Guam Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

US Legal Forms - one of the most important collections of legal templates in the United States - offers a range of legal document formats that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the most recent forms like the Guam Revocable Trust for Minors within moments.

If you already have a monthly subscription, Log In and download the Guam Revocable Trust for Minors from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.Edit. Complete, modify, print, and sign the saved Guam Revocable Trust for Minors. Every form you added to your account does not have an expiration date and is your property indefinitely. Therefore, if you want to download or print another copy, just go to the My documents section and click on the form you want. Access the Guam Revocable Trust for Minors with US Legal Forms, the most comprehensive library of legal document formats. Utilize thousands of professional and state-specific templates that suit your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure that you have selected the correct form for your region/state.

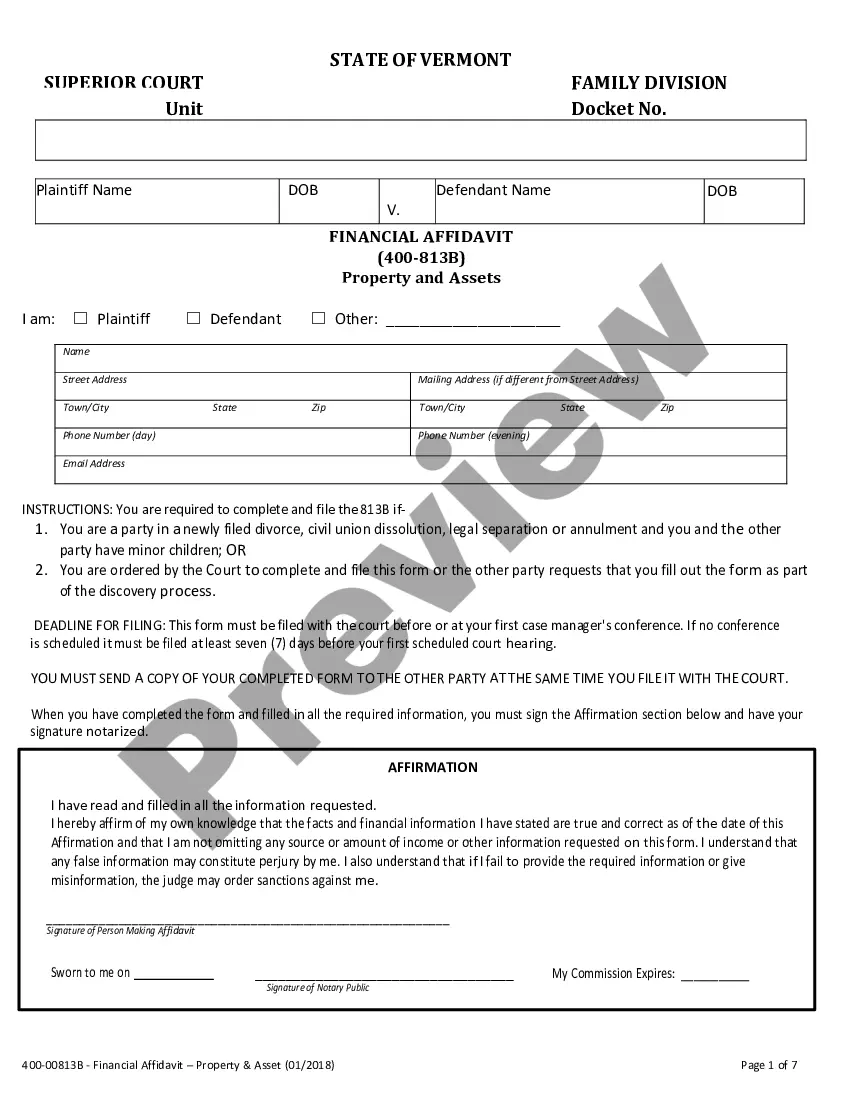

- Click the Preview button to review the content of the form.

- Check the form details to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A child trust fund is an account designed to hold and manage assets for a child until they reach a specified age, usually 18 or 21. It serves as a long-term investment vehicle, ensuring the child's financial growth. By incorporating a Guam Revocable Trust for Minors, you can bolster the benefits of a child trust fund, allowing for planned distributions to support your child's needs throughout their formative years.

A minor trust is a legal arrangement created to manage and protect assets for children until they reach adulthood. This type of trust ensures that funds are used for the minor's needs, such as education and healthcare. With a Guam Revocable Trust for Minors, you can create a customized approach to secure your child's financial future, making it a beneficial option for parents.

Trusts can be categorized into revocable and irrevocable trusts. A revocable trust allows the grantor to retain control over assets and make changes, while an irrevocable trust usually cannot be changed after established. The Guam Revocable Trust for Minors is a type that allows guardians to maintain control while making provisions for the minor's future financial needs.

A simple trust is a trust that must distribute all its income to beneficiaries annually. It does not accumulate income or make charitable contributions. When considering options like a Guam Revocable Trust for Minors, a simple trust can effectively manage assets for minors, ensuring they receive their inherited wealth without complex tax implications.

The best age to set up a trust can vary based on individual circumstances, but starting early is often beneficial. By creating a Guam Revocable Trust for Minors while your child is young, you can secure their financial future and provide ongoing support as they grow. It's wise to establish the trust before any significant assets are transferred to ensure comprehensive management. Setting it up early gives you ample time to adjust provisions as your child matures.

One of the biggest mistakes parents make when setting up a trust fund is not clearly outlining the terms and conditions. A Guam Revocable Trust for Minors should include precise guidelines on how and when funds will be distributed. Failure to do so can lead to misunderstandings or disputes among family members. It's essential to define your intentions, ensuring clarity and reducing the potential for conflict.

The best type of trust for a child often depends on specific needs and circumstances. A Guam Revocable Trust for Minors allows parents to manage assets until their child reaches a responsible age. This type of trust offers flexibility, as it can be altered or revoked, ensuring that your family's needs change over time. Additionally, it helps protect your assets while providing for your child's future.

Inheritance law in Guam dictates how assets are distributed after a person's death, whether they leave a will or not. In many cases, assets may pass according to the rules of intestacy if there is no will, which can lead to unintended beneficiaries, especially when it comes to minors. A Guam Revocable Trust for Minors enables you to specify how your assets will be handled and ensures that your children receive support as intended. Consulting legal professionals can provide clarity on how these laws may impact your estate planning.

Probate in Guam involves the legal process of validating a deceased person's will and distributing their assets. This process can take time, and without effective planning, it may delay access to funds for the beneficiaries, including minors. Establishing a Guam Revocable Trust for Minors can help bypass probate, providing quicker access to assets for your children. Working with legal experts can facilitate a smoother probate process when necessary.

A Guam trust is a trust established under the laws of Guam, designed to manage and distribute assets according to the trustor's wishes. This type of trust can be particularly beneficial for those with minors, as it allows for controlled asset management until they reach adulthood. A Guam Revocable Trust for Minors specifically offers flexibility, allowing the trustor to modify terms as circumstances change. Additionally, establishing a trust can help avoid probate, ensuring a quicker transfer of assets to the intended beneficiaries.