An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of

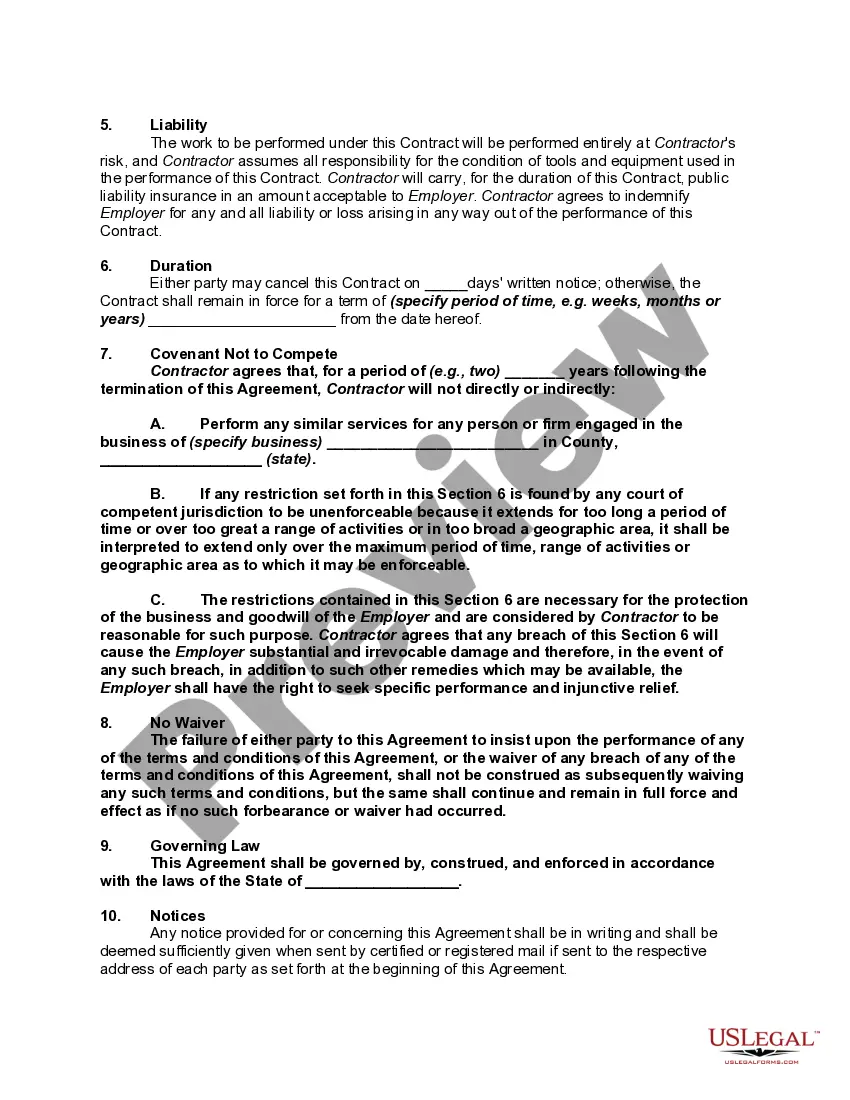

Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete

Description

How to fill out Contract With Self-Employed Independent Contractor With Covenant Not To Compete?

Are you presently in a circumstance where you need documentation for both corporate or personal reasons almost every working day.

There are numerous legitimate form templates accessible online, however, obtaining versions you can rely on is challenging.

US Legal Forms provides a vast array of form templates, such as the Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, which can be drafted to meet federal and state regulations.

Once you find the right form, simply click Get now.

Select the pricing plan you need, fill out the required details to create your account, and complete the order using your PayPal or credit card. Choose a convenient file format and download your copy. Locate all the form templates you have purchased in the My documents menu. You can obtain another copy of the Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete anytime, if needed. Just choose the necessary form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- After that, you can download the Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct region/county.

- Use the Review button to evaluate the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search box to find the form that fits your needs and requirements.

Form popularity

FAQ

Yes, a covenant not to compete can be enforceable, particularly in the context of a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete. Generally, for it to be valid, it must serve a legitimate business interest, be reasonable in scope, and not overly restrict the contractor's ability to work. To ensure compliance with California law, it’s wise to draft this clause carefully. Utilizing resources from U.S. Legal Forms can help you create an effective agreement that meets legal standards and protects your business interests.

Non-compete clauses can be enforceable against independent contractors, depending on state laws and specific contract terms. In your Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, the enforceability will largely depend on the reasonableness of the restrictions applied. It's advisable to consult a legal expert to navigate these complex issues and ensure compliance with both local and federal laws.

Yes, the FTC’s non-compete ban may apply to independent contractors as well. The current regulations aim to ensure fair practices across all forms of employment, including independent contracting. If you have a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, it is vital to understand how these new rules could impact your agreement and your ability to work freely.

In general, the noncompete ban can apply to contractors, but specifics may vary by state and the terms of your Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete. It’s crucial to review the details of your contract, as certain agreements may be exempt from the noncompete restrictions. As a contractor, you are encouraged to seek clarity on these terms to ensure your rights are protected.

A covenant not to compete can be unenforceable if it is overly broad or restrictive. Courts typically scrutinize these agreements to ensure they do not unduly restrict a person's ability to work. When drafting a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, clarity and fairness in the agreement can enhance its enforceability. Utilizing platforms like uslegalforms can help you create balanced contracts that align with local laws.

Yes, employee non-compete agreements can be enforceable, particularly in Guam. However, the enforceability often depends on various factors such as the restrictions' reasonableness in scope, duration, and geographic area. When forming a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, it is crucial to ensure that the terms are fair and necessary for protecting legitimate business interests.

An independent contractor can be bound by a non-compete clause, particularly if it was included in the contractual agreement. In a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, the clause must be crafted to reflect specific responsibilities and protect the business's interests. Consulting with a legal expert can clarify the implications of such terms.

Yes, a covenant not to compete can be enforceable in an employment contract, provided it satisfies legal requirements. The terms must protect legitimate business interests without placing undue hardship on the employee. Carefully drafting your Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete will ensure that it aligns with local legal standards.

Covenants not to compete can indeed be valid contracts when they meet specific criteria, such as clear terms, mutual agreement, and relevance to legitimate business interests. For a Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete, clarity in expectations and restrictions is essential for enforceability. Legal consultation can help confirm the contract's validity.

Navigating a non-compete clause may involve several strategies, such as negotiating the contract terms, seeking employment in a different geographical area, or demonstrating that the clause is unreasonable. In many cases, reevaluating the language in your Guam Contract with Self-Employed Independent Contractor with Covenant Not to Compete could reveal opportunities for adjustment. Engaging with a legal professional can aid in finding solutions tailored to your situation.