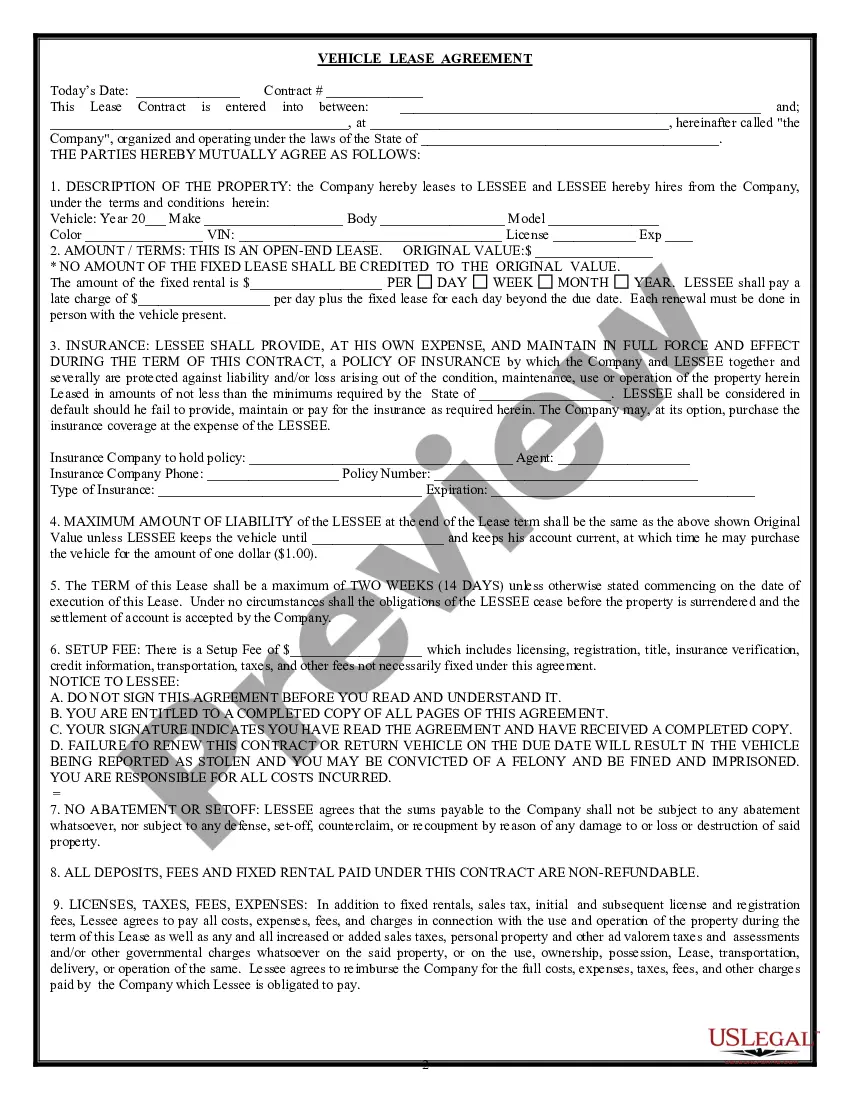

Guam Application for Vehicle Lease Agreement

Description

How to fill out Application For Vehicle Lease Agreement?

Are you presently in a position where you require documentation for either corporate or personal activities on a daily basis? There are numerous legal document templates accessible online, but locating ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Guam Application for Vehicle Lease Agreement, that are designed to comply with state and federal standards.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Guam Application for Vehicle Lease Agreement template.

- Find the form you need and ensure it is for the correct locality/region.

- Use the Review button to evaluate the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you are looking for, use the Search section to find the form that meets your needs and specifications.

- If you locate the correct form, click Get now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

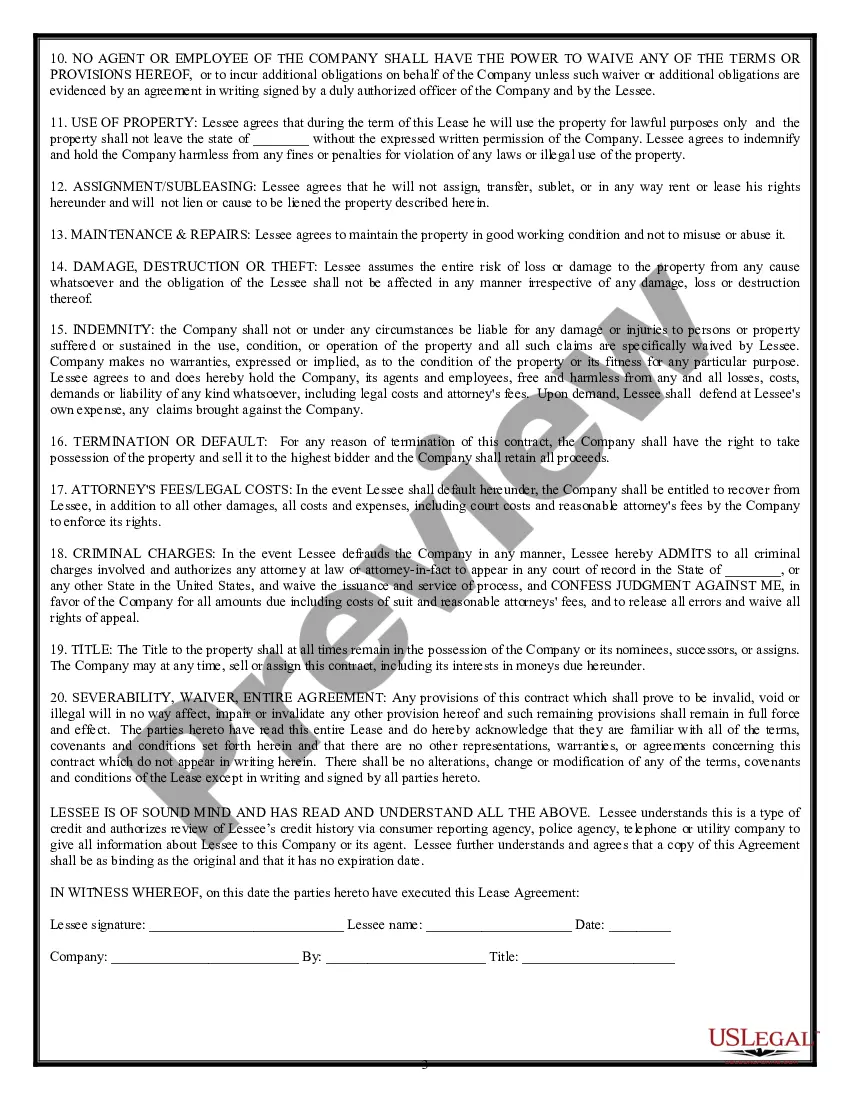

Public Law 27-41 pertains to various legislative matters, including those affecting taxation and business regulations in Guam. This law can influence how vehicle lease agreements are structured and enforced, particularly for the Guam Application for Vehicle Lease Agreement. A good grasp of such laws ensures you stay informed about your rights and obligations as a lessee.

Customs tax in Guam refers to the duties imposed on goods imported into the territory. If you're leasing a vehicle that was imported, understanding customs tax implications is critical when considering the Guam Application for Vehicle Lease Agreement. Being mindful of these taxes will assist you in budgeting for overall vehicle costs.

Residents can file their taxes in Guam through the Department of Revenue and Taxation. For those engaged in vehicle leasing and interested in the Guam Application for Vehicle Lease Agreement, online filing options may also be available. It's advisable to check for the latest updates on filing methods to ensure you meet your tax obligations efficiently.

The GRT rate in Guam typically stands at 5% but may vary depending on specific circumstances or business types. When financing vehicle leases, understanding the GRT rate is crucial, especially for those applying for a Guam Application for Vehicle Lease Agreement. Accurate knowledge of this rate will help you plan better for your financial commitments.

The contractor tax in Guam is another aspect of the Gross Receipts Tax. This tax impacts contractors engaged in a variety of work, including those involved in vehicle lease agreements. For individuals considering a Guam Application for Vehicle Lease Agreement, being aware of this tax can help ensure compliance and proper budgeting for services.

In Guam, the sales tax is known as the Guam Gross Receipts Tax (GRT). This tax applies to all business transactions, including those related to vehicle leases, making it vital for anyone looking into the Guam Application for Vehicle Lease Agreement. It's important to understand this tax structure to calculate the overall costs accurately when filing your vehicle lease.

To get approved for a car lease, start by ensuring you have a good credit score and a steady source of income. Complete the Guam Application for Vehicle Lease Agreement diligently, providing all necessary documents. Finally, consider consulting with our platform to guide you through the approval process and maximize your chances of success.

Factors such as poor credit history, high debt-to-income ratio, or a lack of stable employment may disqualify you from leasing a car. Additionally, any recent bankruptcy or repossession could affect your eligibility. Understanding these factors can aid in preparing a successful Guam Application for Vehicle Lease Agreement.

Most leasing companies prefer a credit score of 700 or above for optimal terms. However, some may consider a lower score if you can demonstrate stable income and a positive payment history. Applying through the Guam Application for Vehicle Lease Agreement can help you understand the specific requirements from different leasing providers.

If you are waiting for a refund related to a lease agreement in Guam, you will typically need to contact the leasing company directly. They should provide details on the status of your refund and any required documentation. For assistance with lease agreements, check out the Guam Application for Vehicle Lease Agreement available on our platform.