A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Guam Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

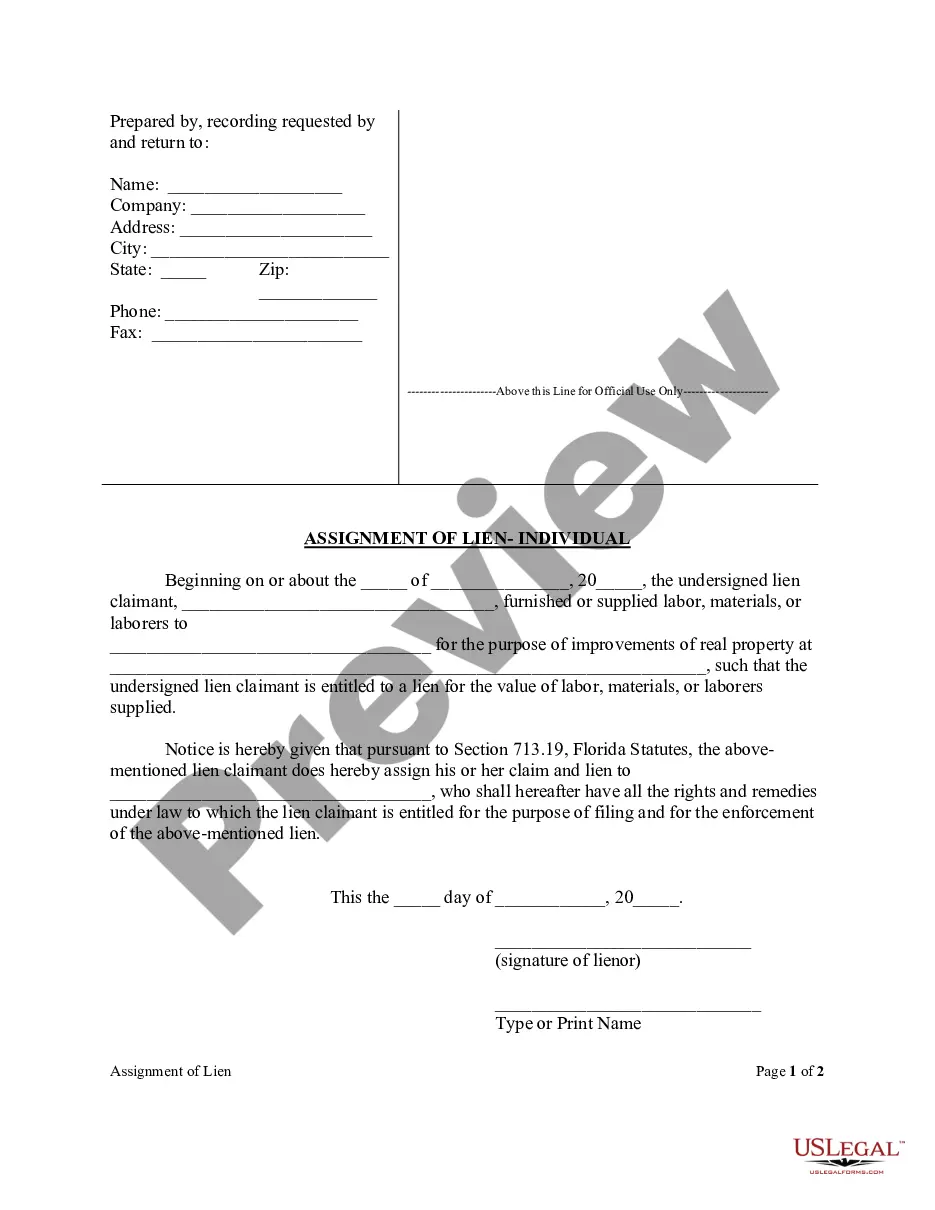

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

If you need to compile, obtain, or print licensed document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to access the Guam Promissory Note backed by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase with just a few clicks.

Every legal document template you buy is yours to keep permanently. You will have access to every form you have obtained through your account. Click on the My documents section and choose a form to print or download again.

Complete and download, and print the Guam Promissory Note backed by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Guam Promissory Note backed by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- You can also access forms you previously acquired through the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read through the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form library.

- Step 4. Once you have found the form you need, click on the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Guam Promissory Note backed by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

Form popularity

FAQ

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A key benefit that a promissory note provides you, whether you are the borrower or the one providing the fund, is flexibility. A promissory note allows you to specify how payments will be made -- in installments, at a future point in time or on demand.

In one state, a mortgagee holds a lien on real property offered as collateral for a loan. The mortgagor retains both legal and equitable title to real property. If the borrower defaults on the loan, the lender must go through formal foreclosure proceedings to recover the debt.

Mortgages are a common type of loan used to finance the purchase of a home or other real estate. These loans are secured by the financed property, meaning the lender can foreclose in the case of borrower default. Home equity lines of credit.

When you take out a loan to buy a home, the lender will probably require you to sign both a promissory note and a mortgage (or another document called a "deed of trust" or something similar). These documents set up the loan terms and have the same goal: to make sure the lender gets repaid.

Secured loans are loans that are protected by collateral. This means that when you apply for a secured loan, the lender will want to know which of your assets you plan to use to back the loan. The lender will then place a lien on that asset until the loan is repaid in full.

A secured loan is a loan backed by collateralfinancial assets you own, like a home or a carthat can be used as payment to the lender if you don't pay back the loan.

Whenever you borrow money and pledge your home or other real property as collateral, you have received a real estate secured loan. You sign a promissory note evidencing your promise to repay the loan, but you also offer security in the form of real estate to "encourage" an approval.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.