Guam Debt Agreement

Description

How to fill out Debt Agreement?

Are you presently in a situation where you require documents for both commercial or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Guam Debt Agreement, designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Guam Debt Agreement format.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

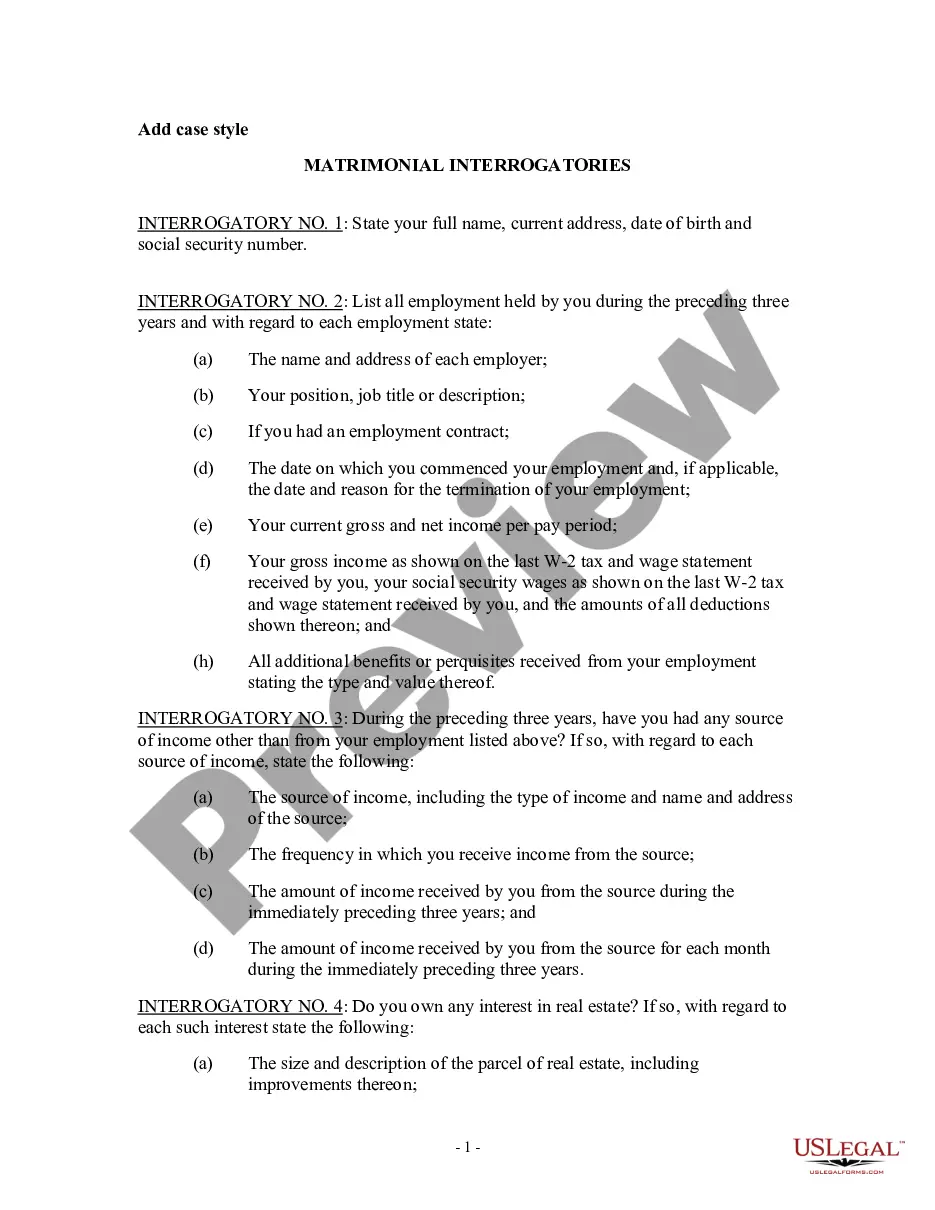

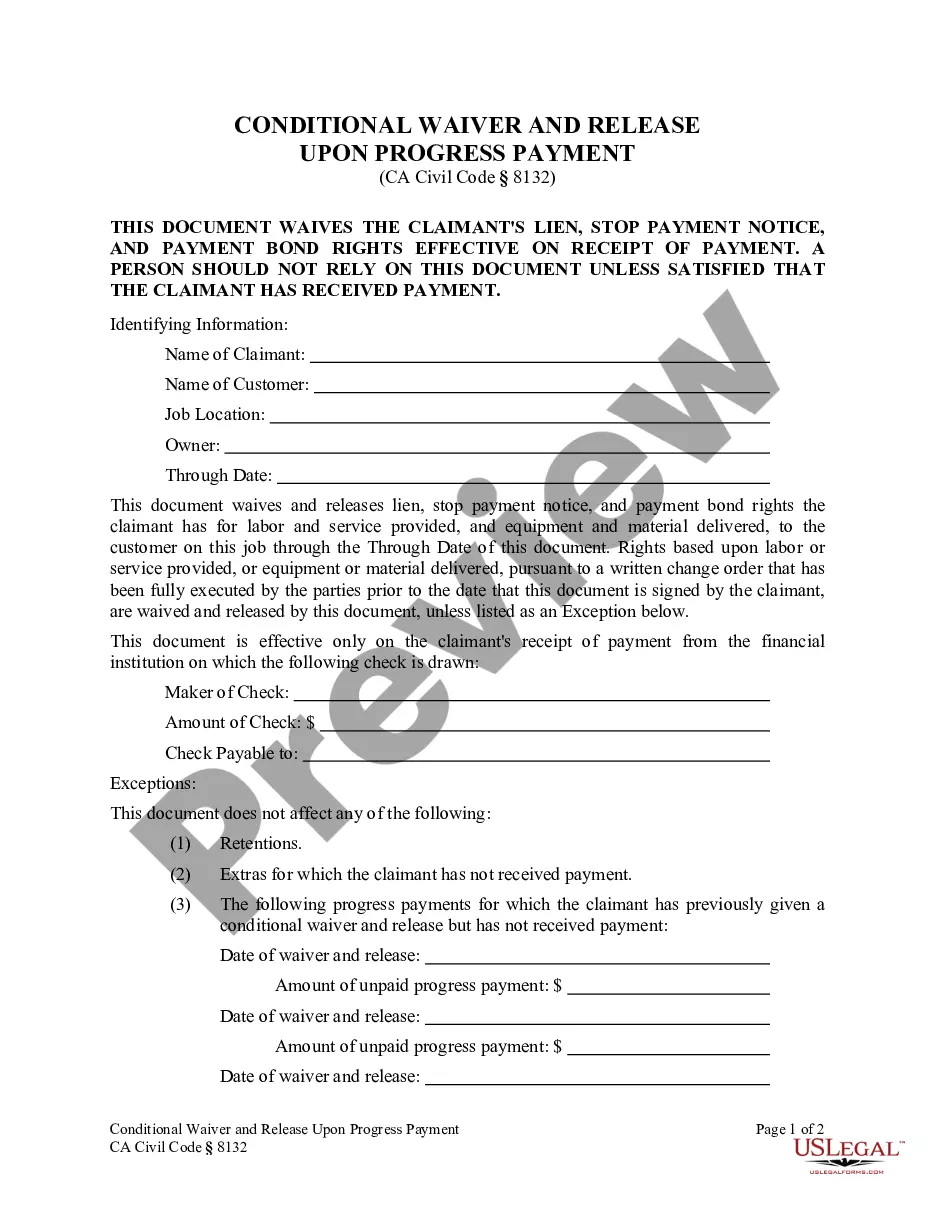

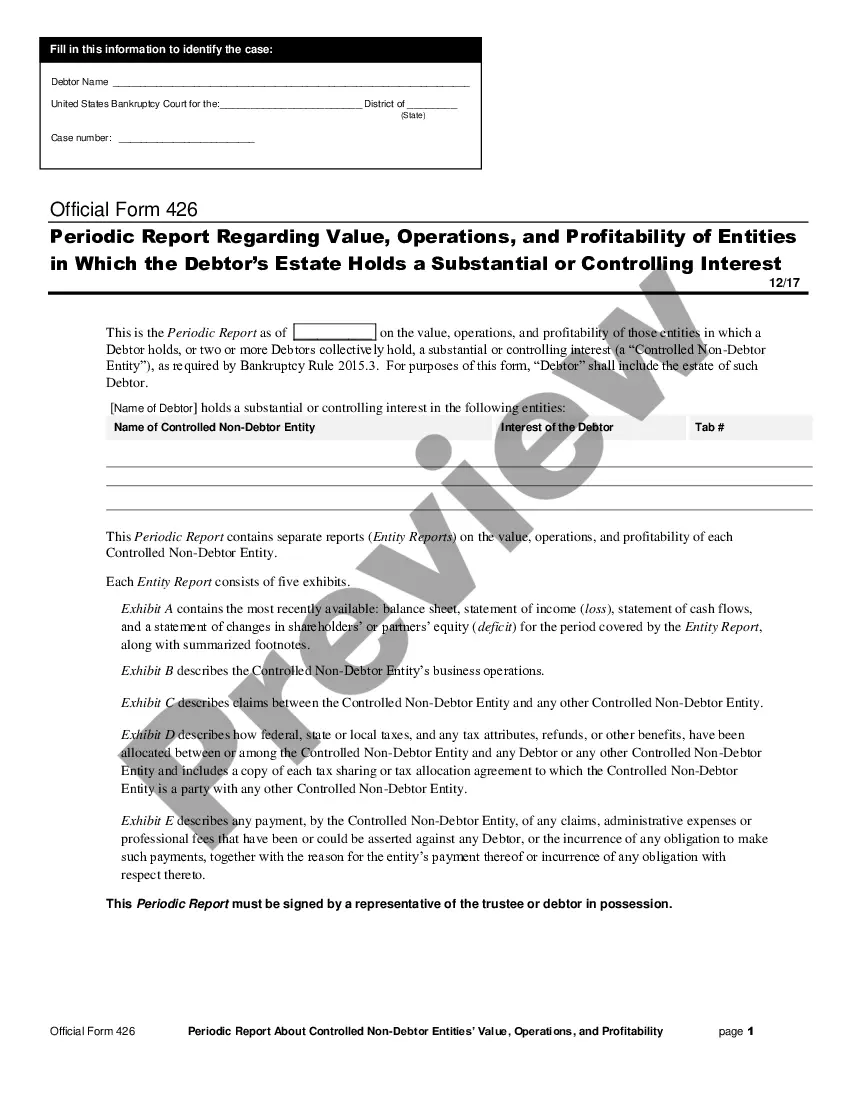

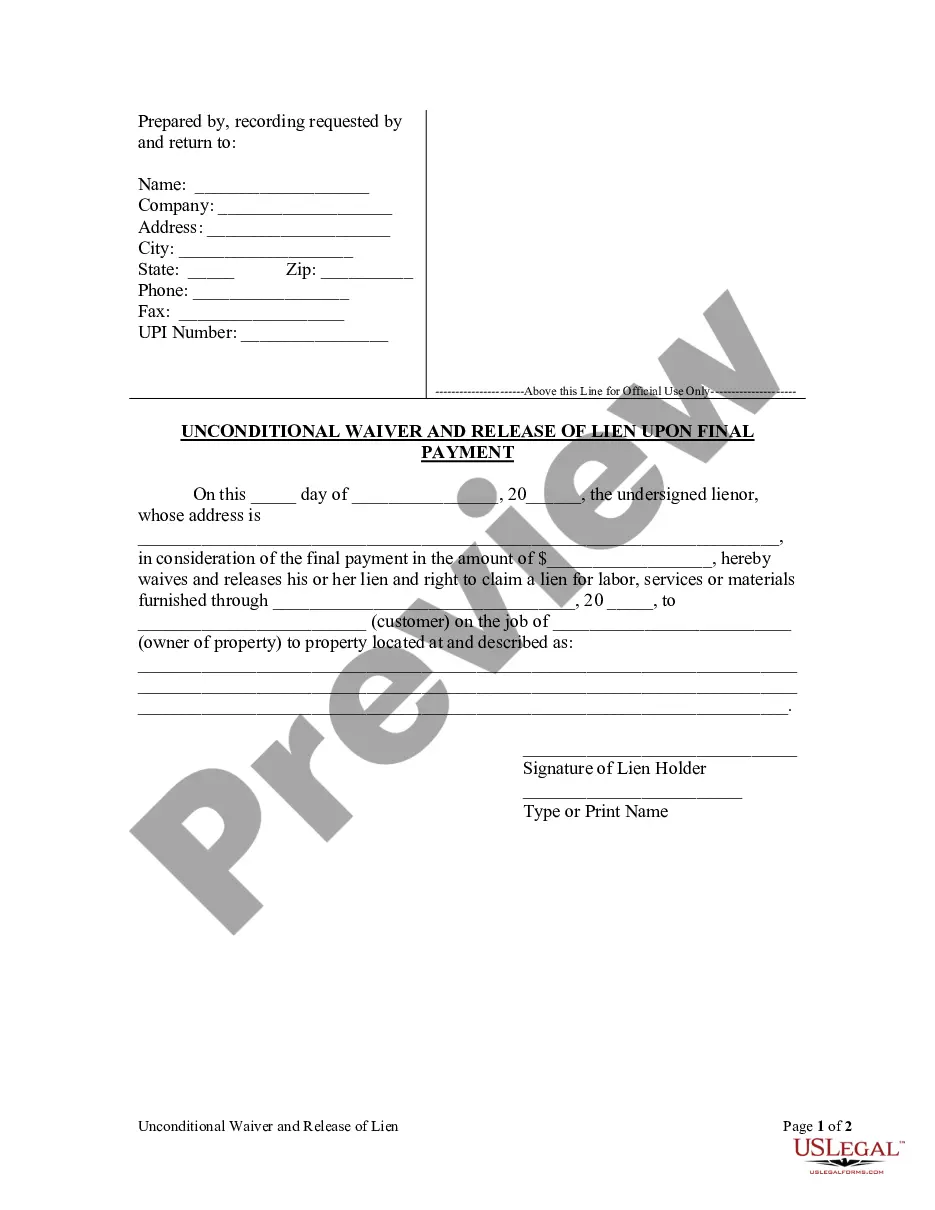

- Utilize the Preview button to examine the form.

- Review the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

As of recent reports, Guam's debt stands at approximately $882 million. This figure includes various obligations across governmental entities. Understanding Guam's financial situation helps highlight the importance of a Guam Debt Agreement for better fiscal management. Engaging with resources such as US Legal Forms can assist in creating effective debt agreements, guiding you through the process with ease.

A debt consolidation agreement is a financial arrangement that combines multiple debts into one single payment, often at a lower interest rate. This simplified method can make managing your finances easier, as it consolidates your monthly obligations. By utilizing a Guam Debt Agreement, you can explore various options to consolidate your debts effectively and regain control over your financial future.

In Guam, a debt typically becomes uncollectible after a period of six years. This timeline varies depending on the type of debt and specific circumstances. It is essential to be aware of this timeframe, as understanding your situation can help you manage your finances better. Utilizing a Guam Debt Agreement can also provide guidance on handling your debts before they become uncollectible.

The statute of limitations on debt in Guam is six years for most types of consumer debt. This means creditors have a limited time frame to sue you for unpaid debts. After this period, they may lose the legal right to collect the debt through courts. Understanding this timeline can help you navigate your financial obligations and establish a solid plan for managing your debt.

Yes, there is a national debt relief program designed to assist individuals struggling with debt, including those in Guam. This program aims to provide solutions through negotiation and financial education, helping residents understand their options. By leveraging the resources available in this program, you can find the support needed to work through your debt challenges and achieve a Guam Debt Agreement. Consider reaching out to approved organizations for assistance.

The national debt relief program in Guam offers residents options to manage and reduce their debt burden. This program typically involves negotiating with creditors to lower payments or settle debts for less than what is owed. Participants can benefit from structured repayment plans, making it easier to regain financial stability. Exploring this program may be a critical step towards achieving your financial goals.

To obtain a Guam Debt Agreement, you need to assess your financial situation and gather relevant documents. Next, consult with a licensed attorney or a certified debt counselor who can guide you through the application process. They will help you understand the requirements and negotiate with your creditors on your behalf. Engaging with professionals can simplify this journey and increase your chances of success.

A reasonable settlement offer typically ranges from 25% to 50% of the total debt owed, depending on several factors. Factors include the creditor’s policies, the age of the debt, and your financial circumstances. When crafting your Guam Debt Agreement, be transparent about your financial limitations, as this honesty can help foster goodwill and lead to a favorable settlement.

A good debt settlement percentage usually falls between 40% and 60% of the owed amount; however, this can vary based on your financial situation and the creditor's policies. Many creditors prefer receiving a lump sum rather than risking non-payment. Hence, a positive approach with the intent to create a fair Guam Debt Agreement can yield better results.

Typically, you should consider offering a settlement of about 30% to 50% of the total debt amount. The accepted percentage can depend on various factors like the age of the debt and the creditor's willingness to negotiate. When dealing with a Guam Debt Agreement, it's essential to research and prepare for negotiations, as every situation can be unique.