrush Removal Contract, understanding the tax obligations is essential. Consulting with a tax professional familiar with both U.S. and Guam tax laws can provide clarity and guidance.