Guam Personal Services Partnership Agreement

Description

How to fill out Personal Services Partnership Agreement?

It is feasible to dedicate time online searching for the legal document template that meets the federal and state criteria you need.

US Legal Forms provides thousands of legal forms that have been reviewed by professionals.

You can easily download or print the Guam Personal Services Partnership Agreement from my assistance.

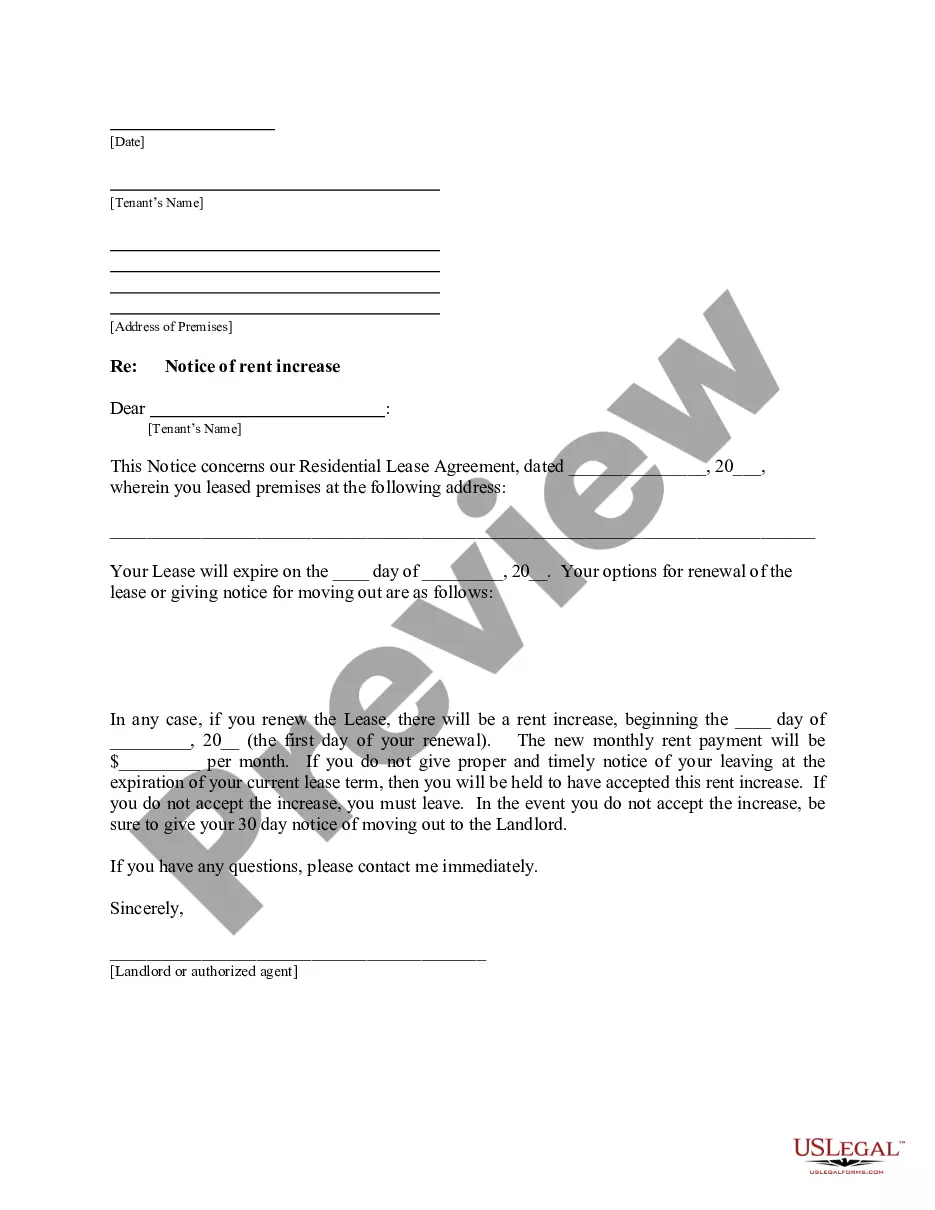

If available, take advantage of the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Guam Personal Services Partnership Agreement.

- Every legal document template you acquire is yours forever.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Read the form description to verify you have selected the right form.

Form popularity

FAQ

Not all partnerships are required to file Form K-2; this form is specifically for partnerships that have international tax implications or certain foreign income. However, if your partnership falls under the scope of a Guam Personal Services Partnership Agreement and deals with foreign partners or foreign income, you may need to file it. It’s wise to consult with a tax professional to determine your specific filing requirements.

To fill out a partnership form like Form 1065, you'll first need to gather all necessary financial information related to your partnership, including income, expenses, and partner contributions. Clearly follow the form's instructions to ensure accuracy and compliance, especially when detailing your Guam Personal Services Partnership Agreement. Utilizing a platform like uslegalforms can simplify this process, providing guidance to help you complete your forms correctly.

Yes, Guam is considered a U.S. territory for tax purposes, but it has distinct rules and regulations. If you are entering into a Guam Personal Services Partnership Agreement, it is essential to understand local tax obligations. Residents and businesses in Guam must comply with both federal and local tax laws, which may have specific implications for partnership taxation.

Partnerships must fill out Form 1065, which is the tax return utilized to report income, deductions, and other relevant financial data. In the case of a Guam Personal Services Partnership Agreement, filing Form 1065 is crucial for tax compliance. Additionally, partners will receive Schedule K-1 to detail each member's share of the partnership's income and deductions.

Form 1065 is specifically for partnerships, not for S Corporations or C Corporations. If you're navigating a Guam Personal Services Partnership Agreement, you would use Form 1065 to report your partnership income and expenses. S Corporations and C Corporations have their own forms—S Corporations use Form 1120S, while C Corporations use Form 1120—so it's important to identify your entity type correctly.

Form 5074 is used to report the income allocation for partnerships that have operations in U.S. territories, including Guam. If you're forming a Guam Personal Services Partnership Agreement, this form helps ensure that you appropriately allocate income and avoid any potential pitfalls in tax reporting. It may become relevant depending on your partnership's activities and obligations in Guam.

Form 1065 and Form 1099 are not the same form and serve distinct functions in tax reporting. Form 1065 is used by partnerships, including those under a Guam Personal Services Partnership Agreement, to report the business's income and expenses. Form 1099 is utilized to report various types of income other than wages, salaries, or tips, often associated with independent contractors. Understanding the difference is essential for proper tax compliance.

Schedule K-1 and Form 1065 serve different purposes in the context of a Guam Personal Services Partnership Agreement. Form 1065 is the partnership tax return, where the partnership reports its income, deductions, and gains. Schedule K-1, on the other hand, is issued to each partner to report their share of the partnership's income, deductions, and credits. Although related, they are not the same document.

Guam is indeed a U.S. possession, serving as a territory with a unique status within the United States. This aspect influences various business practices, including those related to the Guam Personal Services Partnership Agreement. For prospective business owners, understanding Guam's status can provide insight into its tax advantages and legal landscape.

Yes, taxpayers in Guam can file their taxes online through the Department of Revenue and Taxation's website. Utilizing electronic filing can streamline your tax process, especially for those involved with the Guam Personal Services Partnership Agreement. It's a convenient way to stay on top of your obligations and receive guidance if needed.