Guam Revocable Trust for Grandchildren

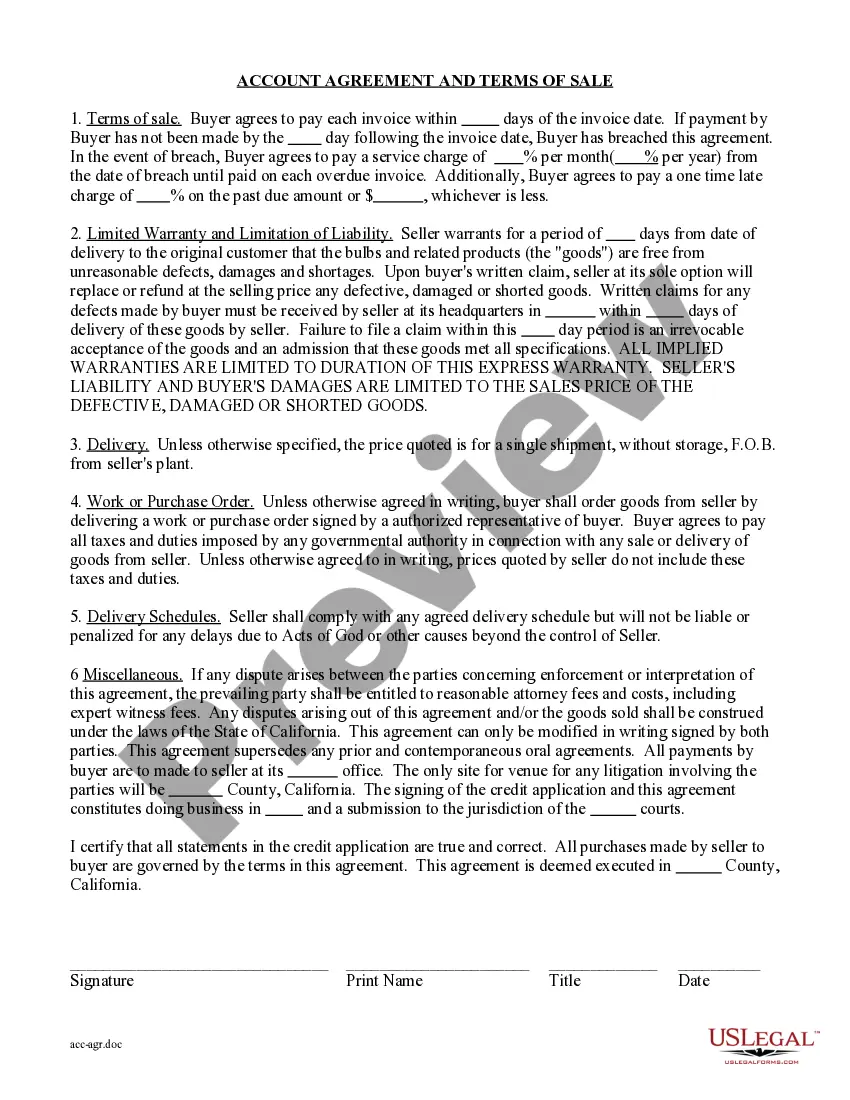

Description

How to fill out Revocable Trust For Grandchildren?

It is feasible to spend hours online looking for the legal document template that fulfills the state and federal requirements you seek.

US Legal Forms provides thousands of legal documents that are vetted by experts.

You can download or create the Guam Revocable Trust for Grandchildren from your assistance.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, create, or sign the Guam Revocable Trust for Grandchildren.

- Every legal document template you receive is yours permanently.

- To obtain another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the easy instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the document description to confirm you have chosen the appropriate type.

Form popularity

FAQ

The greatest advantage of an irrevocable trust is the asset protection it provides. This type of trust can shield assets from creditors and reduce estate taxes. For families looking to secure their grandchildren's future, an irrevocable trust can be a powerful tool. However, consider a Guam Revocable Trust for Grandchildren for those who want flexibility along with protection.

To qualify for a living trust in Guam, you need to establish your objectives and identify the assets you want to include. Working with legal professionals to draft the trust document is also crucial, as they provide guidance on local laws. A Guam Revocable Trust for Grandchildren simplifies this process, ensuring that your trust is tailored to your family’s specific needs.

Choosing the best trust depends on your goals. A revocable trust offers the benefit of flexibility, allowing you to make changes as needed. In contrast, an irrevocable trust can provide tax benefits and asset protection, but limits your control. A Guam Revocable Trust for Grandchildren strikes a balance, offering customization while protecting your grandchildren's future.

The primary difference lies in control and flexibility. A revocable trust allows you to modify or revoke it as your needs change, while an irrevocable trust locks in the terms and removes assets from your control. Choosing a Guam Revocable Trust for Grandchildren means you can adapt to life's changes without losing the benefits of trust protection.

Yes, a revocable trust generally becomes irrevocable upon the death of the trust creator. At that point, the terms set forth in the trust document are set in stone, and the designated trustee must follow those instructions. This is important to consider when establishing a Guam Revocable Trust for Grandchildren, as it allows you to control assets during your lifetime while ensuring your wishes are met after passing.

A Guam Revocable Trust for Grandchildren is often considered an excellent choice. It allows you to specify how and when assets will be distributed to your grandchildren. This type of trust provides flexibility as circumstances change, and it can help in managing educational or health-related expenses effectively.

One significant mistake is failing to clearly communicate the trust's purpose with their children. When parents do not involve their kids in discussions about the trust, it can lead to misunderstandings and disputes. It’s essential to consider a Guam Revocable Trust for Grandchildren to ensure that intentions are clear and beneficiaries understand the purpose of the trust.

An irrevocable trust cannot be easily altered or revoked. Once assets are transferred into this type of trust, you lose control over those assets. For many, this can pose challenges if financial situations change. In contrast, a Guam Revocable Trust for Grandchildren allows greater flexibility while still providing the benefits of asset protection.

A custodial account, such as a Uniform Transfers to Minors Act (UTMA) account, is a strong choice for starting an investment for your grandchild. It allows you to manage assets on their behalf until they reach adulthood. Incorporating a Guam Revocable Trust for Grandchildren can add an extra layer of control over those assets, ensuring they are used wisely for your grandchild's benefit. This structured approach helps instill financial responsibility as they grow.

To list a trust as a beneficiary, you must provide the full name of the trust and its date of creation on the beneficiary designation form. When using a Guam Revocable Trust for Grandchildren, ensure that you include the specific terms of the trust to clarify how the assets should be distributed. It's wise to consult with a legal professional to confirm that everything is set up correctly. Doing so will help prevent any potential complications in the future.