One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Guam Irrevocable Trust Funded by Life Insurance

Description

How to fill out Irrevocable Trust Funded By Life Insurance?

Locating the appropriate legal document format can be a challenge. Clearly, there are numerous templates available online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Guam Irrevocable Trust Funded by Life Insurance, which you can use for business and personal purposes. All forms are reviewed by professionals and comply with federal and state requirements.

If you are already registered, Log In to your account and click the Acquire button to obtain the Guam Irrevocable Trust Funded by Life Insurance. Use your account to search for the legal forms you have previously purchased. Visit the My documents tab in your account and retrieve another version of the document you need.

Select the document format and download the legal document format to your device. Complete, modify, print, and sign the acquired Guam Irrevocable Trust Funded by Life Insurance. US Legal Forms is the largest repository of legal forms where you can find a multitude of document templates. Utilize this service to acquire professionally crafted papers that comply with state requirements.

- Firstly, ensure you have selected the correct form for your region/state.

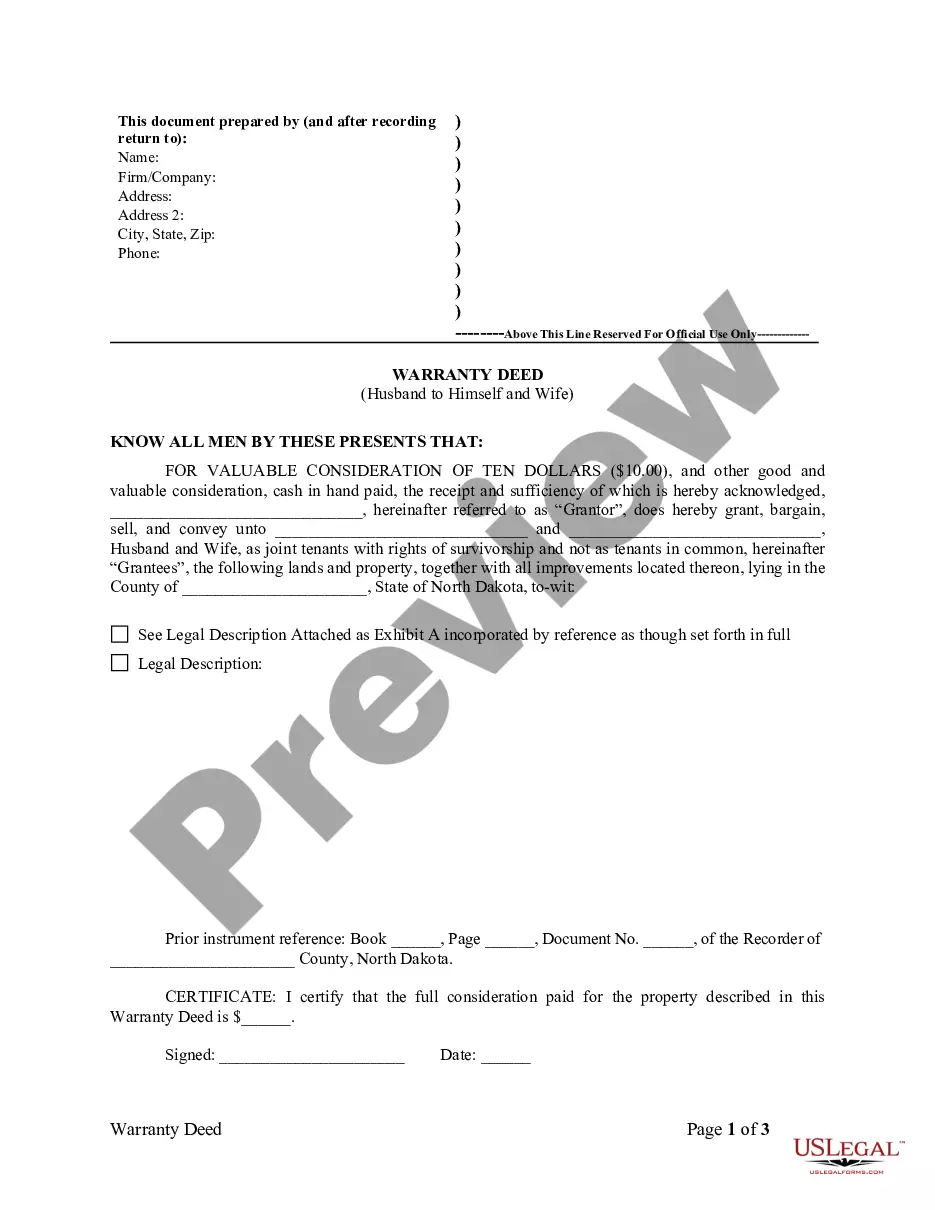

- You can browse the form using the Review button and examine the form summary to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to locate the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to obtain the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

To fund a Guam Irrevocable Trust Funded by Life Insurance, start by purchasing a life insurance policy within the trust. This means that the policy's benefits will directly go to the trust upon your passing. Then, ensure that you properly name the trust as the beneficiary to ensure the funds remain within the trust structure. This approach can provide significant tax benefits and financial security for your loved ones.

Using an irrevocable trust for life insurance, such as a Guam Irrevocable Trust Funded by Life Insurance, helps protect your assets and minimize tax liabilities. By transferring ownership of the policy to the trust, you remove the insurance's value from your estate, potentially lowering estate taxes. Furthermore, this strategy ensures that the benefits are managed according to your wishes, providing peace of mind. Our platform at uslegalforms offers guidance to create the right trust for your needs.

Placing life insurance in a trust, specifically a Guam Irrevocable Trust Funded by Life Insurance, offers various advantages. It ensures the death benefit goes directly to your beneficiaries without going through probate, thus providing immediate financial support when needed. Additionally, using a trust can help reduce estate taxes, preserving more wealth for your heirs. For those considering this option, uslegalforms provides valuable resources to establish a trust effectively.

To fund a Guam Irrevocable Trust Funded by Life Insurance, you will begin by transferring existing life insurance policies into the trust or purchasing new policies directly within the trust. This process involves completing necessary paperwork to ensure the trust is the policy owner and beneficiary. Working with legal and financial advisors can make this process seamless. Having a clear funding strategy enhances the trust's effectiveness in protecting your assets.

When managing a Guam Irrevocable Trust Funded by Life Insurance, it is crucial to understand your tax obligations. Irrevocable life insurance trusts generally do not need to file a tax return, as the trust is typically considered a separate entity for tax purposes. Income generated by the trust's assets generally does not necessitate filing, but consult a tax professional for personalized guidance. Understanding your obligations can keep your estate plan compliant and effective.

The 3 year rule for irrevocable trusts ensures that any assets transferred to the trust within three years of your passing may be included in your estate for tax purposes. Understanding this rule is crucial for those considering a Guam Irrevocable Trust Funded by Life Insurance. It helps prevent unanticipated tax burdens on your beneficiaries. For optimization, work with legal platforms like uslegalforms to establish a trust that aligns with your estate planning goals.

Yes, you can put life insurance in an irrevocable trust, making it a common strategy for estate planning. This setup allows the policy's death benefit to be excluded from your taxable estate, thereby optimizing tax advantages. An effective Guam Irrevocable Trust Funded by Life Insurance can help ensure your loved ones receive the full benefit without the tax burden. It’s essential to consult with professionals to set it up correctly.

One of the biggest mistakes parents make when setting up a trust fund is not clearly outlining their intentions and goals. Failing to communicate their wishes can lead to confusion and conflict among beneficiaries. For those using a Guam Irrevocable Trust Funded by Life Insurance, it's important to provide detailed instructions to ensure that your assets are distributed according to your desires. Taking the time to draft a comprehensive plan can prevent future disputes.

The 3 year look back rule for an Irrevocable Life Insurance Trust (ILIT) ensures that any life insurance policy transferred within three years of death is subject to estate taxes. This rule is essential to understand when creating a Guam Irrevocable Trust Funded by Life Insurance. By adhering to this rule, you can protect your beneficiaries from unexpected tax liabilities. Consulting with legal experts can help you navigate these regulations effectively.

The 3 year look back on life insurance refers to the period during which any transferred life insurance policy may be included in your estate for tax purposes. If you transfer a policy to an irrevocable trust less than three years before your passing, the death benefit may still be included in your taxable estate. Understanding this concept is vital when establishing a Guam Irrevocable Trust Funded by Life Insurance to ensure your estate plan functions as intended.