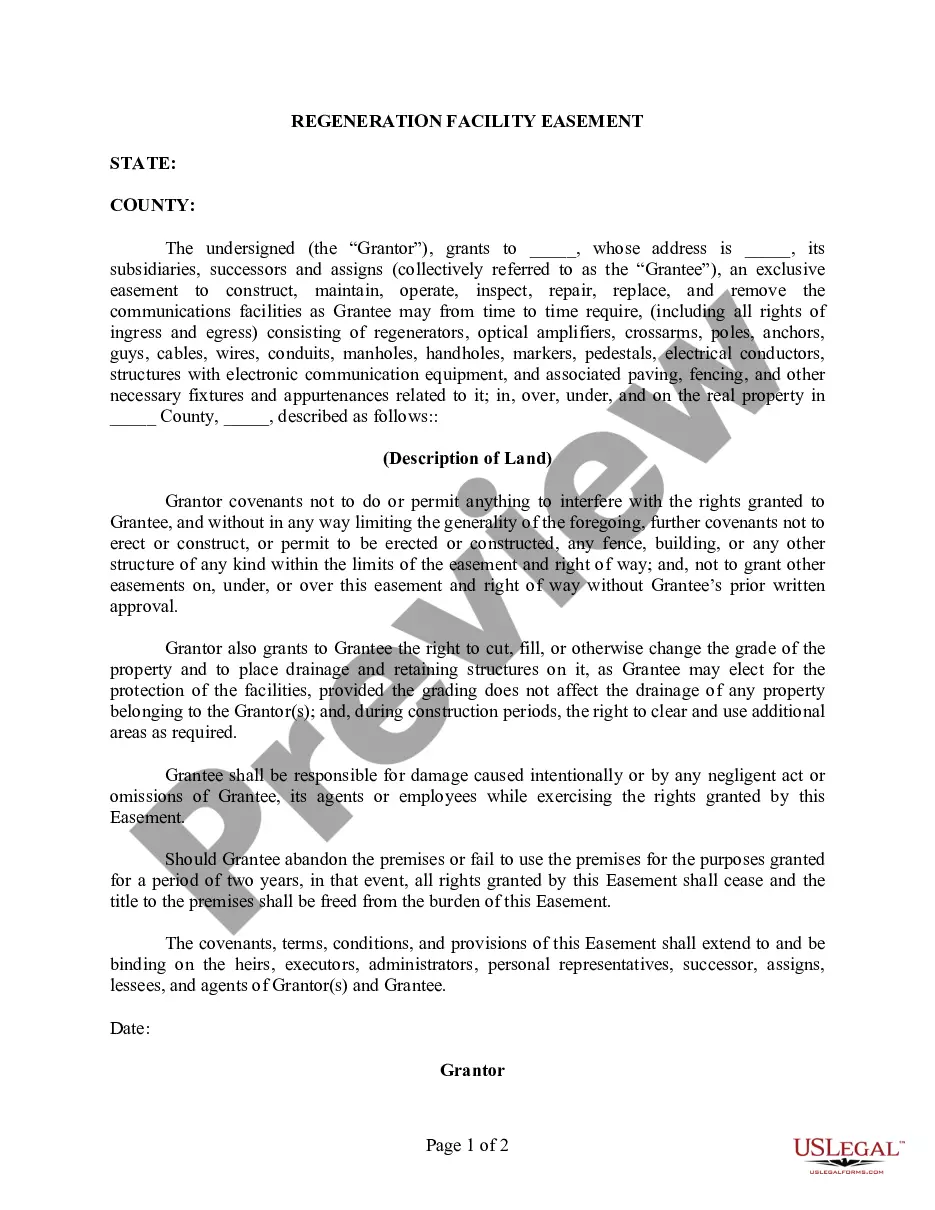

This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Guam Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

If you need to obtain, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s simple and convenient search to find the documents you require. Various templates for business and personal use are categorized by type and state, or keywords.

Use US Legal Forms to locate the Guam Unsecured Installment Payment Promissory Note for Fixed Rate in just a few clicks.

Step 5. Complete the payment process. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Select the format of your legal document and download it to your device. Step 7. Fill out, modify and print or sign the Guam Unsecured Installment Payment Promissory Note for Fixed Rate. Every legal document format you obtain is yours permanently. You have access to every document you purchased with your account. Click the My documents section and select a document to print or download again. Stay competitive and download and print the Guam Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Guam Unsecured Installment Payment Promissory Note for Fixed Rate.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have chosen the correct form for your city/state.

- Step 2. Utilize the View option to review the form’s details. Remember to read the description.

- Step 3. If you are dissatisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred payment method and provide your details to register for an account.

Form popularity

FAQ

Yes, you generally need to report a promissory note on your tax return. This includes the Guam Unsecured Installment Payment Promissory Note for Fixed Rate, as it represents a financial obligation and potential income. Keeping accurate records of the note and any payments received will simplify this process. It is wise to consult with a tax professional to ensure you are meeting all reporting requirements.

Filing Guam taxes as a foreigner can be straightforward if you understand the process. First, ensure you have the necessary forms, including any related to the Guam Unsecured Installment Payment Promissory Note for Fixed Rate. You will likely need to file a Guam tax return, detailing your income and deductions. It’s advisable to seek guidance from a tax professional familiar with Guam’s tax laws for accurate filing.

Promissory notes, including the Guam Unsecured Installment Payment Promissory Note for Fixed Rate, are generally subject to taxation as income. When you receive payments from a promissory note, you must report this income on your tax return. It's important to keep detailed records of all transactions related to the note to ensure accurate reporting. Consulting a tax expert can help you navigate the nuances of taxation on promissory notes.

Yes, Guam is considered a territory of the United States, but it has its own tax laws that differ from federal regulations. When dealing with the Guam Unsecured Installment Payment Promissory Note for Fixed Rate, you should be aware of how local tax rules apply. You may need to consult a tax professional to understand your specific obligations. This ensures compliance with both Guam and federal tax requirements.

A reasonable interest rate for a Guam Unsecured Installment Payment Promissory Note for Fixed Rate typically ranges from 5% to 10%. This range depends on various factors, including the creditworthiness of the borrower and current market conditions. It is essential to ensure that the interest rate remains fair and complies with local laws. If you need guidance on setting the right rate, consider using the tools available on the UsLegalForms platform.

A promissory note does not always need to be notarized to be legal, but notarization can enhance its validity. In the case of a Guam Unsecured Installment Payment Promissory Note for Fixed Rate, having the document notarized may provide additional protection for both parties. It is advisable to check local laws or consult a legal expert to ensure compliance. Using resources like US Legal Forms can guide you through the process.

Writing an example of a promissory note involves outlining the key components of a Guam Unsecured Installment Payment Promissory Note for Fixed Rate. Include the date, names of the parties, the amount borrowed, interest rate, payment terms, and any conditions for repayment. You can find templates on platforms like US Legal Forms that simplify this process. Tailor the example to your specific needs to ensure clarity.

Secured notes are backed by collateral, offering lenders a safety net in case of default. Unsecured notes, on the other hand, do not require this collateral, making them riskier for lenders. When opting for a Guam Unsecured Installment Payment Promissory Note for Fixed Rate, it's crucial to understand these distinctions to make informed financial decisions. Our platform provides guidance and templates to help you navigate these choices.

The primary difference between secured and unsecured promissory notes lies in collateral. Secured notes require the borrower to pledge assets, while unsecured notes do not. With a Guam Unsecured Installment Payment Promissory Note for Fixed Rate, borrowers can enjoy the benefits of financing without needing to provide collateral. Our platform enables you to choose the right type of note for your situation.

A promissory note does not necessarily need to have an interest rate. However, including an interest rate can make the agreement more attractive to lenders, as it compensates them for the risk of lending. For those considering a Guam Unsecured Installment Payment Promissory Note for Fixed Rate, understanding interest terms is essential for both parties. You can create customized notes that meet your specific needs using our platform.