Guam Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

Are you in a situation where you frequently require documentation for either business or specific purposes? There are numerous legal document templates available online, but finding reliable forms is not simple.

US Legal Forms offers a vast selection of template forms, including the Guam Escrow Check Receipt Form, designed to meet both federal and state requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Guam Escrow Check Receipt Form template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Guam Escrow Check Receipt Form at any time by selecting the needed form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates useful for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the correct city/region.

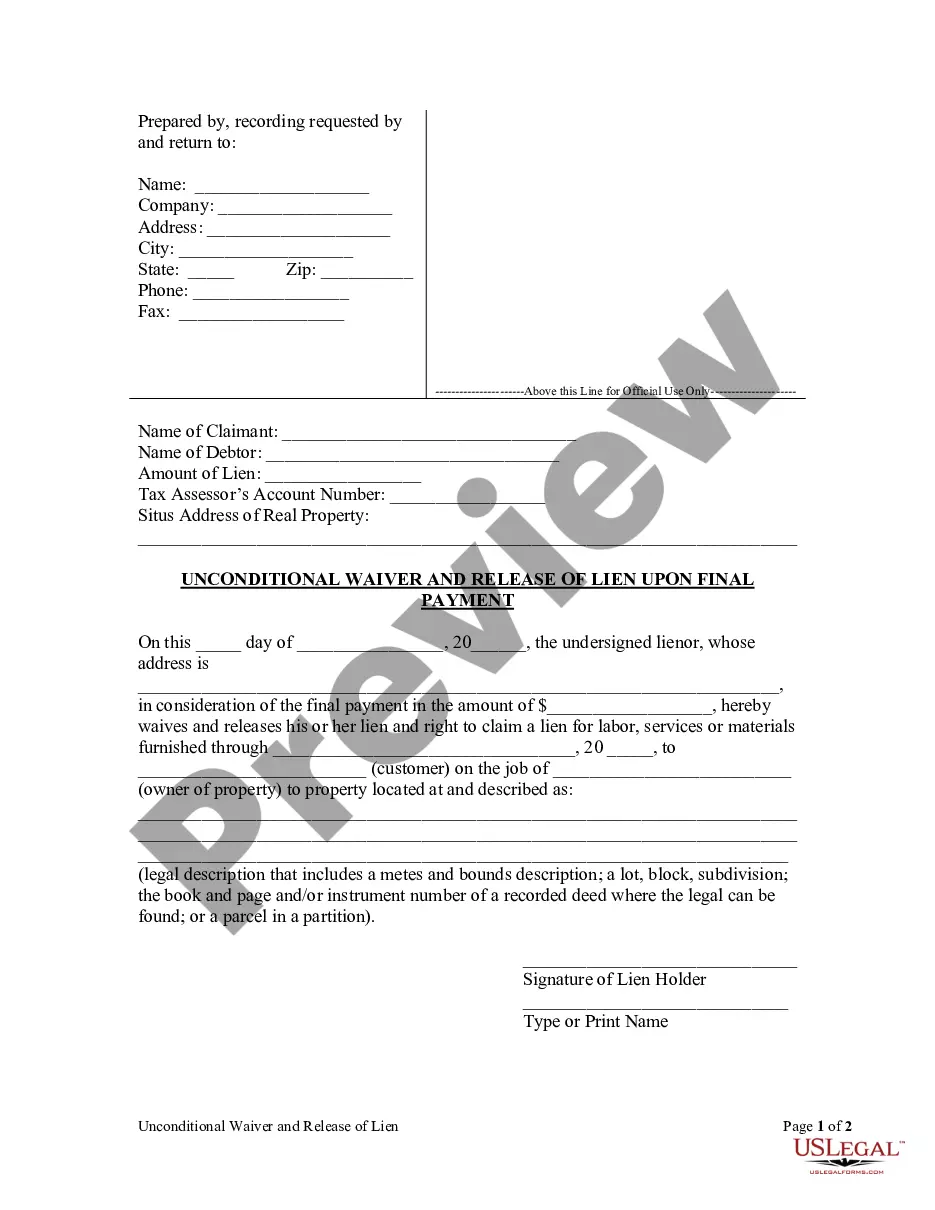

- Utilize the Review button to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search section to find the form that suits your needs.

- Once you find the appropriate form, click Buy now.

- Choose the payment plan you prefer, fill in the required information to create your account, and complete your order using PayPal or credit card.

Form popularity

FAQ

To check the status of your Guam refund, visit the Guam Department of Revenue and Taxation's website. You will need to provide specific information such as your Social Security number and filing details. Using the Guam Escrow Check Receipt Form may help you track any related transactions. Stay informed and proactive to ensure you receive your refund promptly.

The Gross Receipts Tax (GRT) rate in Guam is currently set at 4%. This tax applies to businesses and individuals earning income in Guam. Understanding this rate is important if you manage transactions using the Guam Escrow Check Receipt Form, ensuring you comply with local tax obligations. Always consult a tax professional for personalized advice.

To check the status of your tax refund in Guam, visit the Guam Department of Revenue and Taxation website or use their automated phone service. Keep your tax information handy for the best results. If you filed using the Guam Escrow Check Receipt Form, ensure the details match your submission. This will aid in a smoother tracking experience.

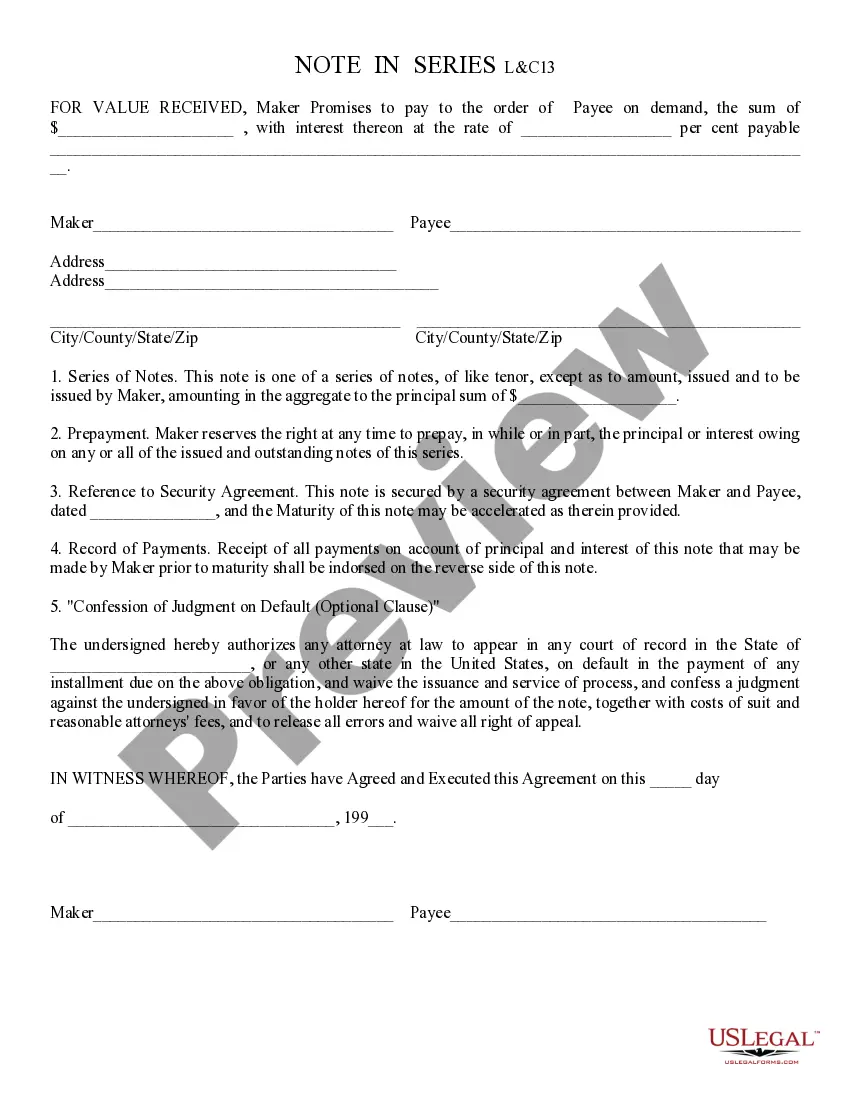

An escrow document encompasses all paperwork related to the escrow arrangement, including agreements, receipts, and statements. These documents ensure that all parties understand their rights and responsibilities within the transaction. Having your Guam Escrow Check Receipt Form as part of your escrow documents is important for maintaining a transparent record.

An escrow certificate is an official document that certifies the existence and details of your escrow account. It typically includes information about the parties involved, the amount held, and the terms governing the escrow agreement. When dealing with a Guam Escrow Check Receipt Form, this certificate can provide essential details about your financial commitments.

Proof of escrow refers to documentation that verifies your funds are held in escrow. This can include an escrow receipt or an escrow statement. When you have a Guam Escrow Check Receipt Form, you possess vital proof that can support your claims regarding any financial agreements tied to your real estate transaction.

You may receive an escrow check as a refund or payment related to a real estate transaction. This typically occurs after the sale closes, and any excess funds held in escrow are returned to you. Your Guam Escrow Check Receipt Form will accompany this check, providing a clear reference for the transaction.

An escrow receipt is a document that serves as proof of funds held in an escrow account. It details the amount deposited and the purpose of the escrow arrangement. If you are dealing with a Guam Escrow Check Receipt Form, this document is essential for confirming that funds are securely held until certain conditions are met.

To verify your escrow account, you should contact the escrow company or agent responsible for managing your funds. They can provide you with information regarding your balance and transaction history. This verification process is crucial for maintaining transparency regarding your Guam Escrow Check Receipt Form.

You can obtain your escrow statement directly from the escrow company managing your account. Many companies also provide online access through their websites, which makes it easy to retrieve your Guam Escrow Check Receipt Form. Additionally, you may contact your real estate agent or title company for assistance in obtaining this document.