Guam Return Authorization Form

Description

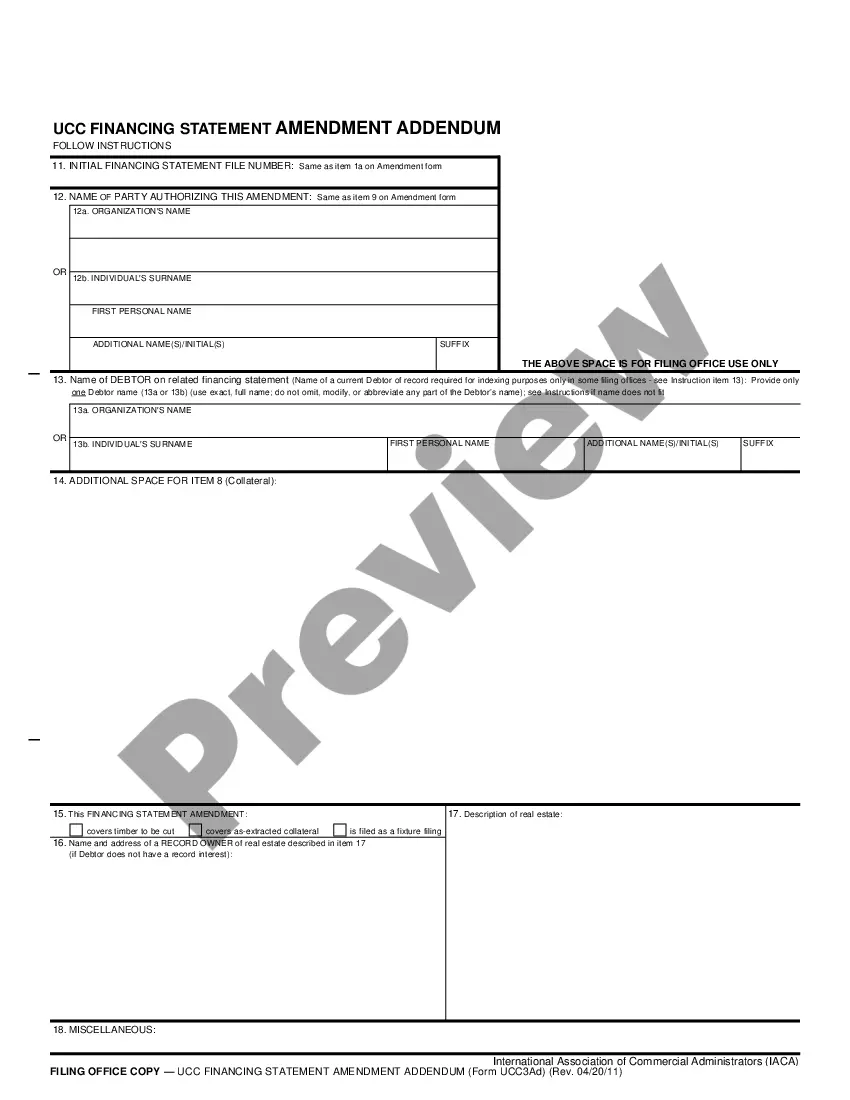

How to fill out Return Authorization Form?

You can spend time online looking for the approved document template that meets the federal and state regulations you need.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

It is easy to obtain or print the Guam Return Authorization Form from my services.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Guam Return Authorization Form.

- Every legal document template you obtain is yours for years.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/town of your choice.

- Review the form description to make sure you have chosen the right form.

Form popularity

FAQ

For tax purposes, Guam is treated similarly to U.S. states, but with its own unique regulations. Residents and certain foreign individuals must understand these distinctions to file correctly. The Guam Return Authorization Form serves as a vital part of this process, ensuring you fulfill all your tax obligations while benefiting from the rights afforded to U.S. territories.

Yes, foreigners who receive income from U.S. sources or meet specific criteria must file U.S. tax returns. This requirement includes filing appropriate forms, such as the Guam Return Authorization Form if the income is related to Guam. Knowing the filing requirements can prevent potential legal consequences and ensure compliance with U.S. tax laws.

You can find Guam tax forms online through the government's official tax website or various legal form platforms. One useful resource is uslegalforms, where you can easily locate the Guam Return Authorization Form along with other necessary tax documents. Utilizing online resources simplifies the process of gathering and filing your required paperwork.

Guam is indeed a U.S. territory, meaning it is under U.S. sovereignty but does not have the same representation as a state. This status affects various legal and tax obligations, including the need to file specific forms like the Guam Return Authorization Form. Understanding this distinction can help you navigate your tax responsibilities more effectively.

Yes, Guam has its own tax system, and residents must file their taxes under Guam law. However, Guam follows many of the same rules as the United States federal tax code. If you are looking to file your taxes and need assistance, the Guam Return Authorization Form may be an essential document for the process.

To email the Revenue and Taxation Department of Guam regarding the Guam Return Authorization Form, you should visit their official website to locate the contact email address. Make sure to provide all necessary information related to your inquiry or request for the form. It helps to include your contact details, so they can respond to you promptly. Utilizing USLegalForms can simplify this process by offering templates and guidance for completing and submitting your forms correctly.

1 Guam is a tax form utilized in Guam for various reporting purposes and serves to collect information on wages and withholdings. It is essential for both employers and employees to understand this requirement clearly. If you are uncertain about completing 1 or need to include any relevant information, the Guam Return Authorization Form can be crucial. Uslegalforms provides tools and templates to assist you.

An IRS estate tax closing letter is a document that confirms the IRS has closed the estate tax return after review. While this letter is specific to U.S. tax regulations, it can also be significant for estate planning in Guam. If you're navigating estate matters and require forms, the Guam Return Authorization Form may be relevant. Uslegalforms can provide insight into this process.

Yes, if you earn income sourced from Guam, you need to file a Guam tax return. This requirement helps ensure that you remain compliant with local tax laws. Using the Guam Return Authorization Form can streamline this process. Additionally, uslegalforms can assist in providing templates and guidance to ease the filing experience.

Guam has its own tax system that is influenced by U.S. tax laws, but it does not completely follow the U.S. tax code. Instead, it has specific regulations and forms, like the Guam Return Authorization Form, that must be adhered to. Understanding these differences is crucial for proper tax compliance. Uslegalforms can serve as a helpful tool in navigating these distinct requirements.