Guam Superior Improvement Form

Description

How to fill out Superior Improvement Form?

You can dedicate several hours online looking for the approved document template that aligns with the federal and state requirements you have in mind. US Legal Forms provides thousands of legal templates that are evaluated by professionals.

You can download or print the Guam Superior Improvement Form from the service.

If you already own a US Legal Forms account, you can Log In and click on the Download button. Afterwards, you can complete, modify, print, or sign the Guam Superior Improvement Form. Every legal document template you acquire is yours permanently. To obtain another copy of any purchased form, visit the My documents tab and click on the respective button.

Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Guam Superior Improvement Form. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you're using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/town of your preference. Review the form details to confirm that you have chosen the right document.

- If available, use the Preview button to review the document template simultaneously.

- If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- Once you have identified the template you want, click Get now to continue.

- Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

The bonus for the Guam National Guard typically depends on various factors, including service length and specific duty assignments. Service members may be eligible for bonuses that recognize their commitment and contributions to the Guard. Utilizing the Guam Superior Improvement Form, members can effectively request information regarding potential bonuses and benefits. This form serves as a valuable tool in understanding entitlements and financial rewards within the service.

The average merit bonus varies depending on the industry and performance metrics. In general, many employees can expect to receive a bonus of around 3-5% of their annual salary. Using the Guam Superior Improvement Form, employers may provide outlines for earnings and incentive structures, ensuring clarity for employees. This form can help establish transparent criteria for merit increases and bonuses.

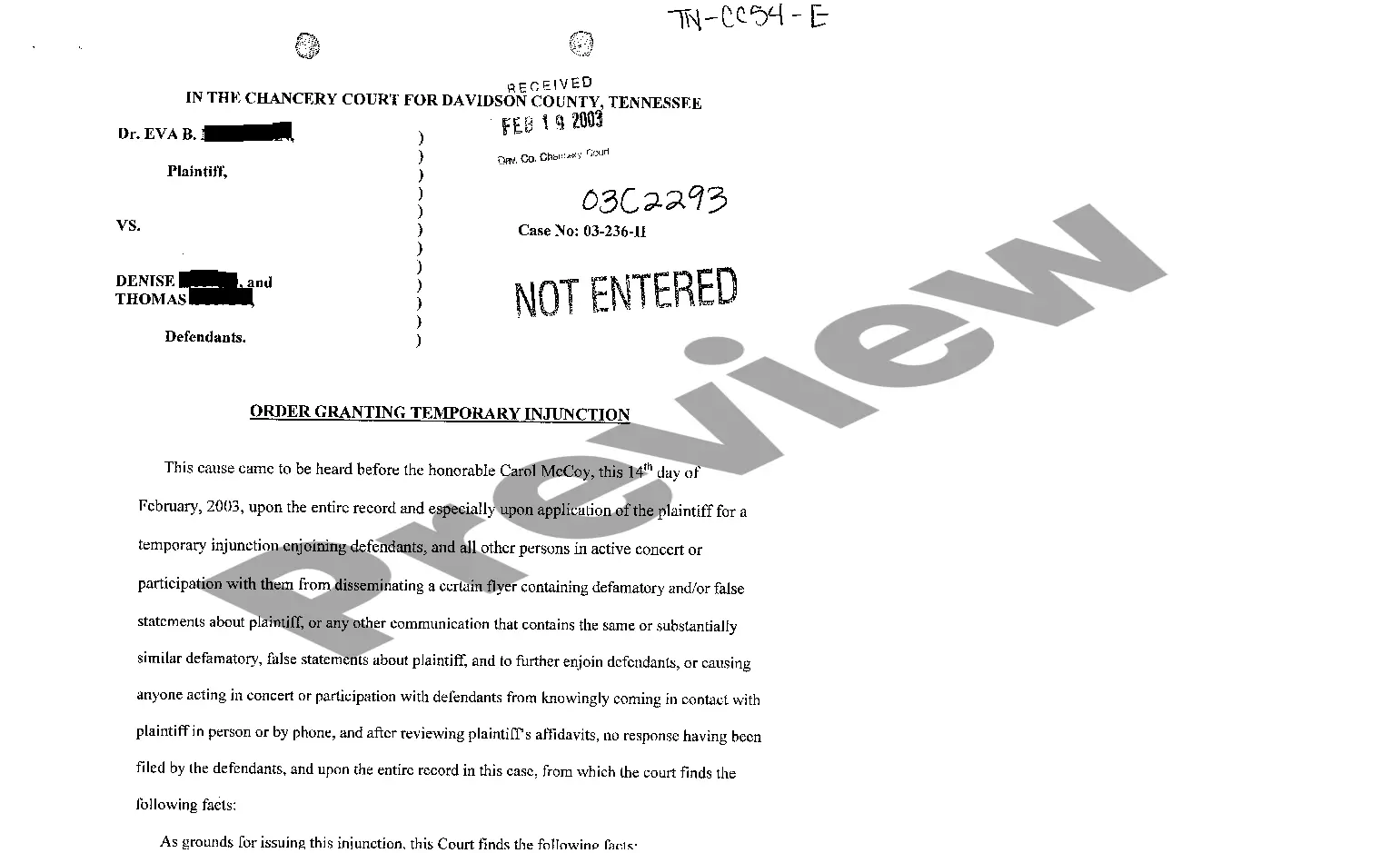

To obtain court clearance in Guam, you must first complete the necessary paperwork, which often includes the Guam Superior Improvement Form. This form helps streamline your request and ensures all relevant details are captured accurately. After submitting the form, you may need to provide additional information or attend a hearing. Engaging with a legal professional can also simplify the process and enhance your chances of timely approval.

If you are a resident or have income in Guam, filing a tax return is typically required. This process allows you to report income and fulfill your tax obligations. The Guam Superior Improvement Form can help facilitate this process by providing a clear structure for your filing. Always stay informed to ensure you meet all necessary criteria.

Filing a tax return in Guam is mandatory for most residents who earn income. This obligation ensures that individuals contribute to the local economy and comply with tax laws. Utilizing the Guam Superior Improvement Form can assist you in managing your return accurately. Remember, staying compliant can help you avoid penalties down the line.

Yes, Guam is considered a U.S. territory for tax purposes, which means residents must adhere to both federal and local tax regulations. Understanding how these regulations apply is critical, especially when completing forms like the Guam Superior Improvement Form. It’s essential to stay updated on relevant tax laws to ensure accurate compliance. Take the time to understand your tax obligations.

To email the Rev and Tax Department in Guam, you should visit their official website to find the appropriate contact information. Look for the specific email address dedicated to inquiries and services. Additionally, you can use resources like the Guam Superior Improvement Form to gather necessary information before reaching out. This preparation can help streamline your inquiries.

Yes, filing a Guam tax return is necessary for residents earning income in the territory. Regardless of your income level, the Guam Superior Improvement Form can help ensure compliance with local tax requirements. It's crucial to stay informed on tax laws to avoid penalties. Therefore, consider filing your return carefully.

The merit bonus in Guam is a financial incentive provided to employees who demonstrate exceptional performance. This bonus recognizes hard work and achievements within various workplaces. It helps promote a positive work environment and encourages continuous improvement. For those seeking to understand tax implications, using the Guam Superior Improvement Form can simplify reporting.

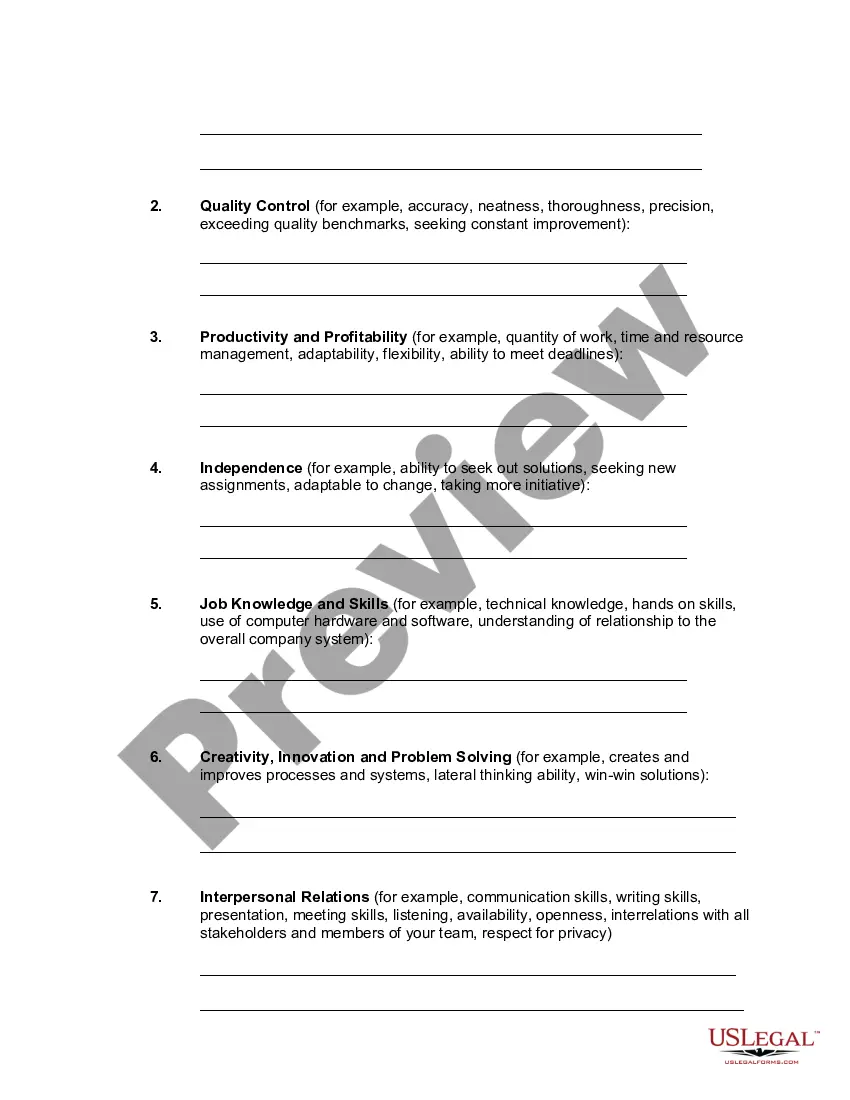

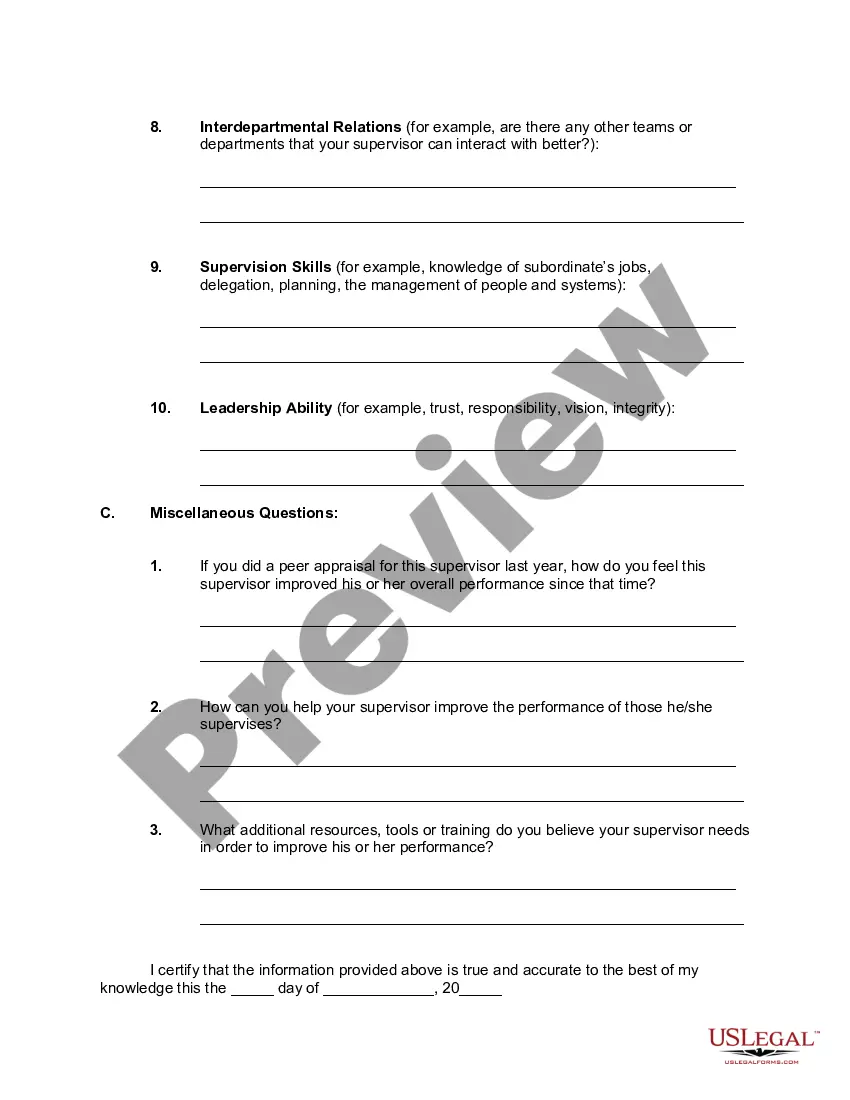

In an employee evaluation, avoid vague comments and negative language that could demotivate the employee. Instead, use the Guam Superior Improvement Form to focus on constructive feedback and actionable insights. Refrain from discussing unrelated issues or making personal judgments. Keep the focus on professional development and clear pathways for improvement, ensuring your feedback is forward-looking and supportive.